Housing Supply Increasing?

There is a lot of attention being paid to real estate. It is obvious as to why this is the case. With it consuming so much of the economy, it is the sector that many watch very closely.

Source

At present, many feel there is a major bubble. Since the Fed are keeping interest rates low, many attribute this to the high prices. While that could be part of it, we are now seeing a lot of cash buyers in the market. This is, in part, tied to the Fed's actions, since the hunt for yield is on. The fixed income market is basically shot, forcing money to find other alternatives.

It seems the equities and real estate markets are the beneficiaries.

There is another factor that many believe is playing into this.

Housing Shortage

We are seeing a situation where there are more buyers than sellers. The availability of homes for listing in many areas is simply not there. This is creating a seller's market which is feeding into the price activity.

It is not uncommon, in hot markets, to see multiple offers coming in above listing. This is giving sellers a major windfall. Sadly, from a market perspective, it also serves to keep pushing prices higher.

This brings up affordability issues. Perhaps that is why, for the last few months, mortgage applications are down. These are the "bread and butter" buyers. Cash buyers tend to be investors. Hence, we get a market that is disjointed.

One of the solutions is obviously more housing. If builders were able to put more supply on the market, that would alleviate the shortage.

Of course, the start/stop process for home construction is like maneuvering an oil tanker. This is something that takes many months before a direction can be changed. Since many of the larger builders tend to operate using the subdivision model, once things start, it is near impossible to stop. The project needs to keep going once the money is laid out for land cleaning and underground utilities.

Nevertheless, if builders start constructing at a much greater pace, we will see things turn in terms of the availability. This could be a problem with timing since the market can turn quickly, much quicker than builders can adjust.

Residential Construction Spending

We might be witnessing the situation heading towards a very painful conclusion. If the bubble does stumble, it could be very difficult consider what the builders are doing.

A lot can be determined by looking at what the builders are spending. When there is a shortfall in the market, you want things to ramp up. We are also seeing the residential real estate construction market as the primary areas of interest.

Source

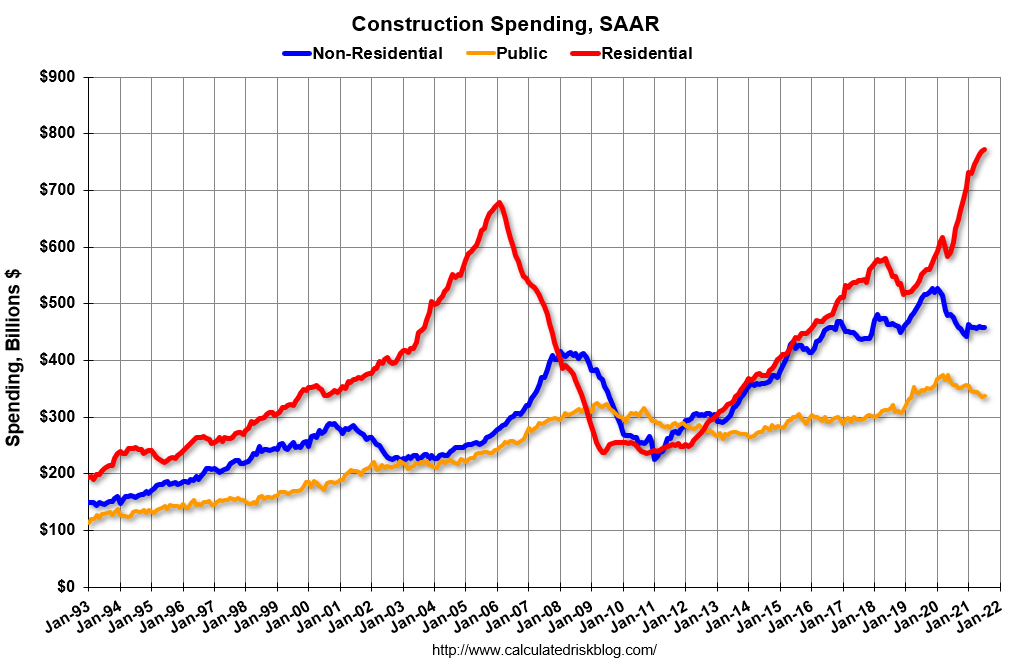

There are a couple things to take note of from this chart.

The first is that while residential construction is taking off, commercial and public projects saw a drop in spending. This makes sense since the remote work concept is really starting to take hold along with the renewed concerns about COVID.

What we are seeing is money flooding into construction of residential real estate.

From the chart, we can see we are at a level far above the last housing bubble, while peaked around $675 billion. At present, we are seeing the number closing in on $800 billion.

