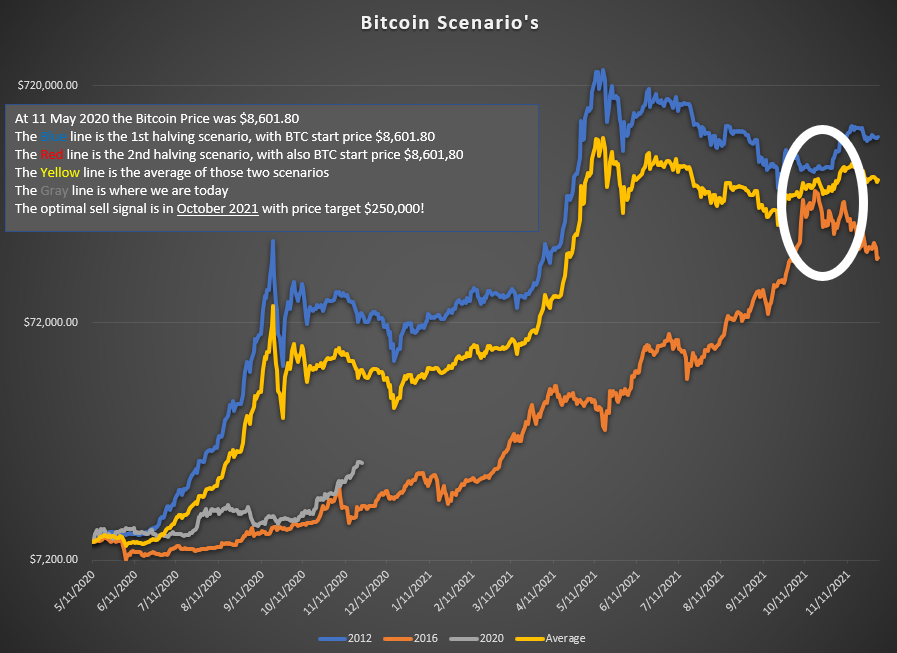

The 2017 BTC Bull Market compared with the current BTC Bull Market

So far the current bull market looks very much like what took place in 2017, what should we expect if that trend continues?

Thus far bitcoin is doing pretty much exactly what it did back in the 2016-2017 bull market.

Actually it has been tracking slightly ahead of what it did back then.

Check this out:

This was before the recent 17% correction though, so we are actually closer to that lower trend line that this image would indicate.

