Bitcoin and The Cause of Huge Gains and Huge Investments

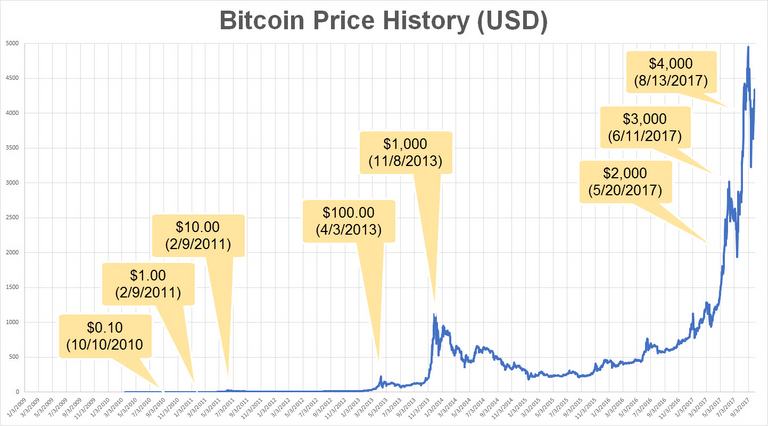

Bitcoin recorded an epic year, after which Bitcoin soared to another record high.

It appears that Bitcoin has not yet completed its rally, and, as of this occasion, it is still making new highs with any stretch of the imagination.

Bitcoin rose to another record high of $ 28,200, Coinmarketcap indicated.

Bitcoin BTC's appreciation has risen over 600% this year since its lowest levels recorded in March 2020.

Bitcoin has become extraordinary compared to other investable resources in every money market.

However, what exactly filled the Bitcoin deal after the highest point in 2017?

What is the force behind the current explosion in the cost of Bitcoin?

The daily chart of dollar funds from the closest starting point of the year to the date of distribution confirms that the dollar is heading for a further decline, and underscores the way in which the opportunity has been presented to hold cash around the world. Slip.

The US dollar has appreciated the worldwide cash supply situation for a very long time at this point, and the central government has misused the power of money in the money market.

Bitcoin can now be converted into money worldwide.

The US authorities were certain that the terminations due to the Corona virus would enable them to print more dollars in unlimited quantities without sabotaging the position of the outstanding cash, allowing the nation to go ahead with significant shortages without apparent results.

Be that as it may, the component adopted by the US government focused on the dollar, and the money file fell to its lowest levels recorded in 2017.

The fall in the dollar's value strengthened Bitcoin's case.

This can be unambiguously seen through the phenomenal development of BTC after its amazing dispatch since April.

Speculators were quick to place their fortunes at the highest point in cryptocurrency forms to support them in the face of the dollar's ongoing free fall.

Moreover, by expanding discussions about pulling more dollars into the market, this all accelerated the rise of Bitcoin Cash, which is currently valued at over $ 28,000.

Huge investment

What MicroStrategy publicly started with its massive acquisition of Bitcoin led by Michael Saylor has caused many organizations to restore their records and invest the resources in Bitcoin.

Initially sarcastically about Bitcoin, he said in 2013 that the times of the important digital currency are numbered.

This month, MicroStrategy purchased approximately an additional $ 750 million from BTC.

Square recently bought $ 50 million in Bitcoin.

Bitcoin When the cost of resources was approaching $ 10,000, even the chief data officer in the organization felt free to state that the cost of Bitcoin should be at any rate of $ 400,000.

Institutions are the force behind Bitcoin's spectacular pooling this year, and the brutal convergence of assets from these organizations and deep concealed partnerships is what keeps the agreement flawless.