BTC - Large Funds warming to the idea of 1% exposure to Bitcoin

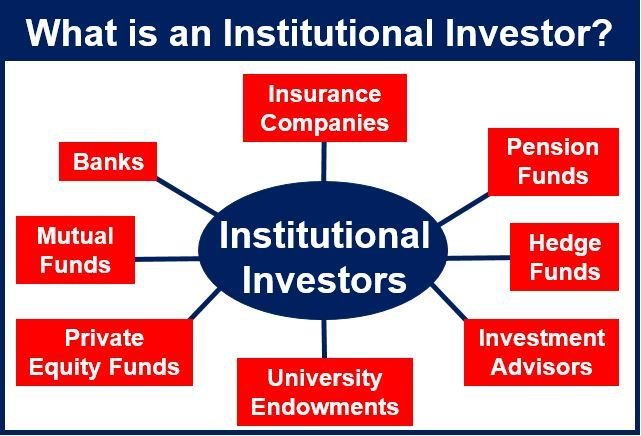

Bitcoin is becoming an easier and easier sell to large institutional investors

Several years ago, most pension funds, endowments, and family offices laughed at someone saying they should invest in bitcoin.

Today, not so much.

At this point an investment in bitcoin is more than just a hedge, it's an investment in technology and innovation which makes it even more attractive.

An investment with asymmetrical return possibilities...

The numbers just make sense...

Mark Yusko of Morgan Creek Capital pulled the data from endowments and foundations from 5 years ago and it's pretty interesting to say the least...

According to Yusko's figures, endowments and foundations totaled roughly $670 billion in investments.

Taking just 1% of those holdings would equal $6.7 billion worth of investment.

If they had put that 1% in bitcoin they would have made 9.2% instead of the 7.2% they generated.

"If you took 1% of all the endowments and foundations five years ago, that would have been $6.7 billion out of $670 billion. You took that one percent — half percent from stocks, half from bonds — instead of making 7.2%, which is what they made, they would have made 9.2% or 200 basis points better. Two on 7.2% is a lot of alpha.”

(Source: https://cointelegraph.com/news/1-bitcoin-no-longer-crazy-for-portfolios-says-morgan-creek-ceo)

That means, just a 1% exposure to bitcoin would have increased the entire portfolio returns by 2%!

That is huge!

(Source: https://blockchainjournal.news/a-major-institutional-investor-plans-to-buy-25-of-all-bitcoins/)

Bitcoin's asymmetrical returns make all the difference...

Due to the asymmetrical return possibility of bitcoin, it more than makes up for risk associated with the non-zero probability that bitcoin eventually goes to zero.

Thus, having at least a 1% exposure to bitcoin can add serious alpha to a portfolio without moving the needle much in terms of overall portfolio risk.

Funds are starting to realize this and are starting to make their way into bitcoin.

Over the next decade, Yusko thinks it will be crazy for these funds not to have had exposure to bitcoin...

“So the idea that ten years from now we won’t look back and say that as a fiduciary of a pension fund, sovereign wealth, family office, etc. you had to have exposure to this asset, is crazy.”

(Source: https://cointelegraph.com/news/1-bitcoin-no-longer-crazy-for-portfolios-says-morgan-creek-ceo)

Plus, I am sure no one wants to be known as the one fund that didn't have exposure to the best performing asset of the past decade...

Peer pressure can be a powerful force!

Stay informed my friends.

Image Source:

-Doc

According to the Bible, Will animals and pets go to heaven? (Part 3 of 4)

(Sorry for sending this comment. We are not looking for our self profit, our intentions is to preach the words of God in any means possible.)

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #SteemPower. It's our little way to Thank you, our beloved friend.

Check our Discord Chat

Join our Official Community: https://beta.steemit.com/trending/hive-182074

Sometimes, I can't help but visualize all these "traditional" investors like a group of cavemen standing in front of an animal they've never seen... Will it bite? Is it dangerous? Does it run fast? So much hesitation... but I'm gonna guess that once the green light is there, we're going to suddenly see some FOMO....

Yep, I think so. Besides the volatility, I think a lot of has to do with regulatory uncertainty. No one wants to buy something that could be banned a few months later...

Bitcoin has been the best performing asset for years. The regulatory hurdles and mass-perception of Bitcoin has changed during that time, too. I think it'll be silly for institutions and funds to not have some form of exposure for cryptocurrencies, especially given Bitcoin's performance. In fact, I still think 1% is a bit stingy at this point... Although it's a good starting point :-)

I remember reading a study that was put out by a university a while back... They concluded that a 3% allocation was the optimal model, though a 5-6% allocation was recommend for the less risk averse.

That seems like a pretty good amount. For a large fund with huge investments, I think that level of diversification is pretty good for a nascent asset such as Bitcoin, just to balance out those risk-to-return models.

Congratulations @jrcornel! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Thanks.