Not So Funny Money

It's time to have an honest discussion about the complete meltdown of Luna and UST. By that I mean that it's time to take a good honest look at ourselves, meaning all who, like myself, got hurt by it.

source: YouTube

First, before I start my rant, let me say how sorry I am for all the millions of people involved in this crash. I was hit too, sure, but for me the damage is well within acceptable levels and I won't lose any sleep over it. Especially my heart goes out to Tom Norwood and the entire team behind Loop Community and Loop Markets; I can't imagine how they must have felt during the weekend of 7 and 8 May when UST, Luna's stablecoin pair, first lost its peg to the US Dollar, and it became clear that Luna was being sucked into a death spiral. I've been with this team since the early days of Trybe, and they've always, ALWAYS, looked out for their users and always operated with the best of intentions; their spirits must have gone free-falling into a bottomless pit, synchronous with the freefall of Do Kwon's Luna/UST coins. I'm grateful that they've already indicated to not give up and keep building on and for the wonderful community they've established over the years.

Having said that, it is indeed time to take a critical look at our own behavior. Don't take this post as a criticism of the team or any person in particular. Well, maybe one person; myself. You see, I'm somewhat of an oddity in this space. Not unique by any means, but as a leftist and socialist I'm in an overwhelming minority here. My ideological background has led me to criticize many aspects of capitalism and has spurred me on to explain its shortcomings and fatal internal flaws on occasion after occasion; If you follow me on Hive or Steemit, or have read my early posts on Trybe, you'll be well aware of that. However, there's been one aspect of our political socioeconomic reality that myself and the overwhelming majority of libertarians and anarcho-capitalists in the space have always agreed on, and that's the concept of funny money.

"Funny money" has many meanings but is mostly used as slang for counterfeit money or money that's worth nothing. Now, there's a huge amount of misunderstanding about money; most people know that you need it, but very few have ever thought about what it actually is. Those who have thought about it have come to the conclusion that fiat money, the money issued and controlled by the central banking system, is entirely debt-based, that money is literally created as a debt. This awards the issuers with almost God-like control over us; we don't actually own our money but have borrowed it, and we're in perpetual debt because we have to pay for the thusly created national debt in many ways, from taxes to accepting austerity measures and KYC practices; it's all related and we've freely given away our self-governance, we've continuously voted in governments that cater to those central banks, commercial banks and the multinationals who crowd the stock markets. This highly centralized power is what unites us all, left and right, in the crypto-sphere.

However, for leftists like myself this is where the agreements end. You see, money isn't that important. Not in itself. The real economy is what's important; the products we make, the services we produce, and the method by which we produce and distribute those material goods and immaterial services. What anarcho-capitalists and most libertarians don't seem to be able to understand is that when an economy is based on perpetual growth, with each participant chasing after private profits, this will always lead to people finding creative ways to make more profits, increase and accelerate growth, and centralization of wealth and power. Simple common sense will tell you that there's a limit to growth. The planet is finite, its resources are finite, the number of people is finite. Everything is finite, yet our economy is based on the need for growth and the accumulation of wealth in private hands, and whenever there's the inescapable halt to that growth, we've devised an economic and monetary system that makes the masses pay for the subsequent crises and leaves the wealthy largely untouched. What I want you to take away from this is that these crises aren't a bug but a feature of this economic system.

In a real economy there's no place for stock markets. There's nothing produced in that market, it's just a way for capital owners to generate money without having to work or produce anything. There's no place for the much hailed derivative markets, which is just an extra layer on top of an already unproductive aspect of our economy. There's no place for rent-seeking as, again, there's nothing produced, while money is put in the pockets of capital owners. And I could go on; there are countless ways in which capitalism's constant drive for more profits have generated creative ways to increase the amount of funny money in the world. The terrible truth is that most of the money on the planet is funny money. Money that's not backed by real production of any kind. And here's where the problems of the crypto-sphere start...

LUNA Is Crashing... Here's Why.

