The Rat Race That Is South African Inflation

Hey Jessavers

Warning: Broad generations ahead, if you get triggered easily stop here and find another post to read

Something has been bothering me for some time regarding how our little country works. I didn't choose to be born here as all of us don't, we try to make the most of our surroundings and the hand that was given to us. I never liked studying like most teens, and student's do, I never liked working in the beginning, only when I got into tech did I like it.

I got to learn some cool shit and got a lot of freebies along the way. I've only been working a "job job", with like a tax number, like a legit job with contracts and all that since 2013. Do I have a lot of work experience, I think so, in terms of years, probably not.

Like most millennials I was impatient, when am I going to earn big money and chill like this old peeps do but not have to wait as long as them, I want it now.

My disillusion for all this work for money, buy a house, get fat and wait for retirement with a few holidays in between sent me down a path of trying to find a better way. Have I found one? Lol not really, still fighting the good fight though.

The more I earned, the less I got

As I mentioned, I've had a brief experience of working for money, but in these last 7 years of being a productive member of society, so to speak, I noticed something. We're all looking to make more money to secure our futures, but as I made more money, I got to hold on to less.

My first experience was naturally tax, as I gained experience and got promotions or raises or moved jobs and negotiated a higher salary. The joy of moving up the ladder and getting new more digits in your bank account is very brief once the dismay of your new tax bracket kicks in.

Like most, I was trying to save to buy a home, and as the lump sum grew, I thought I was making progress. Yet each time I would check home prices, they keep moving up faster than I could save, this was my first light bulb moment, why does it do that dad?

"Ah inflation son, just the way the world works."

I wasn't happy with that answer, sounded like a crock of shit.

Digging deeper

Clearly saving my way to the home was NEVER going to happen, so I had to get more aggressive. I started investing in various financial instruments trying to increase my returns so I could close the gap, which naturally leads me to Bitcoin. Learning more about Bitcoin pushed me into economics and then macro and behavioural economics.

I decided to look into something most South African's don't look at, which is the South African reserve bank reports. This talks about how inflation is kept in the "healthy range" of between 4-6%.

Let's take the low end and say 4% is the range, that means that over 10 years your money loses 40% of its purchasing power. So if you were saving it in cash, you've pretty much wasted 4 years of your life working for money that is pretty much worthless.

CPI lies

The CPI or consumer price inflation is a guide to how much prices increase each year. Banks and governments take a basket of goods and calculate the price increase, and along with hedonic adjustments, they come up with a figure that suits the narrative.

The reason this is not questioned is that inflation is impossible to calculate. Everyone has a different inflation rate since we all buy different goods and services based on the income we can acquire.

So I looked for a better representation of whats going on, and I found one in the broad money supply. The broad money supply is how much money has been created each year and is in circulation.

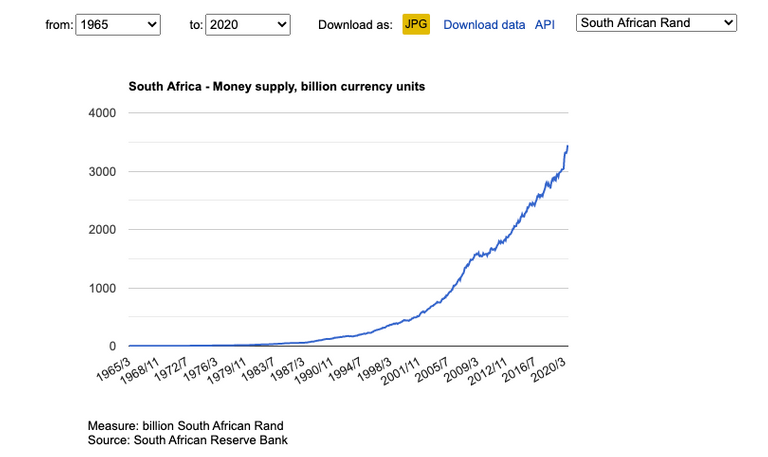

Broad money supply since 1965

As you can see since South Africa left the British Pound and moved to the South African Rand, it's been nothing but units baby!