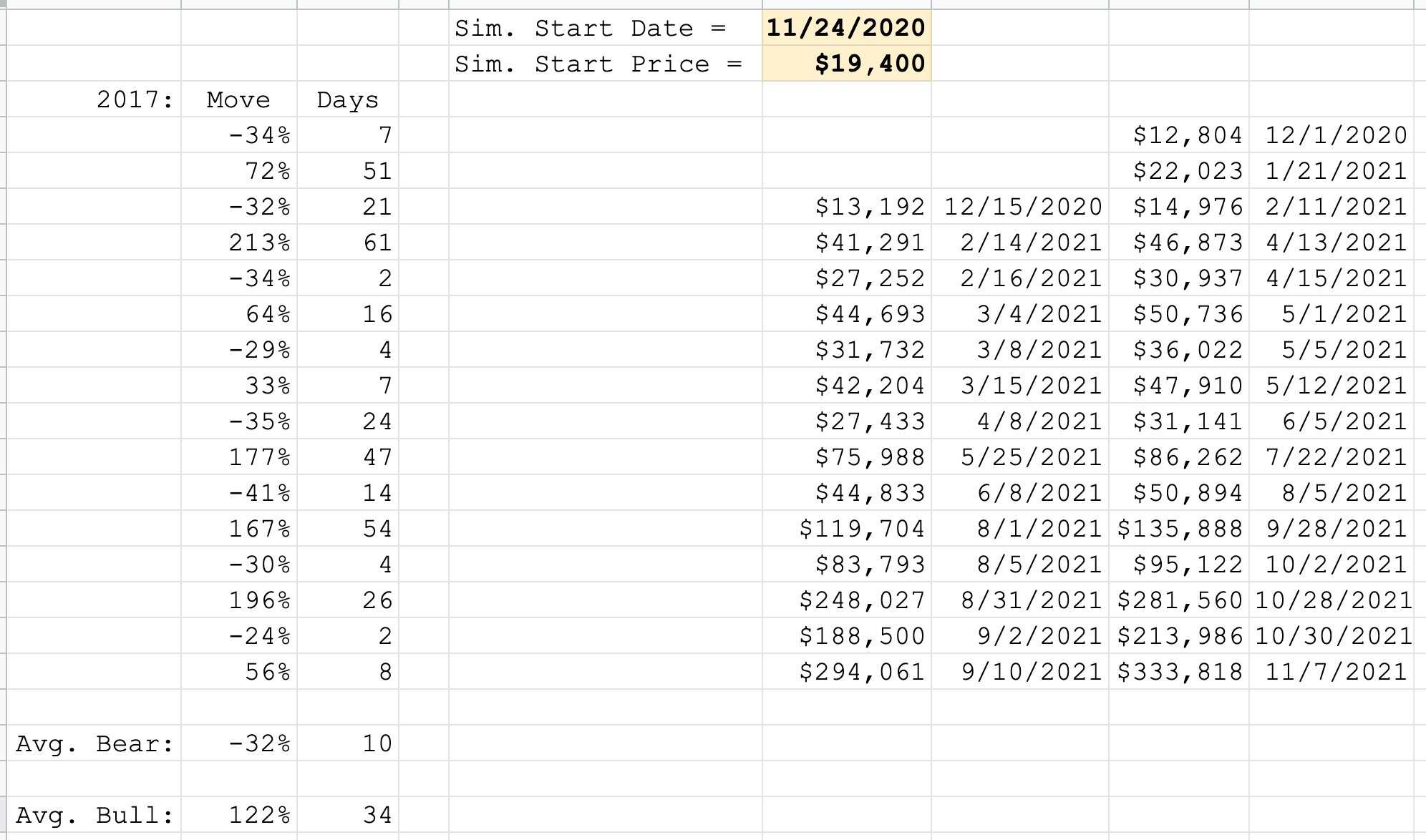

If we continue to track right along with what happened in 2016-2017, here's what's in our future...

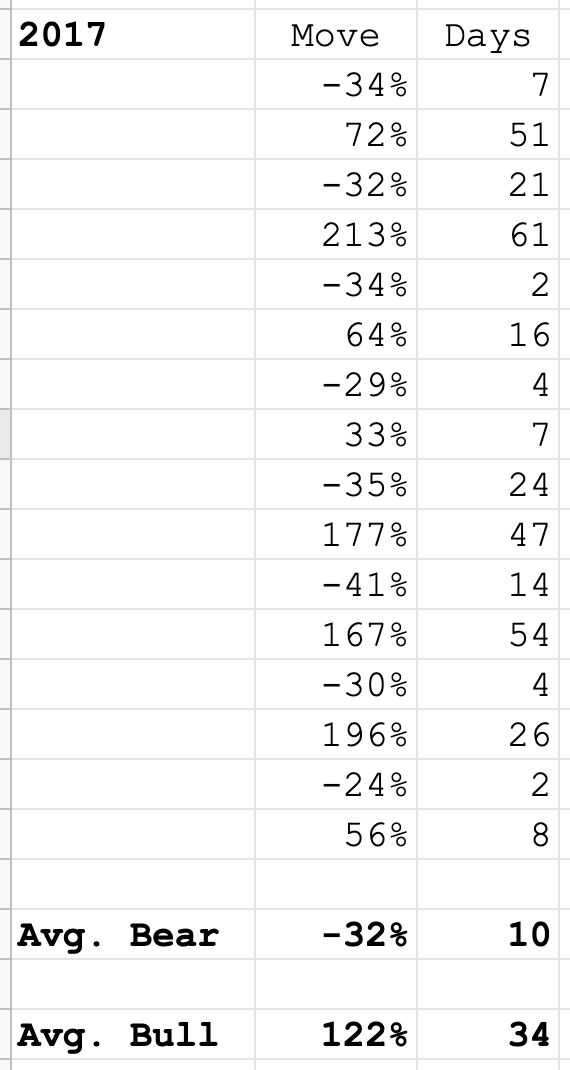

We are going to see roughly 8 corrections dropping 20% or more...

The average depth of these corrections will be 32% and they will last for roughly 10 days from peak to trough.

The average move per day will be 3.3%.

(Source: https://twitter.com/PLK5280/status/1333064705464819714)

Pretty cool right? It gets better...

What should we expect if this cycle keeps playing out similar to what transpired in 2017?

If you want to see those moves from 2017 overlayed on the current chart, check this out:

(Source: https://twitter.com/PLK5280/status/1333064709742923777/photo/1)

This would imply a $20k-$50k channel until May.

After we escape from this range to the upside, $10,000 moves in a single day are possible.

The eventual top would be $295,000 on Sep. 10, 2021.

Personally I think we top out later than this and at a lower price.

I think we are going to top in November or December of 2021 and I think it will be somewhere slightly north of $100k.

I tend to be more conservative than most models though. :)

Stay informed my friends.

-Doc

Every one is speculating about institutional investors - but they also carry a big risk - they can control the market and add more volatility. Having big stake and dumping for small amount of profit also makes the market cry.

Institutional investors tend to have much stronger hands due to their longer time horizons for investments and buy on large dips as opposed to retail who are often very skittish investors and panic sell on the way down, exacerbating drops.

Interesting, after looking at it from this perspective I'm much more comfortable with the short-term moves we've had. Basically, this posts says "buy the f*ckin dip" for the next 10 months. I'm game.

Posted Using LeoFinance Beta