Capitulation Condolences!

Apologies to everyone that took me at my word and bought Bitcoin at the doubling line.

The stock market is fucked. This is far from over. Now that the bottom has fallen out from Bitcoin there is absolutely no telling where it will go. However, considering that breakers are in place to stop the stock market from cratering in a single day, these drops could happen over and over again for quite a while.

I've vastly underestimated how much institutional money was already invested into Bitcoin. It might take quite a bit longer to flush out all the "weak hands" and bottom out.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| $800 | $1600 | $3200 | $6400 | $12800 | $25600 | $51200 |

Sadly, this metric is no longer my golden goose! Bitcoin has fallen beneath the doubling line. I do believe it will still be a good metric once we recover, but going all in blindly at the doubling line is no longer a viable strategy.

I would not recommend trying to catch the falling knife here. It will be much safer to wait for the market to level off and lose some volatility. I think there is a good chance once we bottom out that bulls will be scared to pump the price because of how fucked we're getting. I plan to reenter the market when the price levels off and slowly goes back up. Of course, since it's me staying that, don't be surprised if it spikes up out of control after all this flash crashing is over.

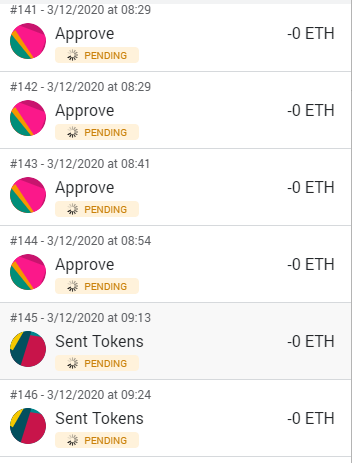

Once again, I am way overextended and feeling the burn. I probably only should have been half way into the market and 50% USD backup, but instead I was over 100% using loans from the MakerDAO. OUCH! Yep... my CDP should be liquidated any second now. I've tried to fix this problem but I can't push a single god damn transaction on the Ethereum network no matter how high I pump the transaction fee. Fun stuff.

Even more annoying, many services that used to claim to be DEXes now require KYC. Yeah, these guys should just give up and shut down. Any 'DEX' that requires KYC is going to fail. I'll just use a centralized exchange, thanks. I tried using https://uniswap.exchange/swap for the first time today... I really like the simple UX. Reminds me of Google. Sadly, I can't seem to make a single transaction on the network. So annoying.

Silver Lining.

The more adversity I face, the more it seems to light the fire inside me. This perfect storm of bullshit reminds me of an Andreas Antonopoulos video I watched the other day. In the video the ultimate conclusion was the best investment is education. Knowledge can not be taken away from you like money can. I'm highly motivated to continue learning.

When I look at my paltry crypto holdings I realize that if I was actually a real blockchain developer I could make that much money in under a few months. And I'm not talking about programming some killer app, I'm talking about the time servant wages that are paid to dev employees. Very few people in the world know how to do this stuff. I just need to keep chugging along.

The best advice I can give is to not be blinded by taking a loss. Sometimes the correct move is to take a loss because you're overextended and the market can always tumble further. Don't let the mental barrier of taking a loss cause you to make the wrong decision. I've fallen victim to this many times. The ultimate goal here should be to lower volatility. Volatility is our worst enemy in this space. The value is there, but the volatility can put us on tilt very easily.

I cashed out my Ethereum on Coinbase in order to prevent my MakerDAO loan from getting liquidated over 2.5 hours ago... they still haven't processed the transaction. It's super awesome how the network doesn't work when you need it the most.

Lesson learned.

Gimme my money back....

Beep Boop Beep

The stock-to-flow model models the supply side of Bitcoin. The demand side seems to have been seriously hammered by the Korona panic. I also think the stock market will continue to fall for quite some time. We haven't seen a recession since 2009. One was long overdue. The big ones come once every 18-19 years, though. But the market manipulations by central banks may have made this worse than it otherwise would've been.

I liquidated my entire stack before the big crash today morning (EET). If BTC goes through the 200 day MA at about $5000, I'll forget about the whole thing and accumulate cash until the bottom of the markets is found.

[Edit: Sorry, I meant the 200 WEEK MA of Bitcoin.]

The 200 week MA:

https://www.lookintobitcoin.com/charts/200-week-moving-average-heatmap/

May?

JFC. These markets have been completely manufactured by the incessant pumping of $T's into them - and the pockets of the investor class (all that pumped money is debt, for which government, and thus wage earners/taxpayers are on the hook in the future. This market has been the biggest theft in history). There is almost no correlation between price and value anymore. This is why Buffet is on the sidelines, and why everyone not all in on the VIX should be too.

Thanks!

Agreed. The Korona virus is the perfect scapegoat.

BTW, Austrian Korona's seem to be a fine investment presently. Just sayin'...

Most likely.

I always suspected that on the next hype, there will be the same problem as on the hype in 2017-2018. Exchanges will turn off and freeze wallets - the networks will hang - everything will be done so that you can not make money on it.

I hope you have learned well the real lesson here: TA is a trap.

Some while ago I discussed Warren Buffet's investment methodology with you. I noted he understands the underlying value of an investment vehicle and it's market, or he doesn't invest. TA does not reckon that information at all.

It never was. It's just pretty lines on paper. Art. The value of investments and their potential to increase is determined by the market and their ability to profit from it, not the pretty lines.

Hope you well extricate yourself from this snafu, and move forward with improved ability to profit.

Thanks!

@edicted i still believe so much in your analysis,yeah bitcoin price dropped and went against your prediction but we cannot always be correct all the time...you are doing awesomely well...everything will be fine...the coronavirus is affecting all the markets...

Posted via Steemleo

@edicted i will sue you to the supreme court ,you will be charged for "capitulation condolences....lol

Posted via Steemleo

Over 45 minute transaction times on ethereum right now.

Dang :D

Head up :)

Posted using Partiko Android

Everything is low right now. Gas is low, stocks are low, food is on sale.

I am sad about the refinance I was planning in June - with all the prices crashing the housing market is bound to crash too.

Thankful that my husband has a steady job right now which is getting lots of overtime because of the impending doom we are all living in.

His wages stay the same, prices drop - maybe we’ll be able to save some thing or other.

Posted via Steemleo

Ouch I actually put in a lil bit at the 6,400 level myself last night. Thankfully not anything I will lose sleep over. Im just gonna hold it till a recovery no point in dumping now.

First time I entered crypto markets in 2017 I got Eth at around 300 it crashed to 150 I ended up buying double the amount I had at 150 and it eventually went up to the crazy ath’s we saw end of 2017.

Maybe the institutional investors are the weak hands. They have no loyalty to Bitcoin and they know to protect themselves against volatility.

In general, the idea that adoption will make crypto prices seems like an illusion to me. It will remain easy to cash out of voluntary currencies. At best, we could make the dollar just as volatile as bitcoin.

Good luck! I feel very relaxed, since I have no investments at all anymore.