[BTC/USD] - Let's consider the 'post-halving dump' case

As many of you know (or not!), the way of looking at the crypto markets from a long-term/investor perspective is always observing at Bitcoin, the king.

As a prominent crypto analyst well known here by the OG's used to say (decent upvote if you say their name at the comments section).

'BTC is the biggest of the stars at the firmament and the one that dictates the market sentiment'

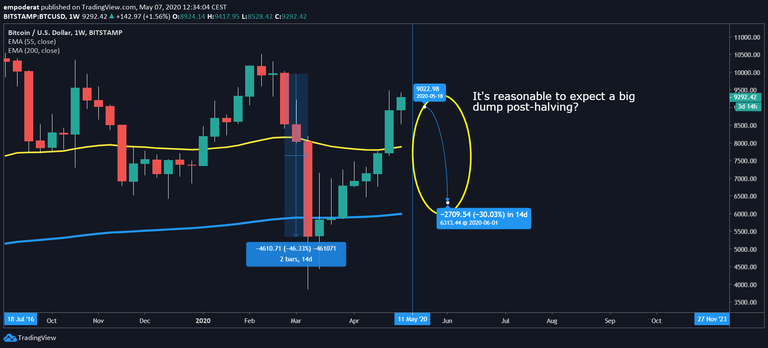

Let's make a fast look at the market 1 week pre-halving:

BTC above 2 major resistance zones (EMA's of 55 & 200 periods), less than 5 days for the next halving (which is a very bullish event) and recovered +100% of the losses caused by the flash crash of the 12th of March.

Only these FA is 'enough reason' to be bullish.

Only 1 thing to take in consideration.

The halving is considered by many as a 'sell the news' event. That means that a lot of people will be dumping their BTC a few hours before the event anticipating a BTC dump. IMO it's very possible we see some type of dump (nobody can predict the %'s here)

If we compare with the previous halving in 2016:

You can see that the price decreased 3 consecutive weeks after the previous halving (even with a flash crash), but we usually forget that the price rallied a not negligible ~70% a couple of months before.

These days the situation is radically different. As we dumped very hard a couple of months ago (the before mentioned march-crash).

Given the fact that we dumped that hard, it's reasonable to expect a significant dump after this halving event?

I don't think so.

And If we dump, the fall will be short-lived.

In addition: the chance of a big push to the upside is greater than a deep fall. Remember, we already dumped and we didn't had a 'proper rally' since January, we've been falling since.

If we don't fall hard, a lot of traders in the sidelines will start feeling nervous, what do you think will happen if a few of big hands start feeling the FOMO?

IMO it's a big risk to stay in the sidelines. I expect chopping or upside.

I also noticed this:

I like to see the MACD in longer timeframes as I see it as a 'giantic dock' waiting to 'break free' pressure from time to time.

And looking at the weekly MACD, we can see that the histogram has been compressing since the end of the last bull run, January of 2018. Ofc, we wasn't able to notice as we need the price to draw their whims.

Hopefully Bitcoin will wake up soon, and will caught everyone off-guard. As does every time. Doesn't matter what traders or investors say. It will keep being unpredictable.

Hope you enjoyed this post.

Thanks for reading!

You can follow me on Twitter

Although looking at the past is a good exercise, in trading, anything can happen. To me, the world situation with Covid19 unfolds a completely different scenario than the previous two halvings. There is bad economic news every day and that is just good news for crypto.

On top of that, there are more and more traditional investors keeping an eye at BTC as traditional markets are quite messy and the total trading volume of Bitcoin is peanuts as 70% of investors just practice HODL.

I only see a long-term bullish market.

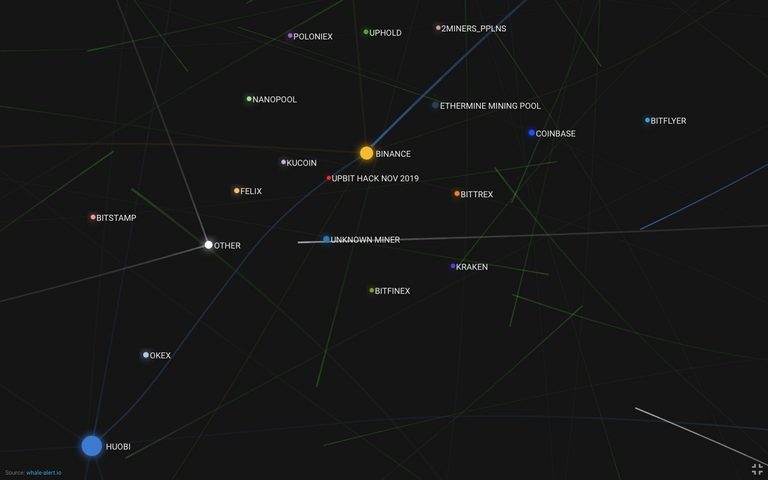

There is also an additional piece of info I just discovered today. Whale Alert

It tells you about big transactions getting in and out of exchanges, which is an additional input to consider before a market move. With beautiful graphics by the way.

Agree with everything you said in the first paragraph. The current situation with the covid 19 is only turning more eyes into Bitcoin.

This tool is pretty interesting (just bookmarked it), Easy to gape into the lines moving...

Thanks!

This is what is starting to happen, it just makes BTC and crypto an additional push to go up

I think it's hilarious you refer to yourself as a prominent anylast maybe in the HIVE world of amateur traders farming rewards

And... when I said such a thing? As far as I know I never refered myself as a 'prominent analyst'

Sorry only spend about 30 secs reading posts

I see now you weren't saying this but referring to what someone else said 🤣🤣🤣

More concretely I was referring to our 'beloved haejin, dunno if you know who he is. He's spamming the steem database since there's no police.

No problem hope you have a great day :)

Great analysis. My take is that BTC will indeed dump after halving and I believe that will happen thanks to small mining pools and amateur miners that will not find mining it profitable anymore. One-two months after that the party will begin. Interesting but, as you said, unpredictable times ahead.

Long term very bullish without a doubt. It's just that I'm skeptical to see a 'big dump'. It already happened.

My perspective here is that I see more risky being 'out' rather than 'in'.

Regards and thanks for the comment :)

It's definitely risky being out because nobody knows for sure what will happen. Considering that some have had the chance to buy it at $6,000 you're perfectly right.

duuuump finally!

Orange coin number keeps going up sir. I'm a bit bored if you ask me.

At this point I just want the price to do something!

Posted Using LeoFinance

haha yes our trading group is also bored :D :P