MAP Rewarder: MAPR Payouts to Delegators and Price Increase for Token-Holders for 6 Jan 2020 (17.5% APR, 19.0% APY)

Earn significant passive income with STEEM without locking SP by investing in MAPR tokens.

This week's distributed profits are 0.335%, equivalent to 17.5% APR and 19.0% APY.

This is higher than most individuals can earn from vesting their own STEEM.

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the same amount in STEEM as you would have done under the old system of just paying out STEEM transfers.

Token-holders receive no token distribution, unless they are also delegators. Their profit comes in the token price increase.

The added bonus is that if you don't sell this week's tokens, then next week their value will rise to at least the new BUY Price. This is how the token allows compounding of profits, for both delegators and token-holders.

Using the language of investment trusts, delegators hold "income" stakes where the "interest" is paid out in tokens, whereas token-holders have "capital" stakes where the profit is added to the token price.

A reminder that new delegations start to earn 2 days after the day of delegation. This means that the first week's payout will be lower than for a 7-day week. Also, as payouts are done on Mondays, delegating on a Saturday or Sunday will yield no distribution till the following week. This has always been in place and is to avoid people trying to game the distribution. The positive part is that there is no unstaking period for the tokens, merely the standard waiting time for undelegating.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 22.1% [1a], 12.6% [1b], 12.1% [1c]

Value of Steem author rewards payouts = APR 11.1% [2a], 6.3% [2b], 6.1% [2c]

Distributed MAPR payouts = 0.335% (APR 17.5%) [3]

Projected Compounded APY 19.0% [4]

MAPR BUY Price: 1.08418 STEEM [5]

MAPR SELL Price: 1.09502 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens and the MAPR price adjusted to reflect this.

[4] Equivalent compounded yield as an APY for this week's distribution in [3].

[5] Our BUY price is the price you may sell your MAPR tokens such that their value in STEEM is the same as if this week's distribution was done by direct STEEM transfer.

[6] Our SELL price is about 1% above the BUY price.

Our MAPR distribution [3] is much higher than the average blockchain author rewards [2].

Our payout [3] is now significantly higher than most users can achieve [2a, b & c]

and

higher than most users can even generate with a full vote [1b, 1c].

Profits will be paid today in the new MAPR tokens.

MAPR News

I have made a change to the data presented above, with [4] now being a calculation showing the compounded rate of return for a year. Most delegators and token-holders are keeping their tokens, hence compounding the weekly profits. This new calculation is thus a better measure of returns for most MAPR members.

A reminder that during this price-stability mechanism (the so-called haircut, or tonsure) the market price of STEEM does not affect income that is generated and paid out in STEEM. As SBD has a print rate of zero, our earnings are also unaffected by its price.

Income is thus very much a function of blockchain activity - rshares activity. This is, however, complicated by things such as downvotes and the earning potential from the curation curve.

Our income of 17.5% APR continues to be significantly higher than most users can earn with their own SP. Just look at the numbers above: an SP of 10k STEEM can generate a vote worth just about a 12.6% yield. The new reward curve means that MAPR income is now even higher compared to the average user than it was before. Sure, it has dropped slightly in money terms due to the same reward curve changes, but compared with one's own personal SP, either delegating or buying MAPR tokens can produce very attractive income.

Indeed, by investing in MAPR, whether as a delegator or by buying tokens, you will be earning close to the same percentage as a whale. Sure, it won't be the same amount but it is the same percentage - and with a non-linear curve that's important. As most MAPR members are hodling, the APY rate of 19.0% is closer to the true yield for most people.

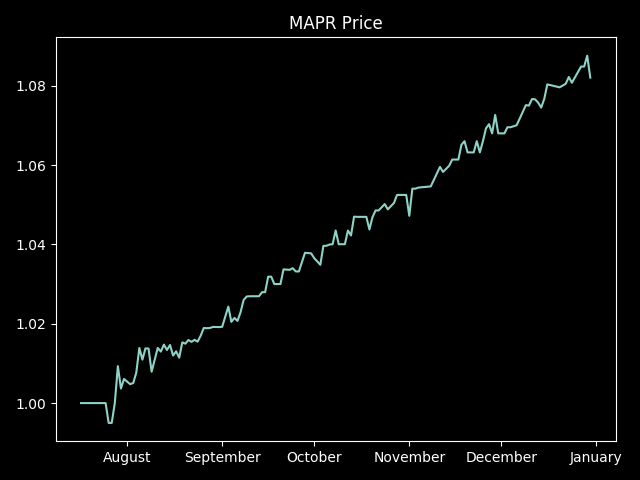

Although our weekly returns are variable, here is a graph of how we have been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

MAP Rewarder, without the token, has been in operation some 23 months, so you can extrapolate back from that graph to get an idea of our returns to members. We celebrate 2 years of operations at the start of February.

