Money-Printing Could Lead US into “Economic Ruin" ~ Jamie Redman … (Death of the Dollar–9) with Link to Full Story

The recent money-printing frenzy is just a lame attempt to avoid the inevitable crash.

Jamie Redman –

"NY Fed Pumps $108 Billion into US Economy"

(Right-click title to see original story)

(Image source)

– Flash Points –

1 – Owing to its excessive money-printing, the US faces economic ruin.

2 – These days, central banks can survive only by printing money.

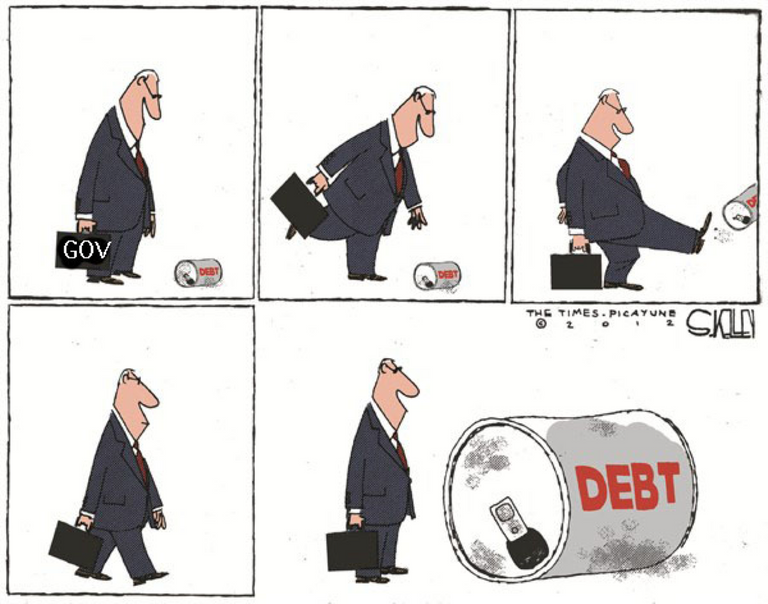

3 – Kicking the can down the road only exacerbates the problem.

– Synopsis –

For the past 2 months or so, the US Federal Reserve has been printing billions of dollars and pumping that money into the economy. The objective is apparently to stimulate the economy. But as stated by 2 researchers – Scott Wolla (St. Louis Fed) and Kaitlyn Frerking (University of Missouri) – a more likely outcome will be the “economic ruin” of the US.

Need a Few Billion? Just Print It

Inevitably, that type of policy always leads to economic devastation. As Peter Schiff commented, “We’re going to have a dollar crisis. I think we’re going to have a sovereign debt crisis … this is going to end very poorly.” (Image source)

Lame Policy

Sven Henrich, of Northmantrader.com, has a similarly alarming outlook. “The global economy is on crutches.” He added, “the world has $250 trillion of debt. And the only solution is to do more of the same — Genius.”

Of course, he was being sarcastic. The current money-printing frenzy is not “genius.” It’s utter stupidity.

– Insight from Outside –

Since the 2008 Great Financial Crisis, not much has changed, and little has improved. Back then, as the economy started to tank, the powers-that-be responded by printing money. Essentially, they kicked the can down the road.

Kick the Can, to Infinity and Beyond

As they “progressed” over the following years, they kept on bumping into that can. Each time, they simply kicked it further down the road.

Crippled, Powerless Men Try to Kick $250-T Can

This latest US money-printing fiasco is just another lame attempt to kick the can further … to save the economy from the inevitable crash or even a total collapse.

Hope We Can Hope For

At the end of the article, the writer Jamie Redman makes the bizarre claim that “Despite the warning signs, left-wing leaders … are advocating the Fed print money.” Bizarre because, as he points out, “both the left and the right seem to concur” that the continued money-printing frenzy is acceptable. In fact, QE1, QE2, QE3, and the current QE4 were instigated by overlords other than Bernie Sanders, AOC, Elizabeth Warren, and Andrew Yang.

The US is in such dire shape that it has virtually no alternative but to print more money. During the aforementioned QE programs, the overlords gave all that money to the top 10%, where it continues to slosh around and distort the economic numbers. None of that money has ever trickled down, and it never will.

As for those disparaged lefties, at least we can hope that any stimulus from them would be injected into the real economy. (Image source)

Left or right they both have the same game plan print more money and while it's going to hurt a lot of people, unfortunately, it has to happen if we are to ever start to seriously look at alternative methods.

Indeed. The system is beyond saving, and will have to collapse and be replaced by a new system. Hopefully, a much better one.

I already solved the U.S. Monetary Reset to "Sound Money"...

It was never "beyond saving"...

December 17, 2019... 6.6 Hollywood Time...

The current monetary system has been imploding, particularly for the past 10 years. It cannot be saved, and will continue to implode. What to you mean when you write that it "was never beyond saving"?

i believe there is already a Plan in Place to Replace the U.S. Fiat Debt Notes with the "Activation" of "Sound Money"... The Transition from Fiat to Sound Money will be very Smooth, because of the "Redemption Period" of all Fiat Debt Note Dollars... No one will suffer any losses, due to the U.S. Monetary Reset to "Sound Money"...

December 18, 2019... 6.8 Hollywood Time...

Dear @majes.tytyty

In a way I understand what FED and other central banks are trying to do. Currently lack of liquidity is becoming a major problem and by printing more FIAT currency into the system this problem was supposed to be "removed".

However it's just postpoining mentioned crash (perhaps even by year or two) and making things worse. Mostly because majority of those new money are being as a QE or pumped straight into REPO market. Basically those money do not benefit real economy - it's almost all ending up in 'financial economy' and it's driving asset prices even higher.

So maybe object has been to stimulate economy, but that is just not happening. Wall street guys already found ways to put hands on most of those resources.

Upvoted already :)

Cheers, Piotr

Exactly! The money they pump does not go into the real economy, just into the financial system, where it's used to drive up asset prices / the stock market. The only ones who benefit from that money-pumping are the top 10% or so.

That money never trickles down to the middle class. On the other hand, the middle class ends up losing more and more ground to the elite, and the middle class is eventually hollowed out until it disappears.

As for the crash, it's long overdue. With the recent QE pumped into the repo market, many analysts say that this situation cannot continue for more than a few months before it causes a crash. Some say it'll come in April. We'll see ....

This is such a thought-provoking post. The arguments are so compelling that one needs not look further for more evidence. I have resteemed this post but not without first thanking you for this delicious insight from outside.

Thanks, glad you're reading about this news and thinking about it. These major events will affect people around the globe, regardless of whether you're working in banking or trucking or factory work.

Hahaha can't stop laughing. I strongly share these sentiments.

Glad you see some humor in it. Many of us are looking forward to the collapse, as this current fraudulent and predatory system has to go.

Often, we just have to smile (wryly) at the foolish actions of the powers-that-be, as they are allowing the collapse or hastening it along.

It will result in pain and misery for all involved. A currency collapse is not joke. But I hope to keep laughing at the fools ...