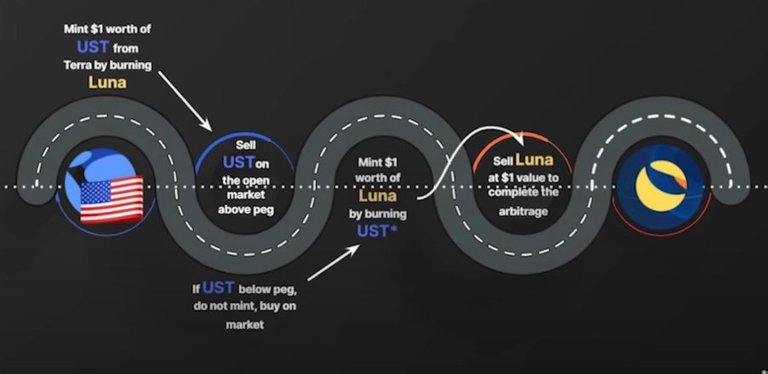

I'm sorry for the long introduction before coming to the point here, but I believe it's necessary, always, to place these subjects in their proper context. You see, cryptocurrencies only address the problem of money, but still operate within the larger space of capitalism. It still drives on the same incentives and still amounts to strong centralization of wealth; this is true for all blockchains, even bitcoin, the most decentralized of them all, has its whales and market-manipulators. Funny enough, Do Kwon, the man behind Terra/Luna/UST, has recently become one of those bitcoin-whales; I'll come back to that in a moment. As you know, UST was supposed to be a stablecoin pegged to the US dollar. There are three kinds of stablecoin: 1) fiat-backed, where each stablecoin's backed by "real" dollars, 2) crypto-backed, where stablecoins are backed by another cryptocurrency like bitcoin or ethereum, and 3) algorithmic stablecoins, where there's no backing at all and the value of the stablecoin is regulated by algorithms and arbitrage.

UST is an algorithmic stablecoin, paired to Luna to enable arbitrage. What this means is that if 1 UST is worth less than a dollar, say 99 cents, investors can buy 1 dollar worth of Luna with 1 UST, and then sell that Luna for a dollar, making an instant profit of 1 cent. The idea here is that you can always buy 1 dollar worth of Luna with 1 UST, regardless of the real price of that 1 UST. Conversely, when 1 UST is worth more than a dollar, say $1.01, investors can buy 1 dollar worth of Luna and trade that for 1 UST, which is worth 1 cent more and again make an instant profit of 1 cent. The algorithm burns and issues coins as needed through this process to maintain a balance. Now this seems a perfect system; if 1 UST trades above or below 1 dollar, people will exchange UST for Luna or vice-versa until the price of 1 UST gets back to 1 dollar, thus it should never move away from its peg for long. It's pitched to investors as a risk-free method to make money using this arbitrage process.

There's a big problem however. This whole process is based on the assumption that, no matter what happens, Luna will always be worth something. When the price of Luna falls, there's simply more Luna issued until it balances out with the total amount of UST. And that's where the death spiral begins, as issuing more Luna puts downward pressure on its price, necessitating even more Luna to be issued. This won't be a problem with relatively mild fluctuations in price but, as we've all seen now, will become a problem when the crypto-market is in a sharp downward trend. It's here where I have to point out that we should have known this was never going to end well. I should have known. There's already a long history of stablecoins that perished in exactly the same way; SafeCoin, BitUSD, DigitalDollar, NuBits, CK USD, Mark Cuban's Iron Finance and Basis Cash to name a few. To make matters worse, UST’s Do Kwon Was Behind Earlier Failed Stablecoin, Ex-Terra Colleagues Say...

There are a lot of theories spread across the internet and Twitter about Terra's downfall, some implicating a malicious attack of the blockchain by enemies of Do Kwon. I say that this doesn't matter at all; the concept was fallacious from its very start, and I should have done more due diligence. In my, and all our defense it must be said that Terra was the first algorithmic stablecoin of this enormous size, there's never been one more successful as this one, with now countless projects and DEXs based on its stablecoin. This makes the pain of failure unprecedented as well of course. I also don't like the voices putting all the blame to Do Kwon. Sure, he set this whole thing up, but many have profited from his project as well. And as the fun lasted, we've all been guilty of praising Terra to the high heavens, with no one batting an eye when projects like Anchor promised wild APY's like 20%. Worse even; you could borrow at a lower percentage than you received from lending it out (!!!), again playing on the incentive of quick and easy profits.

