The Rise of DeFi Is Just Beginning

DeFi means decentralized finance.

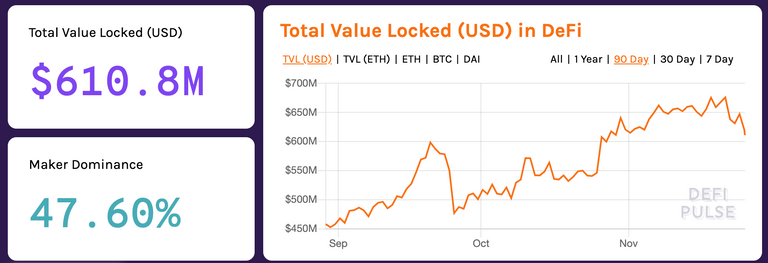

Traditional finance guys, whom I affectionately refer to as TradFi, can be forgiven if they are underwhelmed. According to DeFi Pulse, which seems to be rapidly becoming the Coinmarketcap of this little niche of the crypto world, we are barely up over $600 million of cryptoassets locked up in defi products and platforms.

This figure is somewhat lacking because it mostly only tracks the Ethereum devoted to these emerging protocols. New platforms such as Terra.money and Kava, both built with Cosmos SDK should soon start contributing substantially to such statistics. To be fair, Ethereum and its first-to-market Turing-complete smart contract layer seems to have been purpose-built for an emerging industry such as DeFi. Surely, without Ethereum, DeFi would not exist. But the same old problems that have plagued Ethereum since before this industry went on its round trip to the moon, scalability and speed, will limit the growth of DeFi on Ethereum in the long run.

For an industry in which its name did not really come into prominence until earlier this year, DeFi is growing remarkably fast. The amount of digital assets locked up into DeFi products (like MakerDAO, Synthetix, and Compound) has more than tripled in the past year.

That’s just a drop in the bucket compared to the total crypto market cap of $180-$200 billion (Alas, it depends on the day these days. Such is the extremely fickle nature of Mr. Crypto Market). That ~$600 million figure that DeFi is currently citing is approximately 1/3 of 1% of the total crypto market cap. Once you throw in the Cosmos-based projects mentioned earlier, it could be a little more than that. But the point is, we are still at the absolute beginning of this of the DeFi industry. Like so early, that if we were to throw a baseball analogy on it, as one often does in these types of situations, we might not even have seen the first out in the top half of the first inning yet.

The heightened interest in DeFi is an interesting phenomenon lying at the crossroads of plummeting interest rates (In a lot of places in the world, interest rates are negative), continued and increasingly sophisticated software development by blockchain projects (That's the infamous BUIDL-ing you may have heard of), and more acceptance of cryptocurrency in general (Hopefully, when you go home for Christmas this year, your parents won't look at you with a skeptical eye). I'm really hoping we've gotten to that place with my last point. And I guess that really will depend on the price action we see here in the next few weeks between Black Friday and New Year's Day. Last year, that was an absolutely brutal stretch for bitcoin and its crypto buddies.

For those still involved in crypto and blockchain, and for some of us I'm afraid we might be stuck here forever while we can all only hope that the casual daytrader is leaving forever (good riddance!), DeFi is a breath of fresh air for the entire industry. That's because, in many cases, DeFi assets are a means to bring real world value onto the public blockchain infrastructure that is still very much under development. And that should facilitate increased adoption of at least some of the long forgotten utility tokens of yore.

With DeFi, there's a little something for everybody. HODLers are looking to leverage their long-term positions. Advanced quant traders are looking to amplify their successful strategies. The emerging market token holders that are best suited to benefit from cryptocurrency in general are looking for a means to generate meaningful passive income. Young people, who seem to be consistently ignored and exploited by traditional banks, are looking for an alternative method of saving and investing.

With all of these potential customers and more, it's no surprise that the scope of vision for finance-oriented blockchain projects is expanding. New projects like FinNexus, Konstellation, and the aforementioned Kava and Terra have increasingly grand visions enabled by more robust and interoperable base technology layers like Wanchain and Tendermint.

Unlike the Dec. ‘17 bubble, the DeFi movement actually delivers real value to token holders, giving them the opportunity to earn returns without having to be active traders. Sure, not all of the early DeFi projects will survive, but some of them could

Hi @shanghaipreneur, a free $trendotoken from the TULIP Mania Game!

Round 3 will start soon and full details will follow. Thanks for playing!

A member bonus $trendotoken tip for @shanghaipreneur from MAXUV!

Also consider our MAPR fund and MAPXV vote bonds too.

MAP Steem Fintech: growing your STEEM without SP.

What a coincidence! I just wrote about DeFi as well :)

Nice piece!

Really? Sweet! It’s my favorite topic of the moment. It just might be THE best way out of this bear market, in my opinion. Please share a link to your piece here!

Posted using Partiko iOS

Sure, here it is :)

https://steempeak.com/defi/@culgin/overcollateralization-in-defi-is-it-good-or-bad

it is, hence we check https://fuk.io/best-bitcoin-lending-sites-btc-loans-lend-cryptocurrency/