Intense FUD coming from South Korea regulators !

Hello HODLers,

I completely missed this information as I just became aware of it today. There is a very important deadline on September, 24th for crypto operators to comply before being forced to shut down.

Smaller exchanges and industry actors have contested these new requirements for the past year without success.

Estimates show that c.40 crypto operators out of 60 could have to shut down even if I expect this number to be overstated by South korean Crypto participants.

What does this new regulation want?

The obligation for ALL exchanges to show evidence that they are operating using real-name accounts at South Korean banks. The issue being that many local lenders have resisted doing so over fears og being exposed to money laundering.

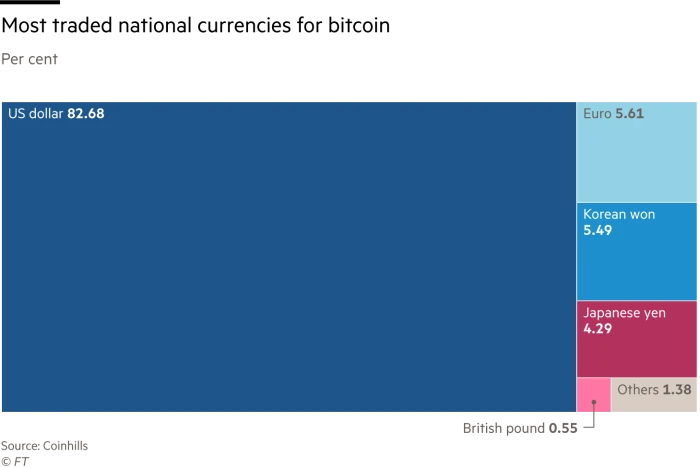

First, South Korea is a big Cryptocurrency market with a tech savvy population and quite a sizeable Crypto Market. It is the 3rd market for Bitcoin and is even bigger than Japan.

It seems that Upbit, Bithumb, Korbit and Coinone (90% of SK traded volume) already or are close to comply to the new regulation* and experts think this could make the market even more concentrated.

42 Kimchi coins are threatened!

You may ask: "What is a Kimchi coin?"

A Kimchi coin is a smaller altcoin listed on smaller platforms and traded against the Korean won. Some local experts expect a Crypto Bank Run as user realize that they have to sell and cash out their smaller coins because they might no longer be listed anywhere.

All these new measures are aimed (according to the regulator) to curb the enthusiasm for crypto trading from retail and younger investors.

What are your thoughts? Do we need all these regulations?

Stay safe out there...

Sources:

South Korea crypto crackdown to wipe $2.6bn from ‘kimchi coins’, FT

Majority of Korean crypto exchanges to shut down this month, insiders say

Latest Analysis

Splinterlands' tokens (SPS, DEC, SPT) are going through a stabilizing period

Which Blockchain attracted the most developers the past 12m?

US Housing Market is heating up. Will tapering and higher rates crash it?

Posted Using LeoFinance Beta

thanks for this information ... it seems to me that South Korea is much ahead of Italy.

Well if you see mandatory KYC as an advancement, indeed they are :D

Posted Using LeoFinance Beta

What a really intense information. Let’s see how it goes, time will tell

Indeed but it seems regulators are just very good are creating oligopolies and monopolies.

Sad 😞

Posted Using LeoFinance Beta

https://twitter.com/VinnieLemon/status/1437395995181080583

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

People will always find a way to evade, especially in Crypto.

I am sure, not South Korea, but others (most likely US) is behind this.

I guess this would be for 90% of investors: normies and speculators.

For the OG crypto addics, anarchist or freedom fighters or whatever, there will be plenty of loopholes to exploit behind decentralized VPNs, etc...

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

If I learned something in crypto, it is the reality of FUD and double digit drops in prices 😅

Haha 😆! Seems almost a weekly thing. Nobody is panicking 😱 anymore, only when -30%+

Posted Using LeoFinance Beta

I don't think we need the regulation but I fully expect it coming by those in power.

Posted Using LeoFinance Beta

We need some but definitely not one killing smaller exchanges and reinforcing oligopolies 😂

Posted Using LeoFinance Beta

If this small altcoin is not real they will run but if they are real,they should comply,so that people will believe on them.it is also a way to make all this small altcoin stable there.. Thanks for sharing.

Posted Using LeoFinance Beta

Some of these are only listed on small platforms due to lower volumes / users. Therefore either they get a big exchange listing (have to pay probably) or they might be only exchange through p2p

Posted Using LeoFinance Beta

Ok

Posted Using LeoFinance Beta

Well , I believe that the fact that cryptocurrency is centralized will always be an issue for it. Government will always want to control cryptocurrency and as such exchanges will have issues getting investors to do kyc verification in line with the agreement of the government

Posted Using LeoFinance Beta

You mean decentralized I think ?

I entrely agree with you but if we are being honest 80% of Crypto users either existant or futures will NOT care about KYC, anonimity or decentralization. These customers will go to Coinbase, Kraken, etc...

And then you have the crypto users that got into the space for the decentralization, anonimity, etc... who will use other means to trade and transfer assets (decentralized AMMs being one).

2 markets inside one ! :D

Posted Using LeoFinance Beta

Yeah . That's a typo. Have corrected it.

Ever since I started using cryptocurrency especially Defi , I now control my funds and I get to earn passive rewards from it which is more profitable than what is available in the traditional banking system

Posted Using LeoFinance Beta

Crime is the exclusive domain of the government.

Indeed, sometimes they let one or 2 little crooks to better go hard on them. But we know who are the real ones... The one at the FED trading stocks before announcing an extra round of QE (just the latest exemple....)

Posted Using LeoFinance Beta

Sorry to say this but both Politicians and Crypto HODLers from Korea are crazy AF. 😂

Such a huge market will die because of stupid regulations. Citizens from other countries must learn from this. We need more DEXs.

Posted Using LeoFinance Beta

Why woul you be sorry to say that these politicians are crazy AF? :D

DEXs, Decentralized AMMs, way to be anonymous, etc... Sorry governments we have too many options: YOU LOSE

Posted Using LeoFinance Beta