Crypto Analysis | Has The Bear Market Just Ended?!

Good day Hiveians!

Join me in analyzing the crypto markets!

You must have thought you read the title wrong

But no, I am really pondering: Has the Bear Market just ended with Bitcoin dropping sub 23k, rather than started?

Surely such a statement needs clarification, so we are going to make it the topic of this post!

Some time ago I noticed that we can draw a trend line from the lows of the previous market movements on the monthly chart for Bitcoin which very accurately predicted the low of the final Bear Market drop. It is quite remarkable:

You will notice one difference for this cycle, however: We have a long wick down to $3000 for the March 2020 crash. This is one caveat of this argument. But if we stick with the monthly candles, the low for this bear market is at about $21.5k. There is a second thinner trend line in the chart which accounts for the weekly chart and has a low of about $14k. However all cycles did not go under the high of the previous cycle which is at around $20k. This is why the $20-22k looks very reasonable to me.

But there is more. When we look at the RSI, we can see that all bear markets reaches a value of about 44. With the drop of today we are under this value. We still have to see where it closes. But it is safe so say that we have reached this value. This indicator has so far worked surprisingly well and I think it is a strong clue that a bottom might be in soon (or has with currently $22.6k). Bitcoin has then stayed at an RSI below about 51 for several months. The longest being 487 days. In 2018/9, it was only half a year, however.

In the previous post I argued that we would be in a bear market for at least another half a year. And because until now we always had bear rallies I thought that a recovery to about $40k was likely. Here is the chart again:

Not having had a bear rally for such a long time (12 weeks+) is highly unusual. There was always the option of going straight dwon to ~22 which I wrote about last time:

Alternatively, we are heading straight down to about 20-22k!

With this now happening, I think there is an actual possibility to having a premature end of the bear market, just like we had a premature end of the bull market. This is obviously speculative, but I honestly think that people are overestimating the lows for Bitcoin at the moment. Especially with the Bitcoin Doubling curve being over $30k right now (which @edicted often points out).

If I say the bear market ended, it does not mean that we will have an instant rally!

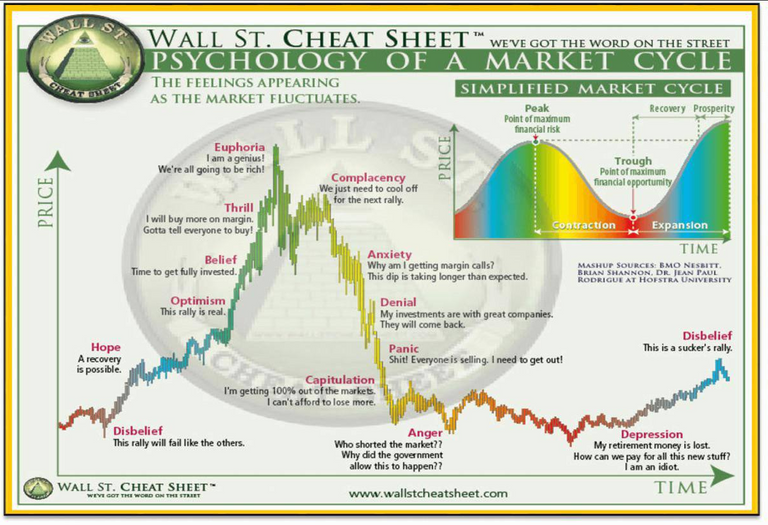

Rather, normally when we have the last crash of a bear market, there is a long sideways movement of several months (even up to half a year). Could this be happening? Or am I simply in the denial stage? :)

Were are you in this chart?

As a general reminder: Please keep in mind that none of this is official investment advice! Crypto trading entails a great deal of risk; never spend money that you can't afford to lose!

Check out the Love The Clouds Community if you share the love for clouds!

I think it is also important to consider factors out of the crypto world. Overall there is quantitative tightening, and with the recently published inflation rate, the market is expecting further quantitative tightening with rising interest rate.

Overall, it is messy because prices of goods are rocketing, i.e., inflation and depressed stock prices. Soon we could hear about lay-offs more frequently. That could be when bottom is.

P/S: Of course, this is not financial advice!

those are some good points. But how is bitcoin linked to all of that global mess? I would argue that the linkis are very thin (mostly in people's heads). The fundamental thing that cryptos need is power and hardware (as well as software development). This should still be around when the world basically crashes (of course discounting black swan events).

A global recession could actually be very bullish for cryptos as it might be seen as a way out of the old system!

Nicely put. The turbulence would be intense on the way. I am bracing myself for that!

It seems the dipping of the coin is no news today, you wake up to only see your money dipping,,,well we just hope it doesn't hit below this

Oh, this is just an amazing picture! I'm somewhere at the level of hope.😀

Very intelligent analysis and truly hopeful, we will just hold on and see how it plays out.

I couldn't read along the graphs well but will soon get a computer set to do these.

They looked very tiny on mobile.

Thanks for sharing this.

In these times it's warming to have your analysis. It gives confidence and hoping crypto will return to bullish ways. Even though my portfolio is not a lot, it's taking a big kicking !

Great job!

Yes the same for me, but everyone are expecting it not to go below. Same with the 200 weekly ma that where bottom for previous cycles. And crowd usually are wrong right?

Hard to say, but I dont feel enough pain yet, I think its very likekly we hit and fill gap at 19k. Would love to see we close above weekly ma and do as you say accumulate for 5months. We are at same spot as in 2018 low.

I remember I was noob back then and that was pain! And I dont feel the same pain this time.. So I think we might see 14k but thats my lowest target. Below I wold cry also, so that would probably be bottom then :)

yeah you are right, if everybody is expecting it.... but perhaps even more are expecting it go go below? :P

we are all guestimating that is for sure and only time will tell :)

Yeah, but i'm a buyer here, It's too much similarities chartwise, my only concern not enough pain and we only are down 70% vs previous corrections that went 82% I think. Im leening 65% more down and 35% 20k is bottom, and you?