This graph is a record of actual transactions on the Steem Engine exchange so it can, in practise, deviate from this apparently-straight line. This can happen if there are large buyers or sellers that can use up all the tokens at a particular price-point. At the moment, we are largely seeing buy-and-hold trades and the market behaves more like a shop than an exchange. So this is just a reminder that it is a marketplace and you can leave open orders to either buy below our own current price, or sell slightly above it.

There also needs to be a psychological change in Steem users who think that SP is the only way to invest in the blockchain. Tokens such as MAPR, and others in the MAP FinTech family, are designed to achieve high and stable returns without any SP. This also means you no longer have to wait 14 weeks to undelegate SP and then power it down fully.

See you next week!

Next rewards distribution will be on Monday 13 January.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]

[BUY MAPXV] - [READ MAPXV]

ONECENT: The First Strategic Token Investment Game (STIG)

Congratulations @pixresteemer, you successfuly trended the post shared by @accelerator!

@accelerator will receive 0.46182150 TRDO & @pixresteemer will get 0.30788100 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Hi @accelerator, a small upvote and a tip from the ADDAX trading game! Round 2 has closed - Round 3 to start soon.

$trendotoken

Congratulations @addax, you successfuly trended the post shared by @accelerator!

@accelerator will receive 0.66135488 TRDO & @addax will get 0.44090325 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

According to the Bible, What is the proper way of teaching children about the Church?(2 of 2)

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #SteemPower. It's our little way to Thank you, our beloved friend.

Check our Discord Chat

Follow my Steemit account on https://www.steemit.com/@hiroyamagishi

Hi @accelerator, a free $trendotoken from the TULIP Mania Game!

Round 3 will start soon and full details will follow. Thanks for playing!

Congratulations @busbecq, you successfuly trended the post shared by @accelerator!

@accelerator will receive 5.10558188 TRDO & @busbecq will get 3.40372125 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

A member bonus $trendotoken tip, and !trendovoter, for @accelerator from MAPXV! These bonuses are for members, selected at random, and last for a few days.

Win MAPR tokens in this new Nonsense Writing Contest.

Also consider our MAPR fund and MAXUV vote bonds too.

MAP Steem Fintech: growing your STEEM without SP.

Congratulations @mapxv, you successfuly trended the post shared by @accelerator!

@accelerator will receive 4.79937150 TRDO & @mapxv will get 3.19958100 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

A member bonus $trendotoken tip and !trendovoter for @accelerator from MAXUV!

Also consider our MAPR fund and MAPXV vote bonds too.

MAP Steem Fintech: growing your STEEM without SP.

Also, please take a look at our new Nonsense Writing Contest post with MAPR prizes.

Congratulations @maxuvv, you successfuly trended the post shared by @accelerator!

@accelerator will receive 4.23561150 TRDO & @maxuvv will get 2.82374100 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

A bonus $trendotoken tip and !trendovoter from ONECENT!

Also consider MAPR fund and MAXUV vote bonds too.

MAP Steem FinTech: growing your STEEM without SP.

Win MAPR tokens in this new Nonsense Writing Contest.

Congratulations @onecent, you successfuly trended the post shared by @accelerator!

@accelerator will receive 7.70841563 TRDO & @onecent will get 5.13894375 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Hi @accelerator, a modest tip of appreciation:

$trendotoken

Also, please check out my new Nonsense Writing Contest.

Thanks!

Congratulations @rycharde, you successfuly trended the post shared by @accelerator!

@accelerator will receive 4.78457888 TRDO & @rycharde will get 3.18971925 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Congratulations @accelerator, your post successfully recieved 27.75673577 TRDO from below listed TRENDO callers:

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Congratulations @onecent, 2.5% upvote has been shared with your successful call on the post that shared by @accelerator!

Support @trendotoken projects by delegating : 100SP , 200SP , 500SP , 1000SP , 2000SP