The Attempted Rebirth of Stakeholder Capitalism

Hi Everyone,

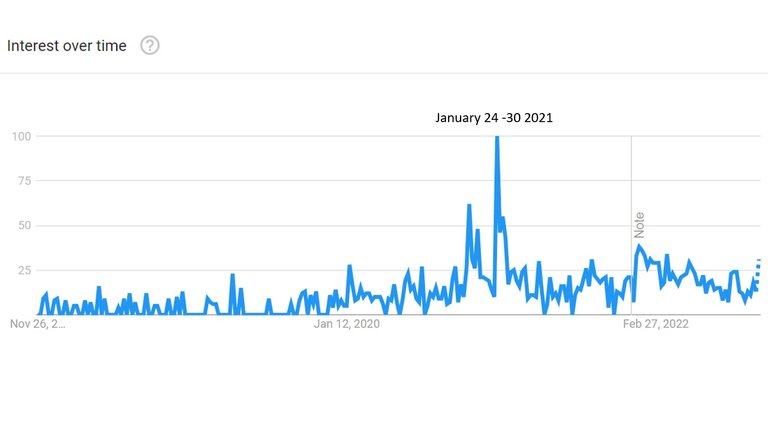

The terminology ‘Stakeholder Capitalism’ has been attracting some attention over the past few years. According to Google Trends, the terminology gathered significant interest at the end of 2020 and early 2021.

Google Trends

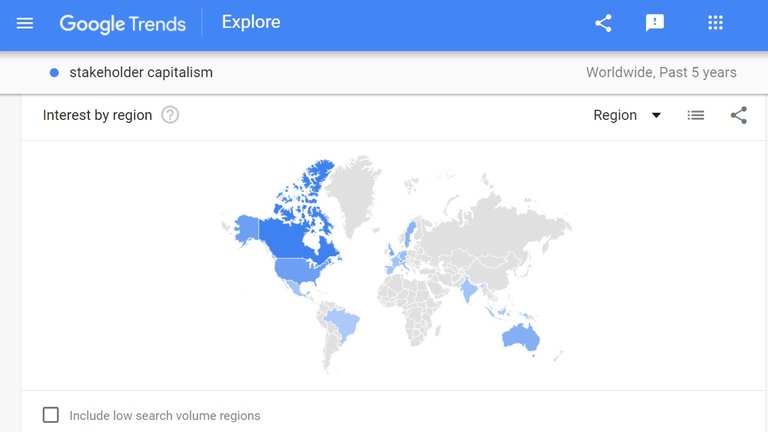

Interest by Region

Source: Google Trends

The initial increase in searches for ‘Stakeholder Capitalism’ occurred not long after the book ‘Covid-19: The Great Reset’ was published in July 2020 and reached its peak interest during the 2021 World Economic Forum in Davos, Switzerland. ‘Stakeholder Capitalism’ is not a new idea but has been strongly emphasized and promoted by the World Economic Forum and its founder Klaus Schwab (Engineer and Economist). In this post, I explore ‘Stakeholder Capitalism’ and what it might imply for businesses and society in general.

What is Stakeholder Capitalism?”

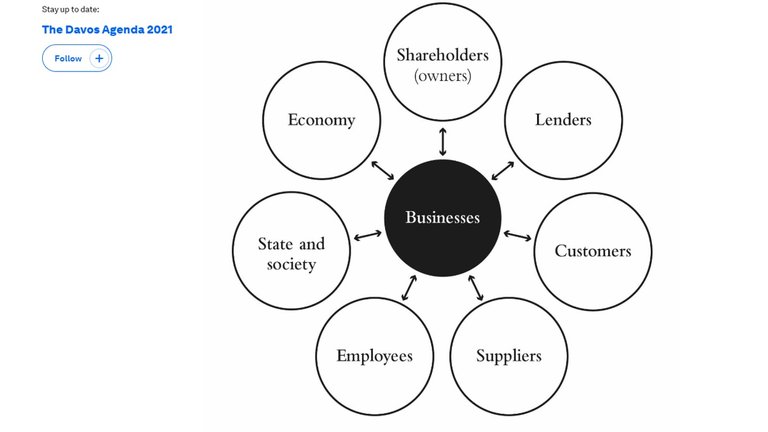

According to Investopedia, Stakeholder capitalism is a system in which corporations are oriented to serve the interests of all their stakeholders. Among the key stakeholders are customers, suppliers, employees, shareholders, and local communities.