New money supply has exploded over the last 50 years, and each year it gets exponentially higher.

Source: theglobaleconomy.com

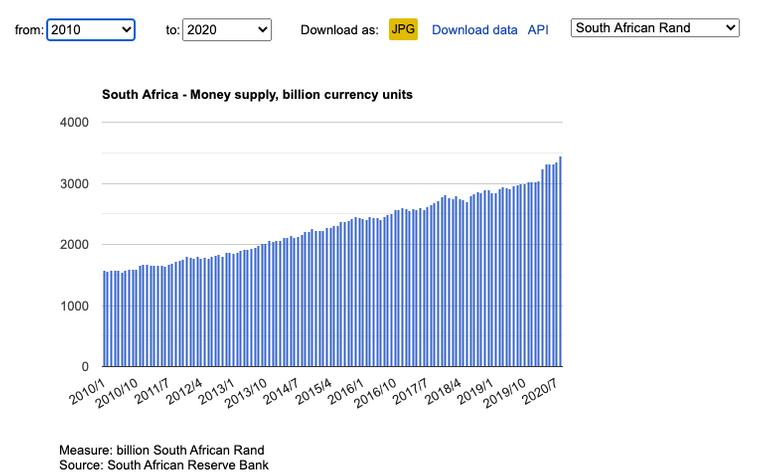

Broad money supply since 2010

I decided to take a snapshot of the last decade, the one I started work in and wanted to see how the broad money increases.

- 2010: 1 569 Trillion

- 2020: 3 446 Trillion

In the last 10 years, we've seen an increase in currency units/broad money by R1 877 Trillion. That is a 120% increase in the amount of money created and put into the system.

Annualised that over the last 10 years and you get 11.96% inflation to the money supply. So broad money speaking, we've actually had an inflation rate of 12%.

Note: These figures should be publically available for your country reserve bank, you could check it out and share how much board money has increased in your country in the last 10 years.

Looking at these figures, I just did some anecdotal research, and in 2010 till now a bread (a product most people buy) has gone up by roughly %100, so this does affirm my biases, that broad money is a better inflation measure.

Yes some of the new money dives into other industries more than others, I understand that, but if we're talking solely on a currency debasement level, I'd say 12% is fair.

Running the numbers

If I take the highest interest rate, the banks have provided savers in the last 10 years of %7.2 for those with larger deposits (R250 000/ $14 705) that means you'd roughly be losing 4.6% of our purchasing power each year due to the fisher effect.

When I take the average interest rates, banks provide around 4.5% (before the COVID reset on rates), that means you'd be losing 7.5% per year.

Note: A large part of South Africans are still unbanked, still using physical cash to live save, so they are paying the full 12% in inflation tax on their money.

Annualised inflation

If we take these set inflation rates over the last 10 years and play our a few scenarios, this is what we get.

- 12% x 10 years (%120)

- 7.5% x 10 years (%75)

- 4.6% x 10 years (%46)

Starting with R100 000 (USD $5882 in current prices), if we run that over 10 years at these inflation rates, your relative purchasing power for the same R100 000 nominal fee would be around:

| 12% | 7.5% | 4.6% |

|---|---|---|

| R27,850 | R45,858.25 | R62,443.00 |

| $1 638 | $2 697 | $3 673 |

These are rough calculations, but those are some scary figures, but it does make a whole lot of sense as to why more people cannot gain a foothold in this economy and are falling deeper into debt and struggling to survive.

I am not sure if this is legit, it's me thinking out loud, and I am happy for anyone to shoot holes in these calculations and provide more information that I may have missed out on.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Browse & Earn Crypto | Stack Sats For Free | Earn Interest On Crypto |

|---|---|---|

|  |  |

Well, I just compare products and services...I know some well-priced (for them) fast food has been able to keep the increase to only about 25-50 % but travel tickets, bread, other food grew between 75 and 100 %...maybe some going over the 100.

