🔥 Bitcoin Stock-to-Flow Cross Asset Model is right!

Hello!

Today one of my favorite authors @100trillionUSD (link to their twitter), published something really interesting. Actually, it was a Medium article wrote by Peter Harrigan (twitter) where he uses his well known Bitcoin stock to flow (S2F) to calculate the US housing market.

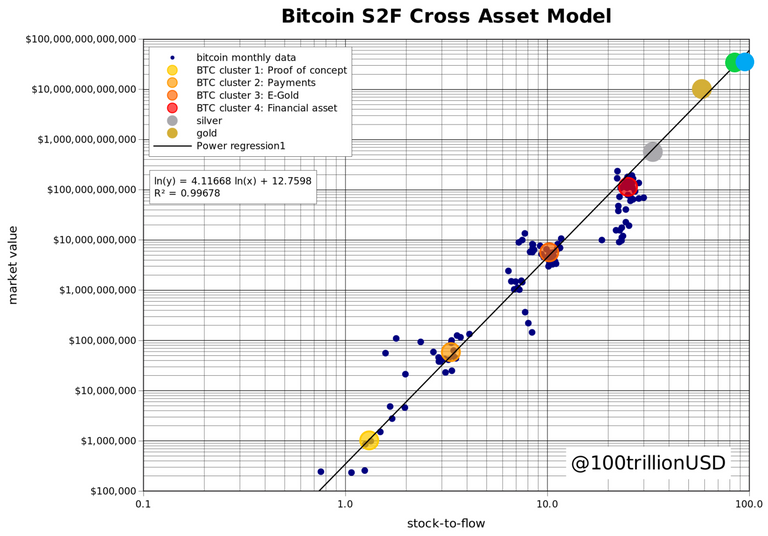

The interesting part is that once calculated Peter merged the data with the Cross Asset Model where Bitcoin is compared with Silver and Gold. (The last 2 dots green/blue are the US house market).

In the following lines I will try to explain the chart below for those unfamiliar.

I will use Peter words to put some perspective:

On this model it is showed that there is a correlation between the market capitalization of Bitcoin and the ratio of existing Bitcoin to annual production of Bitcoin. This relationship appears to hold with gold and other metals.

According @100trillionUSD there are 4 phases for Bitcoin, distinguished in 4 different clusters in the chart. They are represented using the following formula to calculate the S2F ratio:

Market Value = exp(12.7598) * stock/flow ratio ^ 4.1167 The blue dots are the real values and the colored circles are the REAL ones.

Then he used the same conditions and applied the formula for the Silver and Gold. The results were quite impressive as they appear to follow the tendency of the model.

And after this amazing chart, it comes Peter and uses the US house market data calculated in two different ways and the results match perfectly with the Asset Model!

Source

Why is this really interesting?

Because if this model is correct, it predicts an astonishing $288,000 Bitcoin price during the 2020/2024 period!

Holy shit! I need my 1 BTC NOW!!

Enjoy! 😊

Follow me on

Follow me on

Shared on twitter #posh:

https://twitter.com/100trillionUSD/status/1282972307921580032?s=20

I need only two to solve my life ;-)

hahahahaha

2 is more than welcome too!

@tipu curate

Upvoted 👌 (Mana: 0/5)

Thank you buddy! 😊

It's a good post

Here's some !BEER to help with your journey.

View or trade

BEER.Hey @resiliencia, here is a little bit of

BEERfrom @teenagecrypto for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.nice article, if that model is correct only 1 BTC will do everything for me

You liking the model doesn't make it correct or true man, there's plenty of issues with the model ;)

I know you don't believe in the model, as I think we have discussed before.

But it doesn't make it incorrect too 😉

Fair point haha

I see S2F more like a marketing meme disguised as a fundamental valuation model.