Another important variable is that, after the pullback due to the lockdowns, spending is up 30%, in a year. This is a rather large jump and amounts to another $200 billion put into this section of the real estate market.

Just using the eyeball test, it looks like the trajectory over the past year is at an even greater pace than the period that led up to the housing collapse 15 years ago.

Naturally, these are two different markets and this does not imply that we will see a similar implosion.

What it does tell us is that the housing supply could be increasing. This will help to offset some of the demand. Hence, we are brought to the point of how tightly wound is the market. Will the additional supply hit the pricing mechanisms that much?

It is a question that everyone is trying to figure out the answer to.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

https://twitter.com/taskmaster4450/status/1435417455736901634

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Retreat with the likely increase in the prices of building materials, because whoever has a property will not give it up for a small amount

The same applies to investment, as most of them turned to real estate investment after the decline in bank interest and after the weak profit for the projects that became multiple and the market saturated.

I hope that the supply of real estate will increase, because if we continue at this pace, we will witness a housing crisis and a huge increase in the supply of real estate currently offered.

Currently the cities are making it easier to get permits on granny flats or square footage increase.

It's baaaad where I live. It took me over six months to get my place and I had "good" credit, a large down payment, and proof of income.

I would like there to be more supply too - we all need a place to live.

I bought my house about two months ago and bid 50,000 USD above asking price.

I went that high because going 20-30 k over kept getting me outbid.

Today I realized that my house has almost 100k in equity.

It’s a bubble. I don’t much mind even though I know the crash is coming cause inflation makes me feel like the debt is shrinking.

I have these same concerns. It's exciting to be a property owner and to know that my home value is going up. That's the positive side. On the negative side, I don't think it can last, and in fact it is not fundamentally healthy for it to just go up and up. We all know there's a ceiling, and it's just a matter of where/when. Not only that, but so many people are getting priced out of the market, so there are definite downsides to a hot real estate market.

Another factor, I think, is that a hot market is spurred on by the fact homeowners are afraid to sell, even though they could profit nicely. But the low inventory means there is much less to choose from and you'd be vying for the same few homes with people who have cash to put down. What if you can't find another home? (This is our situation. We'd love to downsize, but we are living in a "contingency.")

For some reason it hadn't occurred to me that a large effort to build more homes could be in the works, or that such a factor could alter the course of the real estate market. But that does make sense. It will be interesting to see how long such a thing takes to ramp up and whether it would help to stabilize the market.

Personally I think the next real estate crash will be the last. It will never recover. Those who are selling and renting to see how things pan out are smart.

I believe the combination of the remote work along with technological advancements in construction is going to keep the market suppressed. We are in a 70 year urban real estate bubble that came as a result of having a monopoly on the good paying jobs. This will reverse over the next few decades.

Since down markets in real estate tend to be a long time (just like bull markets), the technological advancement by the end of the decade in construction will make putting up residences a lot cheaper. Couple that with the move away from urban areas and we see how it is ripe for a permanent reset.

Posted Using LeoFinance Beta

Well I do expect housing supply to increase because I fully expect 3D printing to make it far cheaper to build houses. I guess the only issue is institutions and hedge funds being one of the current buyers of homes in general. So its becoming less about normal people getting houses but more about getting people to rent from them.

Posted Using LeoFinance Beta

In the long term, I agree with you. We are going to see technology really alter the housing market.

It will take until the end of the decade most likley.

Posted Using LeoFinance Beta

Both housing prices and rent have increased in my country, especially in last two months due to school opening.

It was a buble even before pandemic, now I can say the prices have been triplicated after pandemic. I don't find any reason for this much increase. Perhaps, in a lockdown, you need a house at first..

Wow, thank you for updating us with the beautiful house structure.keep it up.

The rural houses or outside the city are at a higher price than in the city, even in my country it is more economical to buy a house or apartment in the center of the city than in the outskirts.

And if the pandemic worsens, this will continue to rise.

Posted Using LeoFinance Beta

Dont bet on that. The idea that things will always continue to rise has cause people to get caught losing fortunes.

Nothing continues in one direction forever, especially in markets.

Posted Using LeoFinance Beta

Rent prices are crazy here right now.

I had to renegotiate my contract because I didn't want to move out

Posted Using LeoFinance Beta

Yes, Housing supply is really witnessing an increase sporadically. Especially housing estates basically because of the high demands of a house with more convenience and solitude.

This was not just informative but educative too.

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Did you know that you can use BEER at dCity game to **buy dCity NFT cards** to rule the world.