By my prejudiced estimate, stupidity is up 400 %, corruption is up 800 %, covering up fatally bad for the county deals is close to not being needed at all.

Certain farming is heavily subsidized by governments to allow them to reduce the price and offset it somewhere else that's why things like fast food can also maintain a low price and reduce the rate of the CPI. I agree travel continues to get expensive which makes no sense when you look at the availability of oil, the efficiencies in travel, the amount of people able to travel now, it should effectively be far cheaper but because this industry relies so much on debt all that is passed on to the consumer and price deflation can never happen.

LOL, This line is golden !BEER !ENGAGE 100

Thanks :)

Interesting that you brought the topic of subsidizing up. I just read snippets from Ayn Rand books these days and there was this idea that subsidizing generally meant forcing the taxpayer to pay to those they wouldn't otherwise choose to pay to, even people who could logically be working for the opposite of what the (actually) paying entities would fight for.

View or trade

BEER.Hey @manoldonchev, here is a little bit of

BEERfrom @chekohler for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.ENGAGEtokens.I think you are very much on the "money"🤣 No wonder people just can't get ahead it's all rigged against us😭

I also think it continues since it's been made to seem normal, most people alive today don't know what a non-inflationary monetary policy looks like, they think its always been like this. I legit asked my father today and his like, its all relative, it all works out exactly the same, granted this man can't use excel or a calculator so I take it with a pinch of salt, but this is the consensus of most people, they are all to happy to be stolen from and can't understand why we are upset and trying to stop it

Agree with that.

No you are spot on. Look at the time money was printed from when the ANC took over as I guessed it was happening but these guys haven't exactly been careful. Something stupid like dog food was R43 per 10kg bag in 2005 now that bag is 8kg and is R130 so a 300% increase over 15 years plus you get 20 % less so it is much more than 300% looking at it.

This is looking like another Zimbabwe in many ways as the answer is to fix the economy and not just print money. I cringe when I see prices of things in the States or Europe and do the conversion rates. If we are not careful we will never afford to travel outside of South Africa's borders in the coming years.

It's not only that it's printed but that it is backed by foreign US-based debt so while someone like the US prints and has an obligation, we print and have an obligation in a currency we don't control which makes it worse to pay it back.

It really is death by 1000 cuts and when I speak about this to people they just laugh it off, say it's normal and go on and I've said that they are going to get desperate, they'll trap your funds, they'll convert your gold and forex, they'll bail in the banks.

None of this is far fetched, I wouldn't trust the South African government, and while I used to care about helping I don't care anymore. If you want to be obliterated be my guest, but I am setting up my back up plan.

Yep I am on the same train as you. Many people I know have Swiss accounts or bank accounts elsewhere already and are set for whatever happens here. They don't care as long as they are making money right now and are the ones saying how great everything is. They will be the first ones to bail and wont give two shits about who they leave behind.

That's the funny part and great point, we don't know how prepared the next person is and what they got going on behind the scenes and you all talk shit about keeping positive and we'll get through it, but you only need to fuck up majorly once, we've managed to avoid it for years somehow, but eventually the keep positive people will be wrong and it won't be very pleasant

Inflation have to be the main subject you cover most with your post. BTW - Do you have reades outside blockchain too?

jessie was here - but don´t tell anyone about it.

Lol I know I am like a broken record, but until you live under it as bad as we get it, you won't understand how it affects you mentally. It's as bad any mainstream propaganda and its entrenched so deep, it's basically as if a slave is saying yes give me less freedoms each year. Its like the story of the boiling frog, don't put them in hot water, just slowly raise the temperature and they won't notice until they are cooked

Do you often boil frogs?

I think I go for a !BEER instead.

LOL no I don't I leave that to your friends, the French

View or trade

BEER.Hey @chekohler, here is a little bit of

BEERfrom @minimining for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.