The FED cut rates and Bitcoin... *crickets

Not much reaction thus far for bitcoin on the rate cut announcement

The lack of movement so far isn't that surprising, for several reasons really.

The first being that this rate cut was fully expected, meaning it was mostly priced in. Anytime you have something well telegraphed in financial markets, it tends to be priced in well before it actually happens.

Secondly, the rate cut was only by 25 basis points (.25%).

Many were hoping the FED would cut by .50%.

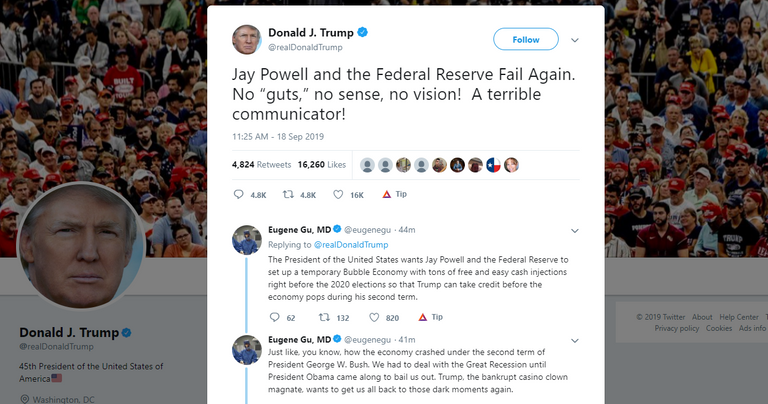

Donald Trump was one of these hoping for a much larger cut...

(Source: https://twitter.com/realDonaldTrump/status/1174388901806362624)

And thirdly...

The movement in bitcoin might just be a little delayed. The fact that bitcoin hasn't moved up yet doesn't mean it's not going to in the near future.

Bitcoin makes a lot of sense in our current environment, it makes even more sense in a rate cutting environment for some of the reasons mentioned here:

With the FED as well as Central Banks around the world basically in a race to the bottom in terms of interest rates as well as quanitative easing and other easy money policies, it is literally rocket fuel for bitcoin:

(Source: https://twitter.com/APompliano/status/1174383953031106561)

Now we just have to sit back and watch the currency debasement begin.

The end result will be sky high asset prices (in dollars) and sky in bitcoin prices (in every currency).

Stay informed my friends.

-Doc

I'm glad it's still mostly an uncorrelated asset. I don't want banks, politicians, or mainstream media able to shitpost in the news and manipulate BTC

Yes, there is that as well. Bitcoin is strange. It mostly behaves like a risk on asset, but it also acts like a risk off asset if that risk is related to a currency crisis. Bitcoin is ambidextrous.

Cutting interest rates is trend now, but won't last long.

Posted using Partiko Android

Why is that? They get to zero? Negative interest rates are becoming the rage all over the world apparently.

Bcoz overvalued dollar is not good for global economy.

Posted using Partiko Android

True. Plus Trump wants it weaker as well, so there is that in crypto/bitcoin's corner. :)

The fact that they printed Billions over the last 24 hours is even bigger news. The economy is about to collapse. It's only a matter of time before they slip up and the domino effect begins.

Yes, but are any of those billions actually going to go out into the economy? I haven't looked into it much yet but saw it had to do with inner-bank lending. Much of the helicopter money back in 09 etc never really got lent out and made it out into the broader economy, which is why we didn't see the massive inflation many expected.

But that's not how it works. It is there, is lent out and paid back all under 24 hours. What happened actually resulted in a slight decrease in the total USD supply because of the 2.25% interest on the loan.

This wasn't QE where the Fed prints money and buys securities to prop up the economy.

Bitcoin moved. It went Down.

And now it came right back.

Looks like in the end, noone cared about the Fed's rate cuts.

I don't think there is bottom in interest rates anytime soon... basically the rate would need to drop to -100% which is definitely in distant future...

I don't think we are near bottom either. I think we are just starting our next rate cutting cycle here in the US. The problem is that once you start these cycles it is very hard to ever come out of them. It's a drug that is very addictive.

As co-owner of two banks, I can understand completely... Here basically the rates are negative for big companies and non-owner individuals, but owners of bank have 0.01% rate.

I am sure they would love not to have to pay anything out to members. Members paying them sounds pretty nice.

Dont know where this will all end. low interest rate is a norm than an anomaly now.The economies of the developed donot support a high interest model unless the economic growth picks up substantially . This looks more like japan of the 1990s

Except their stock markets went down for 2 decades... I don't think the US will let theirs do the same.

In europe, they are even putting in place negative rates...