DeFi On Steem: It Makes Sense

We all know that , especially before the situation with Justin Sun, that Hive was overlooked. The capabilities flew under the radar.

Over the past year, decentralized finance (DeFi) got a lot of attention throughout the cryptocurrency community. Suddenly, companies were offering returns to people for using their cryptocurrency. This was a novel idea, at least to the rest of the industry.

Hive, of course, had aspects to this from near the beginning. There were many ways to get a return on Hive that included both passive and active opportunities. Thus, not only was Hive cutting edge in that regard, it also makes sense from a technical standpoint.

One of the biggest benefits to building on the Hive blockchain is the idea of "fast and fee-less". Hive has 3 second block times along with no direct fees on each transaction. The later is a point that must be stressed.

Why is this important? Because when it comes to the world of finance, consistency is key.

When we look at the DeFi market, it is easy to recognize that a great deal of it was build upon Ethereum. While it is one of the better known blockchains, there are some drawbacks. The most obvious is the price of Gas on there.

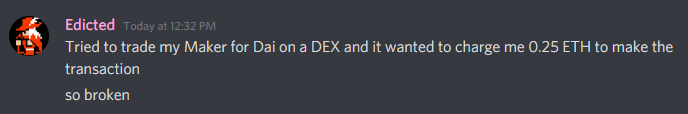

This can create an issue with DeFi. Here is the experience of @edicted.

In this situation, the cost to conduct a transaction ballooned to .25 ETH (or about $30). If he was trading a million dollars, it might not be a big deal. However, if he was moving only a few hundred dollars, this is a huge chunk of change.

This is the problem with the banking system. Returns are hindered by the fees that are charged. It was an issue that cryptocurrency was suppose to solve. Yet, as we can see with Ethereum, this is not always the case. In fact, over the past couple years, we saw the same thing happen with Bitcoin and EOS.

While this is not common, it is enough to really hinder a business. Even if the high transaction costs only last a couple weeks, that can really put a dent in what one is doing. Traders often operate on tight margins, thus high fees can really affect returns, something that sets off another series of events, especially for professionals.

Hive provides the consistency of knowing exactly what something is going to cost. This is a novel approach since the blockchain does not have a fee per transaction. As long as the account has enough Resource Credits, the transaction is processed.

For this reason, it makes sense for DeFi applications to be build upon Hive. By eliminating one of the biggest concerns (and expenses) in the financial/trading fields, the level of attractiveness increases. We are seeing the entire financial sector looking to eliminate/reduce fees in an effort to gain users.

When it comes to the blockchains I just mentioned, it is not a centralized entity deciding to raise transaction costs. It is actually a part of the system. Thus, the price of transactions are subject to increase/decrease as the traffic and market dictates. There simply are going to be times when the cost is outrageous.

With Hive, that is never a concern. The cost of a transaction, to the end user, is the same today as it was three years ago. Since it is constant, individuals and companies can plan accordingly. We do not have to worry about waking up tomorrow and it costs $30 to make a transaction on HIve. Obviously, this is not the case on Ethereum.

Certainly, there are drawbacks to Hive from a development standpoint in the sense it is a specialized blockchain. Thus, there is more that needs to be developed as Layer 2 solutions instead of at the base layer. While this does affect things, it also provides more security to the blockchain since the base code is not at risk. Ethereum experienced a hard fork due to the fact that a DApp bled into the base code and caused tokens to be taken.

Over the next few years, the decentralized finance is going to keep taking on a more vital role in cryptocurrency. The financial sector is enormous and the present system is filled with rent seekers. Since it is unlikely they are going to give up their piece of the pie, a paradigm shift is in order. This means more will be build upon blockchain.

Hive is one that can offer a new project a lot. Consistency in the transaction costs is near the top of the list.

If you found this article informative, please give an upvote and resteem.

Posted via Steemleo

uniswap but on & with steem and SMTs. that's the way IMO

Oh, I am looking forward to trying defi on steem blockchain. Hope it's available one day.

did you read the article ?

I did it. Maybe I did not understand. Is defi already available on steem? Because I have only been using ethereum for defi. I tried the oasis.app/save and also oasis.app/borrow as well as pooltegether.io . When I deposit to these service, they charge with quite high gas fee, since I am only a small very small investor. The gas fee really matter to me. The gas fee to pooltogether.io for example is close to USD1. Now if defi is available in steem blockchain, I would be very happy to use the service. But then again, maybe I don't understand the whole idea of the article. Mind you, English is not my first language. Thanks.

DeFi is the Holy Grail of crypto

Posted via neoxian.city | The City of Neoxian

Highly rEsteemed!

that cool and all but someone needs to build it :P

Smart contract features are necessary for the most part if we want a DeFi style like Eth....

Maybe some features like bitshares but idk

Hi @taskmaster4450!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 5.804 which ranks you at #265 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 81 contributions, your post is ranked at #3. Congratulations!

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

hi @taskmaster4450, if you may be interest in delegating some SP I can offer you 12.5% APR, weekly advance payment on sundays (for instance on 1000 SP delegated, Steem 2.4 weekly paid)

Hi @taskmaster4450

I agree with this point 100%

I think free transactions is a huge advantage Steem has over Ethereum and I think the fast transactions is also huge. This last week when Ether fell 50% in value many loans saw there collateralization ratios fall to the liquidation number of 1.5. Part of this was caused because the loan holders could deposit more Ethereum in the MakerDao fast enough to stop the liquidations, so the speed of transactions when transaction volume on Ethereum is high has become a financial liability. We use so little of our transaction capacity here that we could accommodate that volume. Which is another advantage we have on the Steem blockchain.

I have a question for you:

The MakerDao prints Dai to give to loan takers, which they in turn sell on the exchange for dollars, which creates downward pressure on the price of Dai. Why doesn’t the MakerDao go into the Msrket to buy Dai, thus adding upward pressure on the price instead of downward pressure by printing Dai a traditionally inflationary practice. ??