The FED signalling a more dovish shift

Who is surprised?

https://www.bloomberg.com/news/articles/2020-01-29/powell-paves-way-for-possible-dovish-shift-in-inflation-strategy

"Federal Reserve Chairman Jerome Powell signaled that the central bank would pull out the stops to combat a global disinflationary downdraft, foreshadowing a potential shift toward an easier monetary policy over time.

[...]

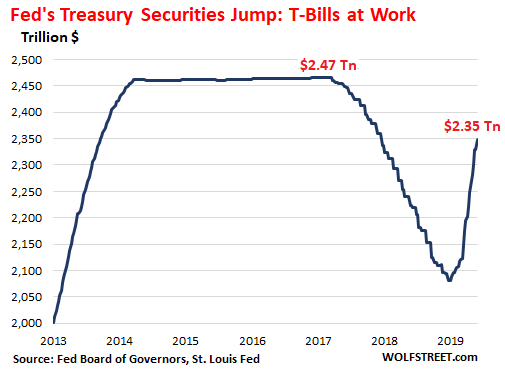

The Fed is currently expanding its balance sheet to ensure ample liquidity in the money markets and avoid the sort of turmoil that briefly occurred last September.

[...]

“Valuations are high, but not at extremes,” he said, adding though that the overall risks to financial stability are moderate."

As the FED balance sheet is already expanding and the stock market rallying from All Time High to All Time High what will be the consequences of an even more dovish policy?

"Inflate or die"

What else?

But if the virus is dragging the world's economy, we'll see weird times.

Already got gold? got BTC?

Of course :D

Hier siehst Du einen Chart des Eurodollar-Futures.

Der Kurs gibt die kurzfristigen Marktzinsen an (100-Kurs = Zins).

Wie Du sehen kannst, fallen die kurzfristigen Zinsen seit einiger Zeit. Die Fed muss den Märkten folgen sonst ergibt sich eine Arbitragegelegenheit.

Ja, genau, das sind die kurzfristigen Zinsen. Die Fed ist oft "behind the curve".

Jetzt kommuniziert Powell, dass er die Inflation über 2% heben will. Ob und mit welchen Mitteln er das schaffen wird, bleibt offen. Möglicherweise springt nur die Asset Inflation weiter nach oben...

"The year is 2023 - The coronavirus has wiped out humankind. A lone server in the basement of the NY Fed building continues to bid the Dow Jones to new all time highs."

!COFFEEA