The Risks And Benefits Of A Cashless Society

The idea of a cashless society is something that's been coming around since at least the 1990s. Back then, it was known as the "electronic wallet revolution" and envisioned as something that would bring convenience to our lives (and help stop crime).

Nowadays, it seems we're closer than ever to realizing this dream, with the number of digital transactions skyrocketing to billions per day. Achieving these astronomical numbers doesn’t necessarily mean the dream will become a reality. For that to happen, a lot of other factors should also be taken into account.

What's A Cashless Society?

Basically, a cashless society is one in which physical money has been replaced by digital financial transactions. In this context, "cash" refers to currency (paper bills) and coins. There are two ways to interpret the phrase "cashless society":A. A society where there's no physical currency at all

B. A society where there's still plenty of physical currency, but it's used less frequently than electronic payments (some countries have already reached this stage).

The Risks Of A Cashless Society

Cashlessness could have its own problems, too. A digital war on crime and terrorism could become a brutal nightmare if the government were to gain access to personal data that's collected by every company.This information would be used in ways we can't even imagine now—and it could mean that some people are excluded from the economy simply because they refuse to accept paperless payments.

A digital war on crime and terrorism could become a brutal nightmare.

"As our digital footprints grow, the potential for abuse by governments and corporations grows too," says Lee Tien, a senior staff attorney at the Electronic Frontier Foundation (EFF). "We're seeing more and more examples of how this technology is being used to violate people's privacy."Tien points to China as an extreme example of what can happen when countries adopt widespread surveillance technology. The Chinese government requires citizens who want to travel abroad or obtain certain jobs to submit personal data including their bank account numbers and social media passwords.

If they refuse or don't meet certain criteria—for instance if they've been deemed politically unreliable—they might not be able to leave the country or get a job in certain industries like journalism. "Not only does it allow them access into your digital life but it also allows them broader control over your life," says Tien about China's social credit system. "That's just one example of how things could go wrong."

Cashlessness could mean some people are excluded from the economy.

If you live in an area without internet access, or if you don't have access to a bank account, it will be difficult for you to participate in a cashless society. This is because most online purchases and financial transactions require online payment options.Those who do not have access to banking services might include:

- Unbanked individuals: People without bank accounts (or those who rarely use them).

- Underbanked individuals: Those with bank accounts but who also depend on alternative financial services such as payday loans (which can come with high interest rates).

A digital economy could be vulnerable to hacking and cyberattacks that would cause worldwide chaos

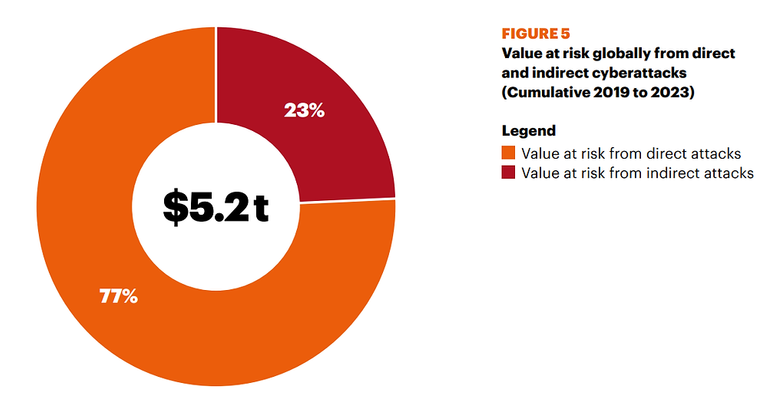

Cyberattacks have been a growing concern over the last several years, and they're only going to become more common. In fact, the risk of cyberattacks is expected to increase as technology becomes more advanced and people rely on it more heavily in their daily lives. That’s why the cybersecurity industry is worth trillions.A cashless society would be particularly vulnerable to these types of attacks because it would bring together many different types of businesses, government agencies, and private citizens all using the same financial system. A hacker could target this system by infiltrating one account or website—and then use that access to wreak havoc across multiple accounts simultaneously.

This type of hack could disrupt transactions among banks, credit card companies, insurance providers, retailers like Alibaba—and even consumers' personal finances if they were linked together through one central hub.

A cashless society could be a threat to privacy.

This is by far the biggest risk of them all. We already know that if one is not careful, their online data can be used against them. In the wrong hands, it can be used for tracking and monitoring by the government or even hacked and have one’s personal information stolen.The Benefits Of A Cashless Society

Let’s look at some seemingly rosy benefits of a cashless society.A digital economy could reduce tax evasion and crime.

Currently, people who opt not to use banks and instead deal in cash are able to avoid paying taxes on their income, because there’s no way for the government or financial institutions to track how much they earn. A digital economy would allow governments and banks to keep track of every single transaction made using currency.This isn’t just good news for those who want to pay their fair share: it would also help authorities stop criminals from getting away with evading taxes and committing other crimes.

The government could see exactly where criminals are spending their money, identify them when they try to hide behind cash-only transactions, or even encourage people reporting suspicious activity by offering rewards for doing so (a sort of bounty system).

There would be more transparency in economies, which is good for businesses.

It may have a negative connotation, but transparency is good for business. When you know exactly how much money you have, it is easier to make informed decisions about where to spend your income. You can see the impact of your spending on the economy and the amount of tax that you pay. You also know exactly how much money you have left in your account after making purchases and being taxed by government or corporations.Is the journey to cashless societies inevitable?

No, probably not. Because there's too much uncertainty about what it looks like and how we get there.

Cashless societies are not inevitable. The world is not going to stop using cash overnight, and the journey from one society to another will be complicated and messy.

There are too many unknowns about what a cashless society looks like and how to get there for anyone to confidently predict whether this will happen or not.

In Conclusion

The journey towards cashless societies is one that will be fraught with uncertainty and controversy. If you think about it, there are so many things that could go wrong: cyberattacks on the financial system could cause chaos; people might not trust their banks or governments anymore if they find out how much information they're sharing; businesses may not want to deal with an economy that's entirely digital because of potential user abandonment due to lack of in-person interaction.But then again, we've seen technological advancements come so fast in recent years—it wouldn't surprise us if this happened soon too. Would it?

Thanks For Reading!

Profile: Young Kedar

Recent Posts;

● Do You Know About The Four Types Of Wealth?

● Will Digital Assets Ever Become More Valuable Than Physical Assets?

● Fine Tuning Your Financial Input And Output With Tech

● Next Gen Platforms And Ecosystems Built With Blockchain

● How Financial Markets React To New Technology

Dolphin Support : @cryptothesis

Posted Using LeoFinance Beta

Sometimes, it’s assume that cashless society have birth easy funding of terrorism whereby money are moved without any restrictions and observations

Yes, that's the perception. It's kind of the same with cryptocurrency, that it can be used as a route to fund terrorism.