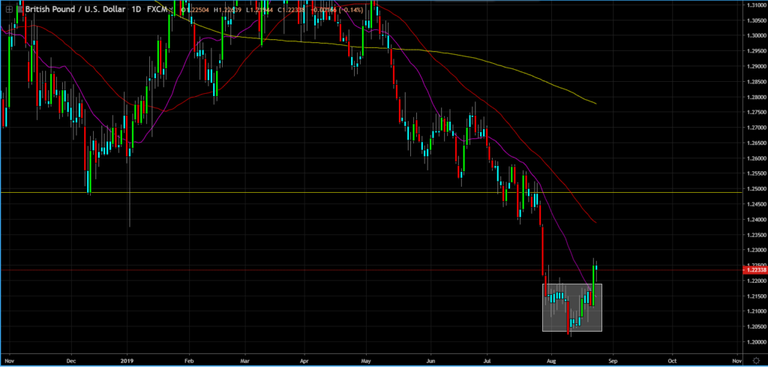

Currency Analysis Report 8/23/19 – Has The British Pound Formed A Bottom???

According to a survey conducted by the business group CBI, British retail sales dropped this month at the fastest rate since 2008 falling to -49 from -16 in July, marking the second weakest reading in nearly four decades. Consumers are starting to leave their wallets home as the Brexit October 31st deadline is fast approaching and causing a lot of uncertainty. Part of that certainty includes England going into a recession if the third quarter England GDP shows another decline. However, hope might be on the way.

Sterling shot higher against the euro and dollar on Thursday, after comments from German leader Angela Merkel sparked hopes that a no-deal Brexit could be averted.

“One should say it can be done by October 31,” Merkel said on Thursday. “It’s not about 30 days, that was supposed to be allegorical to mean it can be done in a short time period, because the UK have said they want to leave the EU by October 31.”

The German chancellor said an alternative to the Irish backstop must be worked out “in the next 30 days” after a meeting with UK prime minister Boris Johnson on Wednesday.

Her use of the word “should” on Thursday suggested a more conciliatory tone and sparked hopes that a deal could be reached to avoid a no-deal Brexit.

If Brexit doesn’t happen, many financial pundits are staying the Pound could rise to $1.30, even $1.35. And that glimpse of hope is why we are seeing the Pound stabilizing and even starting to rise.

It also helps that price is sitting in a monthly demand zone as well...and in the process of forming a hammer bottom.

However, the first will test for price will be the sellers at 1.25000.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

1 !BEER Token for you

As with many of the fiats of the developed countries, it is a race to the bottom as the devaluation continues in turn for more debt.

Posted using Partiko iOS

I want to short it again, but have to take a wait and see approach.

Posted using Partiko iOS