"ECB can boost growth across Europe by buying stocks"

Incredible:

https://www.ft.com/content/e310eb10-aa07-11e9-984c-fac8325aaa04

"A spectre of anaemic growth is haunting Europe.

More than 10 years after the global financial crisis, the unemployment rate in the US has recovered to reach its lowest level in nearly 50 years. However, such a reduction has not been replicated in Europe, where high jobless figures in Greece (18 per cent), Spain (13.9 per cent), Italy (10.7 per cent) and France (8.8 per cent) and an unhealthy skew in most countries towards youth joblessness are all causes for alarm."

So far, so good.

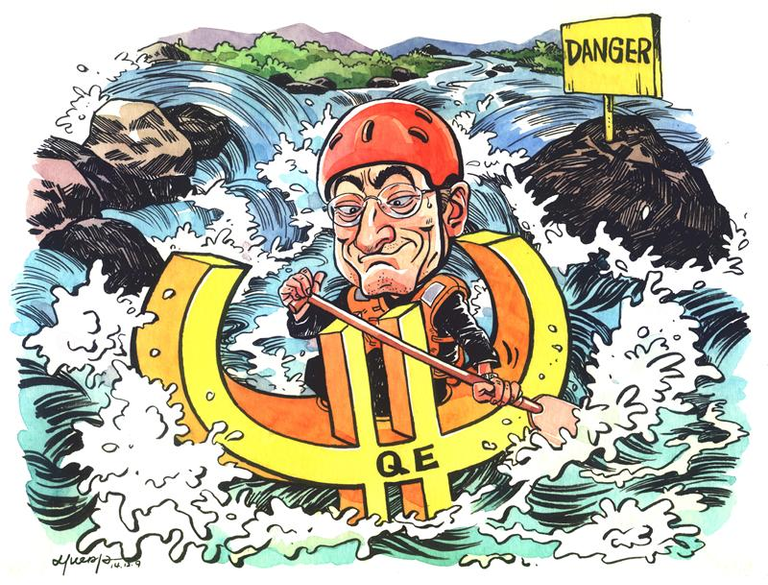

"A key part of the solution would be to stimulate demand for capital, not to further lower the cost of debt. Having nearly exhausted its options on the debt side, the ECB should consider expanding QE to include equity investments to lower the cost of equity for European enterprises. That could narrow the abnormally large spread between the cost of capital and the economic growth rate. Lowering the cost of equity would stimulate growth through organic channels of investment, including research and development, which can provide durable economic gains."

And my personal favourite quote right at the end of this verbal diarrhea:

"Mr Draghi has displayed courage in the face of crises. We greatly hope that his successor Christine Lagarde can be as farsighted in helping the region break out of longstanding stagnation."

Mr Draghi is farsighted? Wow.

Reportedly, there is not enough inflation in the EU. Where has all the money (printed by Draghi) gone? As far as I can tell mostly into assets like equity, real estate and government bonds (leading to lower yields).

So, what exactly would be the difference if the ECB now starts to directly "invest" (LOL) in equity?

The CEOs of European companies would become even more self-complacent if their companies' stock price increase.

In the years since the last financial crisis companies used the low cost of debt to buy back their stocks. By this they could improve their "earnings per share" measure even if earnings stagnated.

This has shown to be much easier than to really invest capital to further R&D, innovation and productivity.

By providing ever more money, the ECB will continue to zombify the EU.

- Unproductive and non-competitive companies will be kept alive artificially.

- The incentive for companies to invest money will be further reduced.

- The asset bubble continues to increase.

- The role of the ECB as a single point of failure will become more and more important.

- The means of production (equity) will fall into the hands of the state (ECB) which is (according) to Marx the definition of Communism.

- The conduct of companies' leaders will become even more irresponsible.

- There will come a point in time when investors draw their money away from the EU's economy (because of a loss of trust) leading to financial collapse.

nice summary.

Your idea would definitely lead to a lot of new companies. The people here must first think about their vision and not first about costs and what can happen. A culture where failure is not seen as a flaw, but as a chance for something better. Let's hope that Europe will soon develop into an innovative founding country.

Congratulations @zuerich! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP