CRYPTO SUPREME ! Get A Rayban , CRYPTO’s FUTURE IS BRIGHT!!

Who would have thought there will come a time when the trend of financial institutions incorporating cryptocurrencies into their portfolios will be predominant . This fact we’ve come to see in these recent years you will agree with me I bet. Institutional investors and asset managers have suddenly begun to include cryptocurrency as pure digital assets.

Despite their recent inception, this type of asset class has gained widespread market acceptance and rapid growth. Note well , numerous institutional investors have begun to diversify their portfolios and trading methods by including digital currency related assets .

- CRYPTO EXPECTED TO OVERTAKE TRADITIONAL INVESTMENTS -

According to a survey conducted by global cryptocurrency exchange Bitstamp, 80% of institutional investors believe that bitcoin most especially would eventually displace traditional investment vehicles.

Subsequently, 70% of institutional investors rated cryptocurrency as a trustworthy investment, with 68% actively recommending it in investment schemes.

Bitstamp has released an early preview of the results of its 2022 Global Digital Assets Pulse Survey. The research included 23 global markets and surveyed over 23,000 retail investors as well as 5,500 institutional investors in order to provide a fair representation of data and insights about virtual currencies.

- DOMINATING TRADITIONAL INVESTMENT IN 10 YEARS -

According to the Bitstamp poll, one can deduce the fact that investors are confident that digital assets would eventually outperform traditional investing over the next decade.

Within a decade, mainstream adoption could accelerate to the point where it becomes the new normal. The survey disclosed that around 80% of institutional investors have a favorable attitude regarding cryptocurrencies as an asset class.

Additionally, a sizable majority of investing professionals and 66% of regular investors expressed confidence in these as an asset class.

The research gathered data from 28,563 respondents in 23 countries across the Asia-Pacific, Africa, Latin America, North America, Europe, and the Middle East.

Over the last few years, cryptocurrencies have risen from the periphery of the financial ecosystem to the foreground of mainstream investing, with many of the world’s major trading platforms now catering to both retail and institutional demands.

Also , interest in the digital currency market has risen significantly in the years following the outbreak, and Bitcoin and other related coins are now a part of the broader discussion about global macroeconomic issues.

Furthermore, to cement crypto’s bright Future in the coming years, it is projected that trillion of dollars will be poured into cryptocurrency by investors. Earlier this month, Canadian businessman, entrepreneur, and Shark Tank star Kevin O’Leary projected that institutional investors would pour trillions of dollars into cryptocurrency.

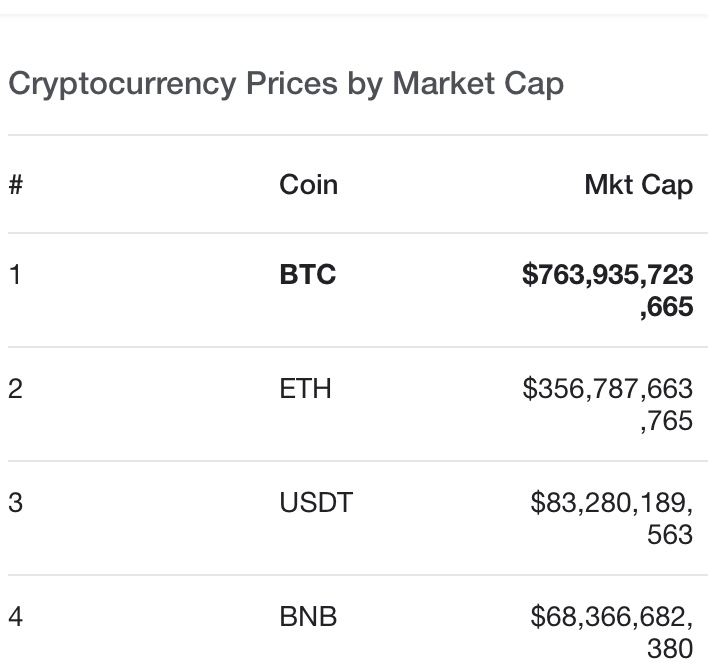

Analysts estimate that the global cryptocurrency market will more than triple by 2030, hitting a valuation of nearly $5 billion. Whether they want to buy into it or not, investors, businesses, and brands can't ignore the rising tide of crypto for long.

However, Cryptocurrency’s future outlook is still very much in question. Proponents see limitless potential, while critics see nothing but risk. What do you see? Feel free to drop your thoughts and comments, Lions. Stay Jiggy!!

Posted Using LeoFinance Beta

https://twitter.com/Pundit_OG/status/1519749809430802432

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

5 Billion until 2030 is not that much. We had already 3 Billion lately. My guess is rather that the crypto market will be around 10-20 Billion until 2030. 💪🏻

Well, that won’t be a wild guess.