Australian Tax Office "is considering events in El Salvador" to revise tax status of Bitcoin

Yesterday I wrote to the Australian Tax Office (ATO) about revising their Tax Ruling (TD 2014/25) regarding whether bitcoin was a foreign currency in light of El Salvador's adoption of bitcoin as legal tender.

Here's what I wrote:

Last week El Salvador passed a Bitcoin Law which makes bitcoin legal tender in that country.

In TD 2014/25 the Commissioner determined that whether or not bitcoin was legal tender in another country was the determining factor in whether it was foreign currency under Australia law. See para 32:

"32. The Commissioner considers that when defining 'foreign currency' as 'a currency other than Australian currency' in section 995-1, Parliament intended to use the term 'currency' in the same sense that 'currency' is used in the Currency Act - namely, a currency legally recognised and adopted under the laws of a country as the monetary unit and means of discharging monetary obligations for all transactions and payments in that country. Consistent with the Currency Act, this concept of currency is in turn divided into two types for the purposes of the ITAA 1997:

(1) Australian currency, and

(2) every currency that is recognised and adopted by the laws of any other sovereign State as the monetary unit and means of discharging monetary obligations for all transactions and payments in the respective sovereign state (that is, foreign currency).

Now that bitcoin has been recognised as legal tender in El Salvador the factual situation on which TD 2014/25 was based has reversed.

When will the ATO be announcing a revision to TD 2014/25?

Further details re ne El Salvadoran law here: https://peakd.com/bitcoin/@apshamilton/breaking-news-el-salvadorss-btc-bill-passes-by-supermajority.

When I wrote this I noticed that another person had already raised the issue and had got a response from the ATO that they had "passed it on to their crypto area."

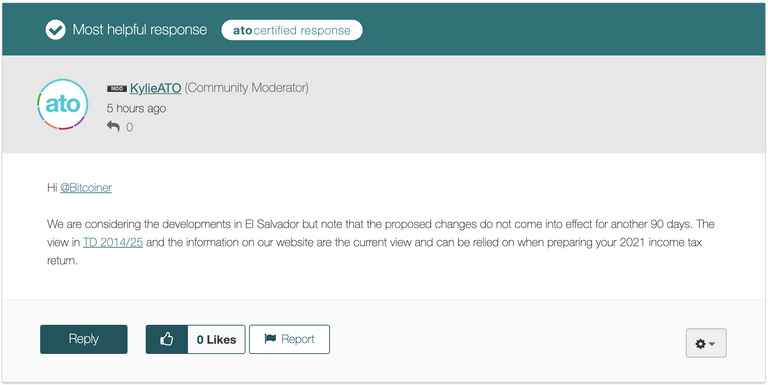

Today I got the following response from the ATO:

This is a very interesting response as it shows they have read the El Salvadoran Bitcoin Law because they know it comes into effect in 90 days (something I did not mention in my enquiry).

It also shows that they are now actively considering the issue and have a proper response for their front-line staff to give.

As I noted immediately upon hearing the news of El Salvador's (then) plan to adopt bitcoin as legal tender, this was going to have international tax and accounting implications.

Watch my Hive feed - I'll be following the issue closely.

Please vote for my Hive witness. (KeyChain or HiveSigner)

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more

Keep it up!

Posted Using LeoFinance Beta

is their TDS high

Hmmmmm. I wonder what the situation is in the UK and whether or not anyone has written to HMRC. I haven't seen any information about it anywhere other than "the changes in El Salvador will make no difference to our tax situation".

Posted Using LeoFinance Beta

You need to look at existing HMRC rulings re status of Bitcoin and see whether foreign currency status is raised.

I just had a quick look and at least some types of foreign currency trading is tax free in the UK.

If bitcoin is recognised as a foreign currency under UK law than these forex trading rules will apply, rather than capital gains tax.

I'll have to look that up. Not sure if that would be a good or bad thing. 😊

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.Oh, this is definitely interesting! I didn't really get into the hype of El Salvador, but I hadn't thought about the ramifications in other countries!

Fantastic catch on the 90 days point. They know that, without a change in Australian law or guidance, BTC changes status in Australia for all Australian tax payers!

That is pretty awesome. It is nice to that we have some people on our side who are versed and invested in the crypto world but also have the skills to navigate all of the legal stuff. I think we are going to need to see one or two more countries do the same thing before stuff really starts snowballing. Until that happens I think countries are just going to be looking for excuses, not changes.

Posted Using LeoFinance Beta

Excellent lol. They must love you as they know you must know the law and what the implications are. This will be interesting to follow and bet all other countries are in the same predicament right now.

Posted Using LeoFinance Beta

This is super news. This type of development is potentially revolutionary. Some bureaucrats will unwittingly cause a seismic shift by just following rules and bureaucrats and technocrats can be hard to touch or influence by politicians and the wealthy. It will be interesting to see how this plays out...

Posted Using LeoFinance Beta