Everybody Should Abandon the US Dollar ~ Peter Schiff … (Death of the Dollar–1) with Link to Full Story

(Edited)

The boom is over. The collapse is imminent. The dollar is doomed.

Flash Points

1 – The extended boom is over, and the bubble has popped.2 – People need to abandon the dollar, as well as any other fiat currency.

3 – All fiat currencies are doomed, and we should buy safe-haven assets.

Peter Schiff –

"Everyone Should Ditch the Dollar"

(Right-click title to see original story)

(Image source)

– Synopsis –

The US dollar is doomed, according to Peter Schiff, the CEO of Euro Pacific Capital. He recently stated that the years-long stock bubble has already popped, and that the economy is obviously slowing down.

Don’t Worry. Be Deluded. Be Happy.

Schiff pointed out that the Fed is trying to “maintain false consumer confidence.”

Schiff pointed out that the Fed is trying to “maintain false consumer confidence.”

In other words, the Fed already knows that the economy is crashing. But they do not want poor suckers like us to realize it, as that would simply hasten the collapse. (Image source) 1

–Insight from Outside –

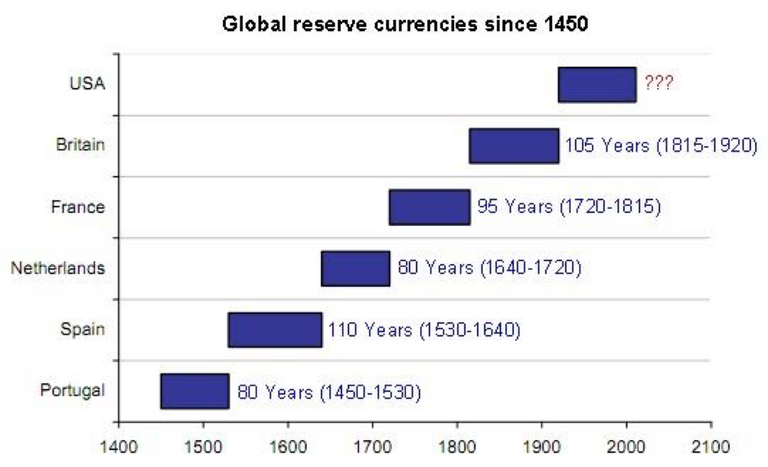

A brief study of historical facts highlights the fate of all global reserve currencies. (see chart) Any reserve currency lasts for only 100 years or so, before being debased by the fools in power.

Collapse Ahead. Hang on.

The US dollar is nearing its 100th year as the world’s reserve currency. Given the increased and increasing internationalization of the world economy over the past century, we can be certain that the death of the US dollar will have greater ramifications than the collapse of any previous reserve currency. Furthermore, the ever-incompetent Fed is doing whatever it can to prevent the inevitable slide into what Gerald Celente calls “The Greatest Depression.” It’s printing truckloads full of fake fiat money, and pumping that phoney money into the economy as if there were no tomorrow. Tomorrow's coming. Hang on. Hang on tight. (Image source)

0

0

0.000

Well, time to buy as much gold as possible. (Says the one who can't buy few grams of Gold.)

Right. Now's the perfect time to buy. I kinda wish I had a steady stream of income now, but I guess I'll hafta rely on my meager profits from Steeemit.

If you cannot buy gold, maybe you can afford a bit of silver. It's much cheaper, and many analysts and observers believe that silver will outperform gold over the coming few years.

@cypro.piotr ... Gold is severely underpriced. That fact is due primarily to the price suppression techniques carried on by the bullion banks.

They sell "paper claims" to gold. Not only do they take large fees from the sales, the constant "selling" keeps the price low, as there may not always be sufficient buyers of the paper gold.

Currently, most conservative estimates put the ratio of Paper Gold – Physical Gold at a staggering 200 : 1. And that's a conservative estimate. For Paper Silver – Physical Silver, the ratio is said to be higher.

That means that, for any single ounce of gold that the banks will have to provide when the owners of the "paper claims," there are over 200 owners. So, the very first owner who shows up at the banks requesting his Physical Gold could get his ounce, but the following 199 "owners" who show up with their paper claims will be told, "Sorry, we don't have any more gold. Now, fuck off!"

So, beyond a doubt, gold is underpriced. Severely underpriced.

why gold? isn't gold still overpriced in your opinion?

Because its price don't decrease with Fiat. I'd say Bitcoin but its price is unstable so I chose the other best thing.

Have to consider that there will be a run on gold when digital asset trading becomes a public certainty. While we won't need it, gold should become a status or ranking system of "old" money.

That's true. Over the past few years, or even few decades, many astute observers have predicted that there will be a run on gold.

Most likely, that will also cause a run on cryptocurrencies. As people abandon fiat currency, both precious metals and cryptos will be the safe havens.

Will be interesting to see how the first couple-of-year runs view cryptos. I doubt it will be as the programmable money and digital asset representation that devs intend. Also, I still have yet to find a satisfactory gold run explanation. I believe it will happen, but yet to envision how with any detail. Maybe because the most wealthy already own the significant portion.

As fiat currencies collapse, it's pretty much inevitable that precious metals will rise to take their place. And cryptos will tag along, or maybe even move ahead alongside gold and silver.

I was thinking along these4 lines in viewing the latest Star Wars and its money.

Dear @majes.tytyty

It's quite obvious that USD will die one day. Pretty much all FIAT currencies that ever existed died at some point. It's a one huge graveyard out there.

Question is: would it possibly happened during our lifetimes? Perhaps yes, perhaps not.

I absolutely disagree with that :) FIAT currency (especially in form of cash) is still giving us some sort of privacy. Blockchain can bring tons of benefits, but idea of full transparency (idea being so highly promoted) is nothing else than giving up your privacy.

Also if we would "ditch the dollar" then I forsee global economy meltdown bringing entire world to it's knees. That's unfortunate reality we're living in. USD is to big to fail without bringing entire world down with it.

Surely difficult times are ahead of us.

Upvote on the way :)

yours, Piotr

I agree that this will not happen very soon. In fact, it could take decades. But it is happening.

Don't take my word for it, cuz I'm just the messenger. There are many observers and analysts today who foretell this. They are wise, experienced students of economics and history.

As for that statement re "abandoning the dollar," that's directly from Peter Schiff, but I tend to agree with him. In fact, over the past year, my Chiang Mai friends and I have lost quite a bit on the exchange rates from our countries currencies to the Thai baht. This means we have 100s of dollars LESS EACH MONTH, simply because our countries' currencies dropped in value over the past year.

One of my good friends is still sitting on a relatively large chunk of US dollars here. He's waiting for it to increase vs the baht. His waiting will be in vain.

As for the "entire world" melting down, that's true. I mentioned that in my COMMENTS in my post. Since the global economy is so interconnected, the effect of any collapse of the USD will be global.

The Reset to "Sound Money" will be a Quick as "Flipping a Switch"...

I believe an Executive Order for the "Activation" of "Sound Money" has already been Written, and is standing by, ready to be Signed by President Donald J. Trump... I'm expecting it to be Signed no later than May of 2020, because of it's importance...

December 18, 2019... 6.5 Hollywood Time...

Hello my dear @majes.tytyty, very good article.

Friend I am not an economist, much less, I do not know if the Dollar collapses soon, what is what we can notice the people of the community, that there is a crisis in progress around the world, that the economies of the so-called "powers" we thought They were unwavering, now they falter and economic conflicts are becoming more and more evident, something is about to happen but I am not sure what will happen.

Blessings!

@fucho80

So true. Even just 10 years ago, many people thought everything was running smoothly and safely. Then the 2008 crash happened. That should have been a wake-up call.

But then the central banks stepped in with their QE money-printing programs, and people remained asleep and deluded. Now, however, the global economy is in such a precarious position that there's virtually no reason for optimism. Except, maybe, if one holds cryptocurrencies or precious metals.

Wooo friend, reasons to worry then, he who has the possibility of migrating his resources to these types of assets to stay safe.

I think at this point people need to recognize the demise of USD being a possible scenario and make suitable hedges.

Peter Schiff will probably recommend gold as a hedge. But my preference is still digital hold, Bitcoin :)

Definitely, Schiff is a gold bug, and in fact, he hates bitcoin. He's debated a few people about the gold vs bitcoin, and he's lost the debates.

I saw Schiff and I was thinking Adam :)

I try not to think of Adam Schiff. Or anybody or anything related to the long charade currently embroiling the USA. :-(

yeah, ouch

Wow, this is a wonderful read and an excellent start to this fine Death-of-the-dollar series. I believe that the age of fiat is about to end. There will be a big move to cryptos and BTC will remain the most trusted. Post resteemed already - at my pleasure.

Thanks for the resteem. And thanks for the compliment.

The age of fiat cannot come to an end quickly enough. It's fraught with dishonesty, fraud, manipulations, and outright theft of wealth.

It's my pleasure. I await the next episode.