Goals for 2020 and Beyond

It's that time of the year again to talk about New Year's Resolutions. For most people, it is a tradition which no actions would follow. For some, they keep up until the end of January or so. Only a small percentage manages to carry on the goals they have set for the upcoming year.

I already have enough on my plates that adding too many items would only make things more difficult. But, I also try to be realistic when I make new resolutions. Since I have been to the gym since the fall, I can cross that off the list. The most obvious goals, then, are still financial in nature.

In Life:

This may sound simple, but making an IRA for myself will be the main goal for 2020. It sounds ridiculous, but I actually do not have one. I have got stocks, crypto, precious metals, etc. Hell, I even max out my 401K and HSA contributions. For whatever reason, I haven't bothered with an IRA.

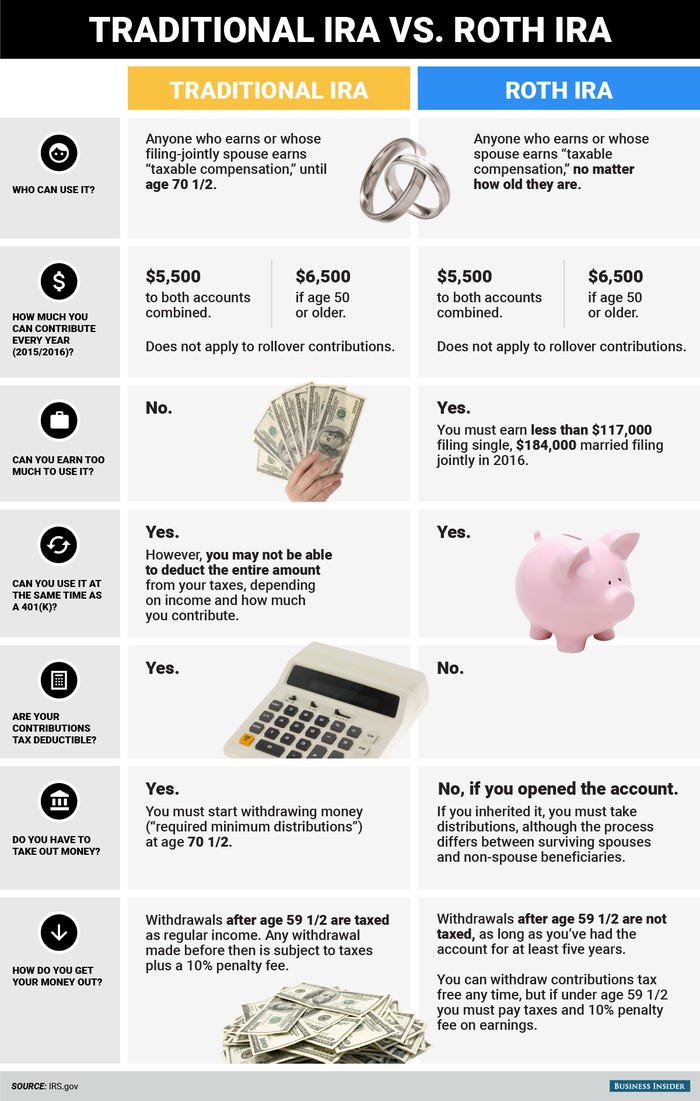

For those of you who don't know, an IRA is an individual retirement account. It is more or less a thing in the USA. Of course, I'm debating between a traditional or Roth IRA. As for the provider, I may consider using Fidelity as my institution.

If you can't see the source of the image, you have problems.

There are advantages to both traditional and Roth option. While I am leaning towards Roth, I am wary of the possibility of rules change by the government. Other than that, I may need to figure out the implications on my state income tax should I include an IRA. Whatever I choose, I will have to reallocate some funds.

Does that mean I will max out my annual contribution limit? Most likely not. For your information, that amount is $6000 for the upcoming year. But, it doesn't hurt to put some money in there each month and let it grow (or shrink).

Either way, to me, once you have your emergency funds, money that sits in your bank account are better off used. At the very least, treat yourself and enjoy life. If not, put it into other vehicles that could make you more money later.

On Steem:

Not much to dive into here. I have long decided that whatever I have in this place is acceptable loss. The question is, how much is acceptable? Would Steem even survive until the next crypto bull run? Even then, would it benefit from the uptrend?

As I am inching closer to 10K SP, I do wonder what my goal should be in this space this upcoming year. It could be as simple as amass a total of 15K STEEM (in SP, liquid, etc.). I definitely am not trying to go above and beyond and be some figure on this platform. That's not what I came for.

While I am typing this out, I guess getting myself to 15K SP may be the most realistic goal I could work towards. Then again, if the prices do soar in the next few months, the goal post would be harder to achieve.

At the end of the day, whatever happens happen.

This is no financial advice. It's only me writing things out for fun.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Not sure if your 401k is self-directed, but you can give yourself a lot of freedom with an IRA. Just get as much money as you can under that IRA umbrella, then there's a lot of creative stuff you could do from there. This includes a checkbook/self-directed IRA, which can own an LLC that can take on a life of its own. You could even buy real estate, crypto and operate nodes, etc. with it.

My 401K is through employer. The only thing I can meddle there is how aggressive the managing institution, T Rowe Price, directs my money.

There's definitely a lot more I need to read up.

I have mixed feelings about employer IRAs. I want to take the match, but at the same time, I don't like the fees and lack of choices and the potential anchor it creates. What I normally do is just go 100% into a stable value fund in my employer 401k, and then roll it over into an IRA when I leave the company with 100% of the principle guaranteed intact. If you have a side hustle, you can also get a self-directed 401k for that, and just put the minimum amount to get the employer match. From there you could put any remainder into that vehicle. I use E*Trade for all of it, and it was all very easy to set up.

Oh, I definitely put in the minimum to get the max employer match.

I just finished doing the financial records for most part of the year and I want to allocate a portion into an IRA. This would mean less into crypto, stocks, etc., but I'd rather diversify.

Glad you changed your mind about a new year's goal. It puts mine to shame! 😎

I had time to think.

From what I read in Tony Robbin’s Money: Master the Game - if you expect taxes to go up in the future (which is very likely given how our government spends/borrow money), then a Roth IRA makes sense, as you’d be paying your taxes now and not upon withdrawal when taxes could potentially be higher.

That’s what I personally chose to do, maxing out my Roth before contributing in a standard IRA. But it really depends on how you perceive our taxes future !

There's also the possibility that they would change the rules about Roth. But, that would cause massive uproar.

By that point, I think we should be moving out of USD. lol

I wish you all the best in the new year :)

Thanks!

Congratulations @enforcer48! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!