Some Financial Philosophies That I Adhere To....

You may be wondering, why should you have a financial philosophy? The simple answer is because it is important. Some of the reasons why include;

- Helps you keep track of your money and manage it more effectively.

- It can help you make good decisions about your money in the future.

- Having a sound 'monetary policy' can help you feel safe and secure with your finances, which means that you won't stress out as much about getting into debt or losing all your savings if something goes wrong (like an unexpected illness).

- You'll be able to handle these situations better than someone who doesn't have any sort of idea how they want their money to work for them.

How do I choose my personal financial philosophies? It depends on a quite number of things. E.g. what my personality traits are like, where I see myself in five years' time (or ten!) and what type of lifestyle I envision myself living then...and even now.

Also, anything else specific about me that makes sense when looking at my current situation as well as future goals will play a factor in the decision making process.

Now, here are the four financial philosophies I adhere to;

1. The Bigger Your Push-Pull, The Better

I’m a big believer in the idea that the bigger your push-pull, the better. The greater your push-pull—that is, the greater difference between what you need to do and what you want to do—the more opportunities and options will present themselves. If you have a tiny gap between what you need to do and what you want to do, then there’s not going to be much of an opportunity for new things.But if there's a huge gap between these two things (e.g., I really need $100 but I want $1 million), then lots of new ideas will pop up around how we can get from point A (where we are now) over here on this side of our push-pull divide, all the way over here on this side where our goal is located.

2. Decide What You Love And Then Make Money From It

Many of the world's wealthiest people are excellent at something they love to do. I believe that you can have everything you want out of life by following this simple philosophy: decide what you love and then make money from it.I'm not talking about just any old thing that you like, but rather your passions and interests; if it really makes your heart sing, if it lights up your eyes and gets the blood pumping through your veins when thoughts of it enter your mind—then there is an opportunity for making money from that passion especially in this day and age where almost everything can be monetized.

For example, Oprah Winfrey was able to turn her passion for talk shows into a wildly successful career in broadcasting (and later into multiple other profitable ventures).

Likewise, Steve Jobs turned his passion for technology into Apple Computers (and later Pixar), which became one of the most valuable companies in history with a market cap exceeding $1 trillion dollars.

In order to achieve success like theirs however requires some hard work on top of being passionate about what you do. It's the battle between talent and hard work. You just can't skip hard work but it becomes more bearable if you’re doing what you're passionate about.

3. Never Let Yourself Work For Free

If you’re going to do something, expect to be paid in some way, shape or form. Even if it’s just a few bucks that you can put towards your savings account. You may be surprised by how much more motivated and efficient you will become if there is an incentive behind what you are doing.This has always worked for me especially for works that I find boring and not engrossing. 24 hours isn't that much when you deduct all the necessary things you have to do in a day.

However, on the other side of the spectrum, I have done many things in my lifetime that I would not consider work because I wasn't getting anything out of them but helping others has its rewards – even if those rewards aren't monetary ones.

The point is that when we give something away freely without expecting anything in return, our mindset becomes a bit twisted (in a good way) and philanthropic. We temporarily detach from the perception of solely focusing on ourselves to focusing on those who need our help. This in itself is a liberating feeling and can bring some unexpected realizations.

4. Find A “Tribe” Of Like-Minded People To Help You

I have found that the best way to grow and stay accountable is to find a tribe of people who share your philosophies and are also looking for growth. This could be a mastermind group, accountability partners, running mates or just friends who will support you as you work towards your goals.It’s important to remember though that not all support will come from other people. You need to be able to trust yourself enough so that when someone offers negative feedback on your ideas or challenges them in some way, it doesn’t hurt your confidence.

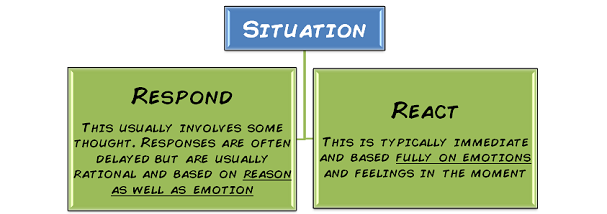

Instead, use those moments as an opportunity for personal reflection and growth so that you can come back stronger than ever. You always have the choice on how to react when a situations happens, be it positively or negatively. If you're feeling inspired, don't react at all, give a response.

In Conclusion

If you want to take charge of your finances, you need a financial philosophy. A financial philosophy is the way in which you think about and understand money. It’s your lens through which financial decisions are viewed and analyzed.It also helps when it comes to avoiding common pitfalls or mistakes that many people fall into thanks to their own faulty beliefs about money (e.g., spending too much money on clothes).

By following a financial philosophy, you can free yourself from the stress of financial uncertainty and begin to focus on the life you want to lead. The key is finding a philosophy that works for you and then sticking with it.

Do you have some financial philosophies? What are they?

Thanks For Reading!

Profile: Young Kedar

Recent Posts;

● Unlocking Innovation With Blockchain Technology

● The Risks And Benefits Of A Cashless Society

● Do You Know About The Four Types Of Wealth?

● Will Digital Assets Ever Become More Valuable Than Physical Assets?

● Fine Tuning Your Financial Input And Output With Tech

Dolphin Support : @cryptothesis

Posted Using LeoFinance Beta

Congratulations @young-kedar! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: