Price Projections using FIBO Levels for 2021: the case of MONERO

Just read @acesontop post regarding his predictions on a few Altcoins at "2021, What The Crystal Ball Say". As everything written by this guy, that post is really a worth reading and since he provided a few predictions about some of his favorite coins I wonder if I could explain some simple TA in order to reinforce the target price of my own "Crystal Ball" regarding some of my Long-term Altcoins.

In order to place the targets, I always used to watch the Altcoin Chart in a High Time-Frame. For BITCOIN, a 1-week Timeframe suits perfectly but for other younger Altcoins, 1-Day to 4-hours timeframe may be more suitable depending on the age of the altcoin itself.

In this example, I have chosen MONERO, since it is one of my Longterm altcoins and maybe one of the most aged that I have. For Monero (XMR), the use of 1-Day Timeframe on the KRAKEN XMRUSD Chart seems fine.

As you can see in the chart above, MONERO has broken the downtrend Channel, overpassing the previous two highs which may indicate the end of the Long Correction, to be confirmed once it reaches another ATH, but, let's say that we are 100% sure that XMR has completed its long correction.

Also note that I am using here the "LOG SCALE" in order to emphasize the explanation.

If so, we could identify the 1st and the 2nd waves of its first cycle

Cycle: one year to several years (or even several decades under an Elliott Extension)

Primary: a few months to a couple of years

Now, we know by EW-Theory that the cycle count would need a 3rd, 4th and 5th waves so, I am going to focus on the 3rd Wave target now which used to be the most explosive wave within the count.

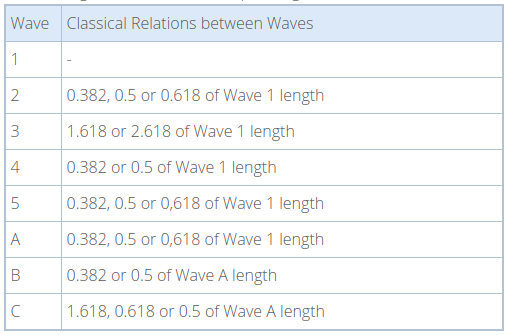

By historical data (Source):

Wave three is usually the largest and most powerful wave in a trend (although some research suggests that in commodity markets, wave five is the largest). The news is now positive and fundamental analysts start to raise earnings estimates. Prices rise quickly, corrections are short-lived and shallow. Anyone looking to "get in on a pullback" will likely miss the boat. As wave three starts, the news is probably still bearish, and most market players remain negative; but by wave three's midpoint, "the crowd" will often join the new bullish trend. Wave three often extends wave one by a ratio of 1.618:1.

Actually, the following Cheatsheet can help us in many occasions while trying to figure out achievable targets by using FIBONACCI.

Fortunately, the majority of the trading apps include FIBONACCI retracement tools in order to measure those relations. The one that I use the most is the "Trend-Based Fib Extension":

It works by placing the first point at the start of the wave, second point at its higher level and third point at the end of the correction. If we apply this tool on the Monero chart we obtain:

As you can see, we get a clear indications regarding the 1.618 and the 2.618 FIBO extensions in relation with the wave 1 length:

Wave (III) target according to the typical 1.618 FIBO Extension:

1st FIBO typical level projects 716 USD which is 324% more than today's price

Wave (III) target according to the typical 2.618 FIBO Extension (aka 3rd wave extended):

In this case, the projection is about 1146 USD (+578%)

All previous charts are done on LOGARITHMIC SCALE, deactivating it the projections are even more exciting visually speaking:

The "Classical Relations between waves" usually may have an error of around 10% but, in whatever the situation and timeframe of the trade in execution, they used to give great results in terms of overall accuracy.

Would this time the "Crystal Ball" be right in its prediction for Monero?

*Disclaimer: This is just my personal point of view, please, do your own assessment and act consequently. Neither this post nor myself is responsible of any of your profit/losses obtained as a result of this information.

Interesting description of Monero. I have some monies on Monero from some mining two years ago.

I should learn some FIVO this year!

Posted Using LeoFinance Beta

Some Monies will get you rich ;-)

It's gonna be delisted by Bittrex as of January 15th. I don't get those american exchanges anymore...

Posted Using LeoFinance Beta

Thanks for the mention and compliments.

From what I see your price predictions on the FIBO extension levels for XMR, range from 716 USD to 1146 USD, so my 1,000 one might make sense after all. The only thing that altcoins now need is an altcoin season as BTC has taken most of the attention from investors.

It will come for sure, the problem is that we have so much FOMO on DeFI tokens nowadays

Yes, the ICOs of 2020.

Posted Using LeoFinance Beta

Congratulations @toofasteddie! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Do not miss the last post from @hivebuzz: