Zero and Negative interest rates for consumers...

Hmmmm, it has come to this... the European Central Bank has had negative rates for a little while now, but in general, the public customers of the retail banking sector have been shielded from these negative rates. The rates have been pitiful, but still positive!

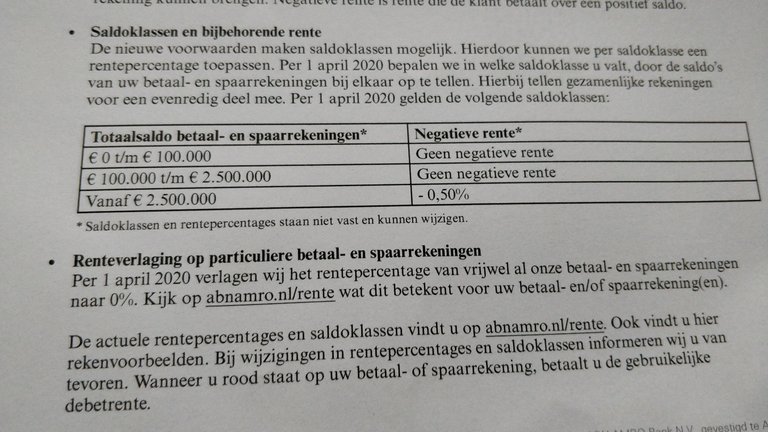

However, yesterday I received a letter from our bank saying that the interest on accounts (regular and savings) less than 2.5 million euros will now attract a nice 0% percent interest... and accounts greater than 2.5 million euros will collect the -0.5% interest rate. I guess I should feel happy that I don't have 2.5 million euros in any accounts!

Jokes aside, it is a bit of a troubling sign... as negative interest rates mean that there just isn't any confidence in the economy... there is little investment, and the negative rates (so, you have to pay to store your money with a bank) are supposed to act as a push to get people to invest. However, there is some debate as to whether or not this will actually work... even a 0.5% "fee" for storing your money at a bank could be better than the expected losses on a stock market!

In Australia, things are marginally better, with the best interest rate on a term deposit sitting around 1.8% per annum over 8 months. That is also not a "normal" interest bearing product, as it is a special deal for a set period of time. More likely, you are looking at something on the order of 1-1.5% on your savings.... still not great, but at least it isn't zero... or negative... yet!

However, doing the Cindicator predictions, I notice that the American stock market (as reflected by the SP500) is still going strongly... I wonder if that is really sustainable, as there is much talk of the overnight repo market being bailed out nightly by the Federal Reserve, and also indications that stock buy-backs by the companies themselves are actually inflating the prices rather than any underlying confidence. Of course, over there you have a President who keeps running interesting lines such as trying to convince the American public that the tariffs are not paid by the American public themselves (at least in the short to medium term!).

So... it could be interesting times ahead for the European (and American... and global economies...).... interesting being a synonymous for "time to bunker down"....

Meanwhile, on the cryptocurrency side of things, things are looking quite different... Compound has roughly a 5-6% return on the DAI and USDC stablecoins, Kucoin has a lending product on the USDT stablecoin of around 7-8% (short term up to 1 month loans) and Binance has lending products that attract a 6% annual return on a 1 month lockup.

Keep in mind that there are also non-stablecoin alternatives, but unless you live COMPLETELY off cryptocurrencies and deal in an ecosystem that doesn't need to refer back to fiat values then these have problems with the currency volatility.. so, it isn't a wise idea to use those to store savings! Let's just say, we aren't anywhere close to that world... yet!

Now, the problem (at least for me...) with the crypto alternatives is the lack of a direct EUR or AUD version. All the interest bearing products rely on the USD stablecoins... which means that I would also be subject to foreign exchange fluctuations if I were to use them. That said, I am considering a little 8 month test... I would lockup some small amounts of DAI, AUD and EUR to see how much interest that they would bear over the time... I will try and plan and execute it in the coming week. The results could be interesting!

There is a bit of hassle and friction with the on and off ramps... but I've have routes that will take very little in the way of fees... so, zero deposit (and zero withdrawal on fiat)... and minimal trading fees. Even with these little bites in place, I think it is still going to work out better... I've planned the routes, and checked against the risks... the biggest risk is the foreign exchange rate fluctuations over the 8 month period... unfortunately, that is going to be a given... Due to this problem, I am going to play it quite safe, and move a very small amount for this experiment.... but I do look forward to the day when everything doesn't need to be denominated in US Dollars!

That said... the EUR one is pretty easy... interest is 0%, so I can already predict the result of that one!

Coin Tracking

Looking for a quick and easy way to keep track of your cryptocurrencies? Coin Tracking offers a free service that includes manual tracking or automatic tracking via APIs to exchanges, allowing you to easily track and declare your cryptocurrencies for taxation reports. Coin Tracking can easily prepare tax information sheets that are catered to each countries individual taxation requirements (capital gains, asset taxation, FIFO). Best to declare legally and not be caught out when your crypto moons and you are faced with an unexpected taxation bill (unless you are hyper secure and never attach any crypto with traceable personal information, good luck with that!).

Keep Your Crypto Holdings Safe with Ledger

Ledger is one of the leading providers of hardware wallets with the Ledger Nano S being one of the most popular choices for protecting your crypto currencies. Leaving your holdings on a crypto exchange means that you don’t actually own the digital assets, instead you are given an IOU that may or may not be honoured when you call upon it. Software and web based wallets have their weakness in your own personal online security, with your private keys being vulnerable in transit or whilst being stored upon your computer. Paper wallets are incredibly tiresome and still vulnerable to digital attacks (in transit) and are also open to real world attacks (such as theft/photography).

Supporting a wide range of top tokens and coins, the Ledger hardware wallet ensures that your private keys are secure and not exposed to either real world or digital actors. Finding a happy medium of security and usability, Ledger is the leading company in providing safe and secure access to your tokenised future!

Account banner by jimramones

except when you ask for a loan then you have to pay interest lol :)

Yes... although, despite the fact that it would be nice to be paid to take a loan... if things got to that point, I suspect that things would be in a very very bad shape indeed....

With inflation 0% interest means you lose.

Yep... the eternal treadmill!

Big Finance is getting crazier.

Paying us Interest to take on more debt?

As Admiral Ackbar said,

IT'S A TRAP!

Well... they haven't quite got to that point yet... but if it does, then things are really going pear shaped!

#posh proof

https://twitter.com/CryptoBengy/status/1220240904717504514?s=19

Congrats! on your upvotes from the IBT Community