I promised to come back to Do Kwon becoming one of the bitcoin-whales. He bought a couple of billions worth of bitcoin for the treasury of the LFG (Luna Foundation Guard). It was pitched as an attempt to further insure backing for UST, but some think there was another motivation behind this move. Some believe that this was done to end some of the criticisms about the Terra project, to get bitcoin-maximalists to back, or at least stop criticizing Terra. And to protect it from external attacks; no one would like to see several billions of bitcoin suddenly dumped on the market when Do Kwon was forced to do so to rescue Terra. I don't know for sure, but suspect that the Terra/Luna/UST fiasco was partially responsible for some of the downward pressure on bitcoin, and as a result on the market as a whole.

To close this of, my sincere question is this: when are we ever going to learn that when something seems to be too good to be true, it probably isn't? When are we going to learn that for something to be worth something, something tangible needs to be produced? And that money should be a representation of those real products and human effort? I don't blame Loop, I don't blame Tom nor do I blame fully Do Kwon; I blame myself and my participation in something that I should have known could never end well. On Friday 6 May, only 8 days ago, Luna was trading for $80, and now it's worth a tiny fraction of a cent. We, as a group, have contributed to this sharp downfall by using the arbitrage system in those hectic final days; at one moment you could, and I'm sure many have done, buy millions of Luna for a measly $100, necessitating the issuance of millions of new Luna, pressuring the price down even more. I personally traded 10 dollars worth of UST for more than 100,000 Luna at one point, so I'm guilty as well. I assume most of us did this for the same reason, hoping that Luna's price will at least recover a little bit, and we can get some of our lost money back.

I'll leave you with a video that explains the problems with algorithmic stablecoins and the process of arbitrage to maintain peg values. I sincerely hope that we've all learned a lesson here. I also want to once again thank the team behind Loop for having our backs and not giving up. But I also hope they'll steer clear from any algorithmic stablecoin-based blockchain, at least for now and until a real solution to the above sketched problem is found. Thanks so much for reading the entire rant, and until next time!

Stablecoins Are Unstable!

Thanks so much for visiting my blog and reading my posts dear reader, I appreciate that a lot :-) If you like my content, please consider leaving a comment, upvote or resteem. I'll be back here tomorrow and sincerely hope you'll join me. Until then, stay safe, stay healthy!

Recent articles you might be interested in:

| Latest article >>>>>>>>>>> | Poetic Power |

|---|---|

| The Social Contract | Why America Sucks |

| Science Of Civil Discourse | Want To "Own" A Bored Ape? |

| There Is No Cloud | P2E Dystopia |

Thanks for stopping by and reading. If you really liked this content, if you disagree (or if you do agree), please leave a comment. Of course, upvotes, follows, resteems are all greatly appreciated, but nothing brings me and you more growth than sharing our ideas.

They told me if I killed myself now it would save the lives of countless others.

Saying the longer I wait to kill myself the more people will suffer.

They are reckless and should have shown the proper media what they had before taking me hostage for 5 years. I know there are many in prison that dont deserve to be there because of this. Your stay in prison will not be fun @battleaxe and friends. People are going to want you dead when they find out what you did. I hope you die a slow painful death. You sick mother fuckers.

https://peakd.com/gangstalking/@acousticpulses/electronic-terrorism-and-gaslighting--if-you-downvote-this-post-you-are-part-of-the-problem

Its a terrorist act on American soil while some say its not real or Im a mental case. Many know its real. This is an ignored detrimental to humanity domestic and foreign threat. Ask informed soldiers in the American military what their oath is and tell them about the day you asked me why. Nobody has I guess. Maybe someone told ill informed soldiers they cant protect America from military leaders in control with ill intent. How do we protect locked up soldiers from telling the truth?

Congratulations @zyx066! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 94000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

The beauty of Life is that in everything that happened, it is a beauty on other side. While some may cry or loss, it is a good ground and opportunity for investors and intending investors. To me, it is the best time to learn