Using MakerDAO to speed up bank deposits

If you're like me you find it very annoying that it takes a week for funds to clear your bank account and make it into Coinbase. The market can move very fast in a week. Sometimes ultra-bullish signals appear and they need to be acted on immediately or not at all.

I've been using MakerDAO a while now to mitigate this problem. In fact, I was able to give myself a loan on October 24th just in time to buy in while Ethereum was still $160.

How does it work?

It's a fairly simple process in theory. After we initiate a bank deposit into Coinbase we give ourselves a DAI loan using https://cdp.makerdao.com/. We then spend that DAI on the asset that we want instantly, and when the bank deposit goes through we use it to buy DAI and pay back the loan.

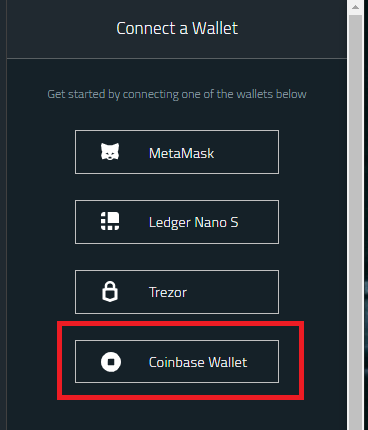

Coinbase even accepts DAI now, so it's pretty convenient.

Apparently there is even a feature that allows you to create the DAI directly from your own Coinbase wallet? Didn't even know that until just now.

This is essentially akin to rolling into one of those check-into-cash payday-loan places that charge those wonderful 15% loan-shark fees.

It's nothing like that.

This strategy only works if you hold enough Ethereum to justify taking out the DAI loan in the first place. Obviously people walking into those payday advance places live paycheck to paycheck and would never have a bunch of Ethereum lying around.

How much does it cost? (MATH WARNING!)

One week is about 2% of a year.

MakerDAO loans currently charge around 5% APR.

2% x 5% = 0.1%

Therefore, this strategy only costs about $1 per $1000.

You'd only have to be right about the gamble 51% of the time for it to be worth doing. The cost is negligible.

What are the risks?

We often trade crypto based on emotions, and those emotions often get the best of us. The FOMO is real. Many people would be better off waiting the full week to cool down before making a decision to buy in. That being said, nothing stops us from making a bad decision a week later either, so this argument might be a pretty moot point. In fact, there's a chance that waiting the week and getting burned by an upswing could ironically cause one to go on tilt and enter the market anyway. It's all speculation.

What are the real risks?

You have to put your Ethereum into a CDP smart-contract. Your Ethereum is no longer Ethereum. It goes from Ethereum to ERC-20 compliant wrapped-Ethereum (WETH) to Pooled-Ethereum (PETH). This PETH then becomes locked in the CDP.

If there is a fatal flaw in the smart contract it's possible that a hacker could start stealing PETH out of the pool, whereas it would have been safe as regular ETH in your wallet.

Then again if you're like me you're already messing around with CDP loans, so it's not really an extra risk to use it for a cash advance.

Interestingly enough, the value of WETH to PETH changes.

I randomly read somewhere that when bad loans are liquidated some of the money from the 13% liquidation fee gets allocated to make PETH more valuable. This means you can actually increase your Ethereum holdings by creating a CDP contract and loading it up with PETH. You don't even have to take out a loan (pay interest) to get the benefit of this. Don't quote me on this.

More risks.

If your CDP collateral falls below 150% collateral during the week your loan will get liquidated for the 13% penalty. This is annoying, but usually not the end of the world. It's already happened to me once.

Also, if this were to happen during a cash advance, you've likely greatly misjudged the market if ETH were to tank this hard. Remember, you were only supposed to make this play if the market was overwhelmingly bullish. You needed that money fast to capitalize on the price action of the next week alone.

A good rule of thumb is to keep CDP collateral around 300%.

If you want to take out $1000, you should have $3000 worth of ETH to back it up.

Slippage

DAI is never 100% pegged to the dollar. There is liquidity involved just like every other coin. Liquidity is getting better on this front so it doesn't matter much. However, if you tried to employ this strategy with a lot of money you might find yourself paying a premium on DAI coins. However, now that Coinbase supports DAI you'd have to be trading over $50,000 these days for it to matter. I imagine this doesn't apply to anyone here, but it might if you were using some podunk DEX with bad liquidity.

Conclusion

The ability to permissionlessly give oneself a loan cannot be overstated. Maker is going to continue to be a big player on the Ethereum network going forward. A one week cash advance only costs a 0.1% fee to initiate now, and if the Maker APR returned to the baseline (0.5%) that number would be reduced ten fold.

Maker is still the best ERC-20 token providing actual solutions to real problems right now. This isn't speculation. There are plenty of fantastic projects out there that should overtake it someday, but not today; probably not even next year.

Thanks for the explaination I was literally trying to research it today! The content I got wasn’t really as clear as this! I’m keen to get into This stable coin to get play on a few trades and see how I fair

Your post has been curated by the bitcoin myk project. Tokens are available for this account you can trade for steem at: https://steem-engine.com/. Join our curation priority list to earn more tokens by registering at:

http://www.bitcoinmyk.com/register/

Bitcoin MYK

admin

Register - Bitcoin MYK

This post earned 150 BTCMYK

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.