Monthly Crypto Portfolio Update (Jan 2020)

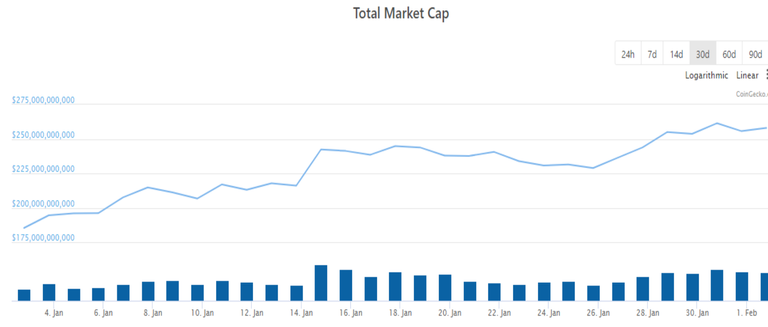

As expected, bitcoin has led the way of the market rise as its dominance only went from 68% to 67% during the month. However, total market capitalization increased to $255 billion once again. In a world that now has a couple of publicly traded companies like Apple and Amazon worth over $1 trillion, the space to continue the increase in value is a reality with more potential. Easy money in the financial markets due to stimulus and accommodating monetary policy by Central Bank and Governments seems to be signaling continued inflationary asset prices which should benefit the asset class as well.

Despite the uncertainty that continues to build on many aspects of the economy and geopolitical environment around the world, capital remains abundant. Unfortunately, we have always learned in the past that it all works until it does not. We also learned in the cryptocurrency market in 2018 that adjustments downward are much swifter and broader than the way up. My key indicator to continue watching will be liquidity as it is a measure that can dry up quickly and although Central Banks are already supporting it, there can always be a tipping point where the response is no quick enough.

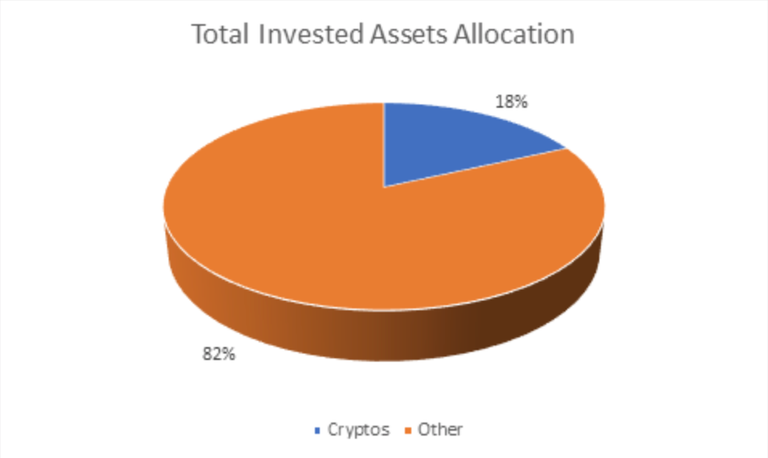

I continue to be in a neutral position despite the moves in the market. It is not necessarily because I want to as some of the asset prices during the month were very attractive. Unfortunately, my liquidity has dried up given some of the decisions I have made for other financial issues like my potential relocation efforts. However, the responses to the markets in these assets have continued to encourage me about the long term potential of the value of the asset class and technology in general. Therefore, I remain committed to adding more of my assets over time to the class given its other benefits.

