This is how to lend DAI for 6% APR

This one of passive income from cryptocurrency tricks that will come to new version of my free ebook (link in the footer)

Lately old DAI changed to SAI now you have to convert them back to new DAI.

With the launch of Multi-Collateral Dai on November 18th, 2019, the name and ticker symbol of Single Collateral Dai is changing to Sai (SAI). DAI now refers to DAI minted in the new Multi-Collateral Dai system. The term Collateralized Debt Position (CDP) is also being replaced with the term “Vault”

Then we go to oasis.app and make a borrowing account that earns 6% APR - more than banks.

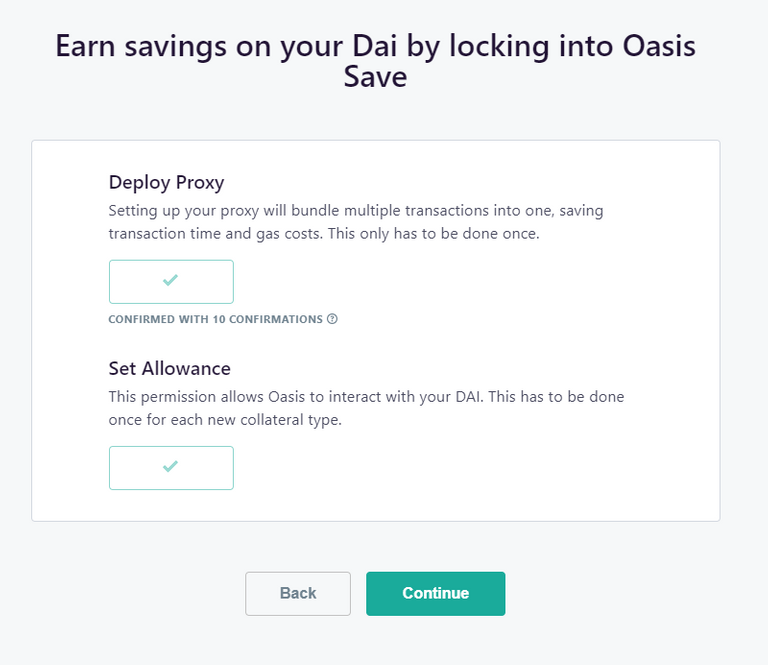

You need to setup these 2.

Then deposit amount you want to make free % off.

Then wait for confirmation.

Thats it now DAI show in vault and you make 6% a year from them (for now) fully decentralized.

REAL WAYS TO MAKE PASSIVE INCOME FROM CRYPTOCURRENCY - DOWNLOAD FREE EBOOK NOW

Join My Official Discord Crypto/Steemit Group - https://discord.gg/Ma3VCxj

Follow, Resteem and VOTE UP @kingscrown creator of Best Crypto Blog with unique newsletter and hidden tips for subscribers! |

|

|---|

Wow! Is that 6% guaranteed?

The banks in the UK give about 0.5% at the moment.

Cg

That’s madness! In South Africa we still get 6.75% from the banks

Yes it fell in the last banking crisis, and of course never returned to its previous rates.

Cg

I forgot to mention even though we get 6.75 our money inflates terribly so it kind of obliterates your savings anyway

I wonder if you guys are going to go negative as Sweden, Germany and The like

guaranteed

it does thats why its so great. the ebook is fully of such things and its free to download. try it and if you like tricks - share with people/friends.

Damn 6% is pretty legit I’ll have to check it out I think you can get around that for a stable coin on Celsius network too

Guys...

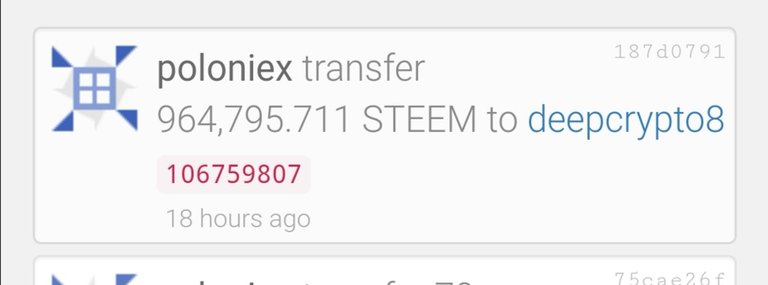

OMG the dump is incoming.. maybe leave that in new post that i just did btw

Congratulations @kingscrown! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

compound.finance (cDAI) is still better.

uses DSR by default, thanks to compounding and demand it's almost always floating above DSR.

to me shows lower %. can you have a look ?

Check loanscan, the other stats do NOT include the compounding effect

i see that, maybe ill move in some time :) thanks

Hmmm, I use Compound... Is Oasis much different?

similar to me looks it has better % hmm