Digging The Wrong Trends

Google, the good all mighty google, tracks everything, knows everything and it's available to almost anyone in this world for free, as a searching engine of course. Now, many of you probably are aware of its trends search page where you can Explore what the world is searching, as it is its motto.

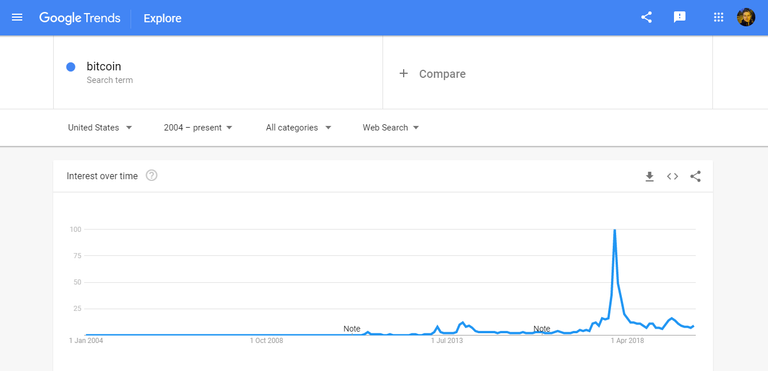

Quite a few Bitcoin and crypto analysts when trying to time Bitcoin's swings, or to "read the trend" for Bitcoin, are going to google trends and search for Bitcoin. There you have a graph of evolution for the search term from its inception, up to the present times, and you can get the market sentiment, from the dumb money point of view, because thy're the ones searching Bitcoin on google..mostly. They're also the ones doing that, like lunatics, when the price is highly appreciated, and decide to buy the peak, without even knowing...

As you can see in the screenshot above, that I took on google trends for the Bitcoin term, on a 2004-present time frame, "the demand" for Bitcoin is not high at all, on google, let's say from the dumb money expectancy. As a time and trending points comparison it's sitting somewhere where it was in May 2017. The level of trending is pointed pretty accurately I would say, and the above mentioned search term has currently 11 points, as it did almost three years ago.

Looking solely at just such that searching criteria for BTC one could say that there isn't actually too much interest in Bitcoin from retail investors and that they're not buying too much of it and neither getting educated about it. WRONG. They are getting educated and you might be amazed to see how accurately they're doing that and what actually will trigger a high demand in Bitcoin over the next months, and probably years, from both dumb and smart money.

Bitcoin is no longer a "baby asset" and there's enough people knowing about it, although not all of them are buying the damn crypto, some even from the large investors arena, although portraying as being against cryptocurrencies, are actually buying Bitcoin, and probably have done that for years. Getting back to the dumb money, and the average Joe, you should know that they are on a strong spike of interest for Bitcoin, but on another type of search and a different trend. One that occurs like four years or so, and is the triggering fire for bull markets. The Bitcoin Halving is what I am talking about and that is the next screenshot about.

In 2016, when the previous halving occurred, the bitcoin halving trend maxed out at 100 points on the google trends chart and now it's currently at 91 points. As you can see, in the chart above, it almost sky rocketed to that level, after dipping its nose into about 38 points in October 2019. The next Bitcoin halving will take place in about three and a half months and that's the event, for the blockchain, when the mining rewards will be cut in half. From 12,5 BTC per mined block, that the miners currently have, they will only get 6,25 for mining a block.

Now, who can imagine that the price of BTC won't react to such an event, when currently the average cost for mining a Bitcoin is about $6,000? I guess that only Tone Vays, Peter Schiff, and who knows what other famous bear that is a charts expert or an investing guru. I, for example, being neither of that, believe that the halving will have a massive impact on the price of BTC and will most probably start a new bull market. I refused as well, in the past, to believe that halvings are so important in the price evolution for BTC, but after researching a bit, I changed my perspective.

.jpg)

I am not the only one in that situation, and google is here to prove that. As you can see above, people are searching for Bitcoin, on google, almost the way they did in 2016. It's that they now are aware of the halving as well, and that's for sure a strong reason to buy. I am aware, that from all of those searching for bitcoin halving, there must be some that know about the asset for years, but didn't know the date for such event, adding points to the chart by searching the event, but even if you're new and just informed yourself about BTC from youtube, most of the influencers out there are talking about the halving.

What do you do then, are you gonna simply search for BTC or BTC halving? I bet on the second option. Even I, not being an influenecer, I mention about the halving every time I talk Bitcoin with someone that doesn't know anything about it. My take is that most of the ones adding points to the second chart are the ones that got burned buying BTC in the previous bull market, and now are trying to do things right, getting informed, and timing their buying and selling to benefit them and not only the big whales.

Don't get me wrong, there will gonna be collateral victims this year, and probably the next one as well, if we're gonna have a bull market, in this BTC game, and that's natural to happen. Someone has to buy the top, right. Analyzing BTC this year though, in my opinion, needs to be taken into account this highly important event as well, and not just charts, bitcoin sentiments on google trends and what the media is manipulating about. Trust your amateur crypto enthusiast, Bitcoin is gonna have the best two years to come, in its current history. For anyone to acknowledge that, all that requires is the right angle to look from and dig the right history annals. Have a great weekend people!

Screenshots and images courtesy of google trends, unsplash and pixabay.

Thanks for attention,

Adrian

Posted via Steemleo

My POSH: https://twitter.com/AdrianPapava/status/1223534931936235521

#twitter #posh #oc

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.