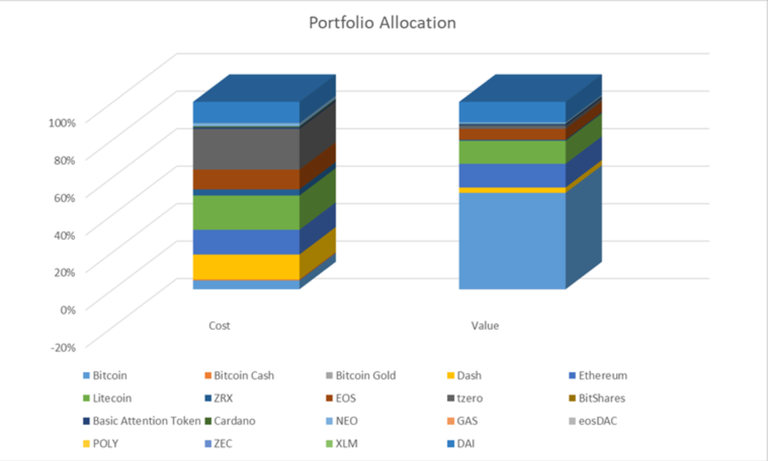

DAI was the only asset I added to in the month as part of my monthly purchase program in place. I also checked how the Oasis deposit has been going and was happy to see the funds deposited growing consistently with a 7.75% savings rate. I plan to update separately on a post but I believe that the DeFi potential continues to be a great opportunity in the short term as it could be the fastest growing application of Blockchain technology this year. With increased adoption and continued development, value can continued to added across the asset class as it draws the attention of a broader class of investors.

The worthwhile venture of the DeFi space continues to lead me on an effort of learning more of its applications and how to increasingly participate. In the effort to grow my exposure to the expanding landscape, I am looking to adding more assets to the portfolio in the coming quarter. It may lead to it achieving 20% or more of my invested assets which is impressive considering the other areas where I am allocating capital like precious metals. There may even be overlaps as a number of projects have looked to tokenize assets on Blockchain.

I am hoping that the months of patience and research for my personal journey into the asset class starts to become once again active as capital and liquidity starts to flow for me personally. It will be more of a challenge to decide on where to allocate versus whether to do so in the coming weeks and months. It will surely be an interesting time; particularly if the market continues to move as it has in January. While risks surely remain ahead, the trend continues to be positive for the long term value of the asset class.

Discord: @newageinv#3174

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

If you are like me and interested in continued personal growth, invest in yourself and lets help each other out by leveraging the resources Minnowbooster provides by using my referral link

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

The best new browser to protect your privacy while still being faster and safer. Try the Brave Browser today with my affiliate link here: https://brave.com/wdi876

Try the Partiko Mobile app to engage while on the go with my referral link

Get started on the latest game on the blockchain Drug Wars by signing up here!

If you select one of my above referral links, I will sponsor a @steembasicincome SBI in return. Let me know if you do so in the comments below!

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.

A very nice review.

I like this quote:

I think that says it all, along with this;

I will continue to buy on dips, anticipating the dips will continue.

I agree with this:

This DAI return is impressive;

I have no dividend paying stocks which can equal that return. Only my whole life insurance cash value at 5.37% comes close due to its tax free status.

I whole heartily agree with this;

I will continue “stacking” Satoshi(s) while remaining diversified.

✍🏼

Posted via Steemleo

I have been thinking about a Whole Life Policy myself these days but have wondered of it it is too late to start! Thanks for the engagement!

Posted using Partiko iOS

I think with careful research and use of an IBC certified agent you may see very good preservation of your premiums as cash value. The process can be tweaked to benefit you more then the agent on your policy, but the agent could win longterm based on volume.

https://infinitebanking.org/about/

Agree at 100% with the DeFi part, in the short-term I think those are the ones that will provide the best ROI, and after I think STO's will be the ones with the highest ROI, assuming STO's aren't DeFi.

I've finished my VET bag, started a CEL bag not sure when I'll finish it, but when I do I'll probably stick with BTC and ETH, and maybe XTZ(not sure)

My only Security Token, tZero, has been disappointing but highlights the importance of selecting the right project to support. ETH continues to grab my attention just because of how much of the DeFi universe it is capturing.

Posted using Partiko iOS

Hi @newageinv!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.697 which ranks you at #1704 across all Steem accounts.

Your rank has improved 7 places in the last three days (old rank 1711).

In our last Algorithmic Curation Round, consisting of 96 contributions, your post is ranked at #39.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server