The power of compounding with DeFi 2.0 (Olympus DAO, Gyro...)

Hi HODLers, Degens

If you have been in DeFi, you must have seen this DeFi 2.0 craze. It is still very hard for me to understand if it will last but it is extremely profitable so why not ride the wave?

This is just an introduction and some points I wanted to talk about.

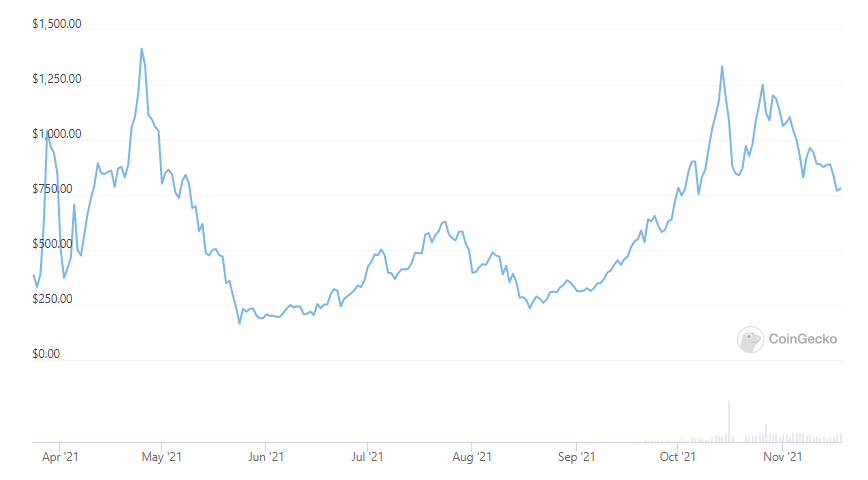

Olympus DAO (OHM) Price Chart

When looking at this price chart, it does not seem that you would have missed a lot of profits right? So what is the fuss about this OHM token?

Well...

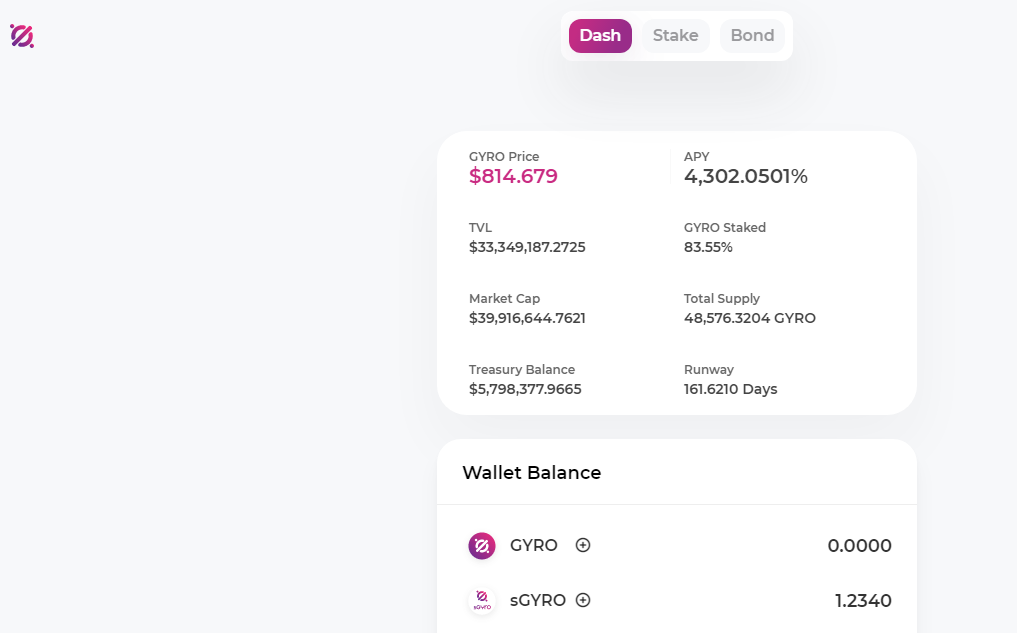

On the Olympus DAO HomePage you have access to a lot of different metrics helpinh you to understand where we currently sit.

As an example, you can see that the current price of an $OHM token is $774 and you can see that the backing per OHM is $165.61.

It means that there is $165 in the Olympus DAO treasury per $OHM token. This could be seen as the floor for OHM as even if we were to "clear out" this protocol, you would get $165 back per token.

This is often used in traditional finance when a company goes bankrupt. You look what their assets are worth as the minimum you would get back.

Moving to the $OHM performance, you can actually see it on the top right with the wsOHM price at $26,901. This would be the equivalent in $OHM tokens you woul have gotten if you would have staked a single one back in April 2021. As OHM was worth c.500, you would have gotten a X40-X45 over the past 6 months.

To attract capital, these protocols pay very high APYs. Currently OHM pays a 8kAPY. These payments are usually done 3 times a day (every 8 hours).

I think I should do a video as there are a lot of other tokenomics and information to give.

BSC Forks?

As many forks were created on many different chains, I have invested in some mostly on Fantom and Gyro on Binance Smart Chain.

I did not invest a lot as I believe it is currently overpriced as the Treasury is quite low compared to the Mkt Cap. Also, the yield is low for an OHM Fork and I expect them to boost it soon to attract more capital and backing.

If you know other BSC OHM Forks, I might be very interested in serious early projects ;).

Sources:

https://www.olympusdao.finance/

https://app.gyro.money/

Latest Analysis

Posted Using LeoFinance Beta

I cannot believe that OHM grow to such extent! The different dynamic behind the system made it quite popular. I looks okay but a bit risky to be in now ^^

Yup but for someone who does not take time to dive in, price is flattish over 6-7 months. Well, when you understand the project you understand that it has been far from Flattish 😉

Posted Using LeoFinance Beta

I'm super-excited about the upcoming Polycubs project by LEOFinance because of this little "backing-up-by-assets thingie"... :)

I'm not sure that these huge APY can work in long term, but some kind of "middle" solution could work... Regarding other similar projects, I think that KLIMA DAO is doing something similar to Olympus, but it's not on BSC, but Polygon...

Also, I do agree that these kinds of projects with huge APY are risky, but I will maybe try some small amount that I can afford to lose... ;)

I have picked this post on behalf of the @OurPick project and it will be highlighted in the next post!

Posted Using LeoFinance Beta

Yup PolyCub will use this system which is better it seems. We do not have a lot of history so let’s still be cautious.

KLIMA looks very interesting and I do not have the time to look at it but it is on the top of my list as they approach the subject differently.

Posted Using LeoFinance Beta

I have no idea about Defi 2.0 xD

Do you know the differences?

Well DeFi pays you to lend liquid assets to the platform. Being a LP is risky and therefore you get a yield out of it.

DeFi 2.0 is different as you pay 💰 some assets to have a share of the overall protocol and through time it increases in value as other people join and the protocol lend your assets for a return.

Posted Using LeoFinance Beta

Interesting :D

Interesting i will have to take a closer look thanks for sharing have an awesome day

I don't understand the floor. It's not like they are holding dollar value but probably assets right? So wouldn't that floor change as prices change?

Posted Using LeoFinance Beta

Indeed but 90%+ of the treasury assets commited when you buy OHM or Bonds are DAI or stablecoins. Therefore the floor is quite consistant.

Posted Using LeoFinance Beta

I find this intriguing. I still don't quite understand it.

I don't really understand this but let's wait for polycub maybe that will give better understanding.

Posted Using LeoFinance Beta