According to the World Economic Forum, ‘Stakeholder Capitalism’ needs to align with environmental, social, and governance (ESG) strategies. These strategies have been used to develop metrics to measure business performance. These metrics are categorised under four pillars. These are as follows:

Source: World Economic Forum

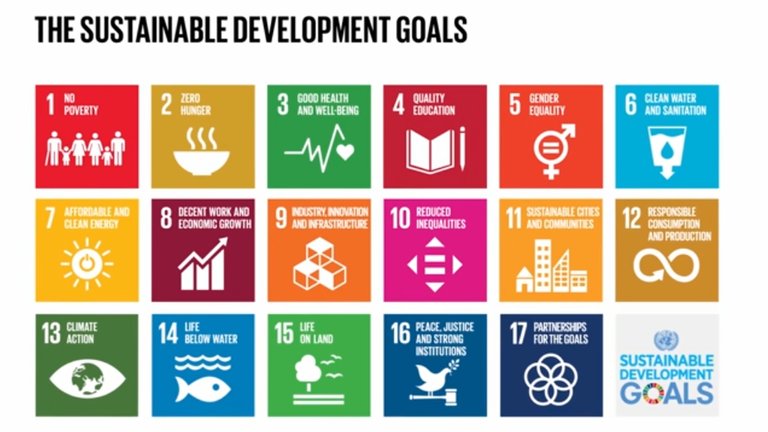

These pillars are aimed to align with the United Nations Sustainable Development Goals (SDGs). These are outlined in the Figure 1 below.

Figure 1: United Nations Sustainable Development Goals

Source: United Nations Department of Economic and Social Affairs

The World Economic Forum identified the following metrics for each pillar and have aligned them with selected United Nations SDGs.

Principles of governance

- Governing Purpose

- Quality of governing body

- Stakeholder Engagement

- Ethical behaviour

- Risk and Opportunity Oversight

Aimed to align with the following SDGs:

- Responsible consumption and reduction

- Peace, justice and strong institutions

- Partnerships for the goals

Planet

- Climate change

- Nature loss

- Freshwater availability

Aimed to align with the following SDGs:

- Clear water and sanitation

- Affordable and clean energy

- Responsible production and consumption

- Climate action

- Life below water

- Life on land

People

- Dignity and equality

- Health and well-being

- Skills for the future

Aimed to align with the following SDGs:

- No poverty

- Good health and wellbeing

- Quality education

- Gender equality

- Decent work and economic growth

- Reduced inequalities

Prosperity

- Employment and wealth generation

- Innovation of better product and services

- Community and social vitality

Aimed to align with the following SDGs:

- No poverty

- Decent work and economic growth

- Industry, innovation, and infrastructure

- Reduced inequalities

Shareholder Capitalism used as a yardstick for comparison

The World Economic Forum compare their vision for ‘Stakeholder Capitalism’ against their interpretation of ‘Shareholder Capitalism’, which they describe as focused on optimising short-run profits for shareholders.

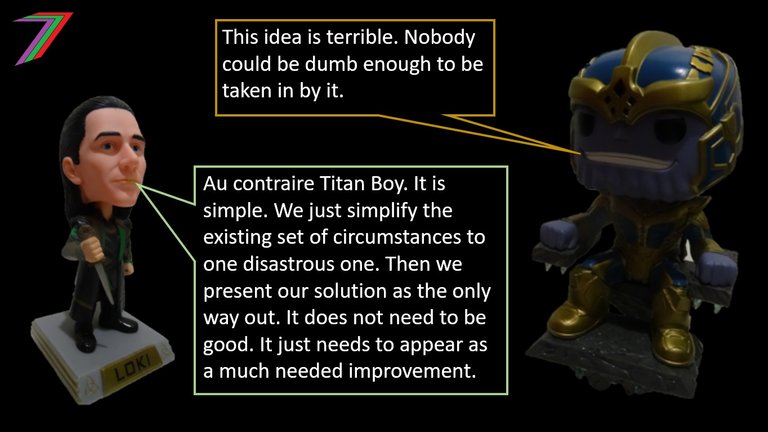

A trick to make something look better is to compare it with something else that is easy to describe as inadequate or failing (e.g. this is similar to how the results of a cost benefit analysis are distorted). What the World Economic Forum describe as ‘Shareholder Capitalism’ is an interpretation of Milton Friedman’s ideology regarding businesses’ responsibilities to its shareholders (business owners). Milton Friedman, In his 1970 article in the New York Times titled ‘A Friedman doctrine‐- The Social Responsibility Of Business Is to Increase Its Profits’, describes the relationship between various stakeholders and how their needs can be met through voluntary market interactions. Business owners desire their businesses to be profitable. In order to so, they need to meet the needs of their shareholders. Customers need to be pleased or they will shop elsewhere. Employees need to be pleased or they will work for a different business. Lenders need to be pleased or they will not continue lending money. Not satisfying these stakeholders reduces the business’s profit; therefore, owners desire to please their stakeholders so as to please themselves.

The article does not mention desire for short-run profit. Instead, it discusses meeting the desires of the owners. These often relate to making profit but not limited to a short-run timeframe; the focus is likely to be growth and medium to long run profits. Focusing on short-run profits indicates that a business is struggling to survive. It is unlikely ‘Stakeholder Capitalism’ would be considered an alternative model by such businesses. The emphasis on short-run is also likely to create the picture that shareholders are only interested in making a quick return on a higher share price than anything related to the business itself. This is an attempt to create the impression that ‘Shareholder Capitalism’ is purely motivated by greed, which is then vilified.

The World Economic Forum’s focus on the terminology ‘shareholder’ is to emphasise that capitalism is focused on the needs of just a small group of people at the expense of the majority. Therefore, creating the impression that traditional capitalism (shareholder) is bad. If capitalism is allowed to operate within free markets it can achieve positive outcomes for all involved. The terminology ‘shareholder’ is preferred to that of ‘owners’. This has been done to focus on large businesses. The 120 companies that co-designed the stakeholder capitalism metrics are some of the large businesses in the world (World Economic Forum). Altogether, 150 large businesses have shown support for the ‘Stakeholder Capitalism’ metrics (World Economic Forum). Small businesses do not appear to fit into their ‘Stakeholder Capitalism’ model. Therefore, there is little to no discussion in regards to small businesses in the contest of ‘Shareholder Capitalism’.

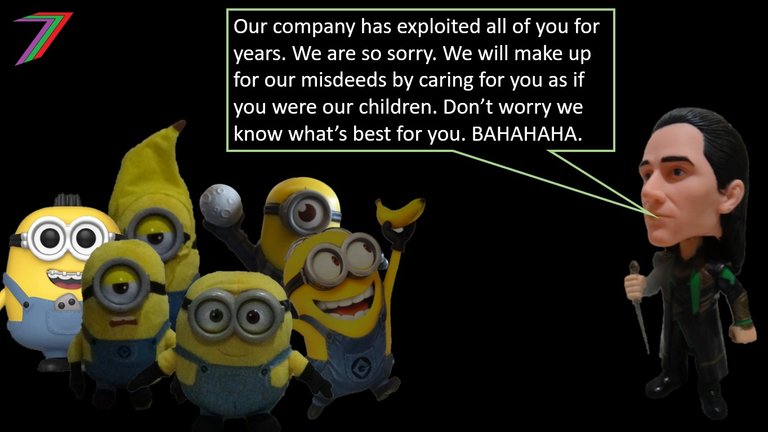

The image that the World Economic Forum want to create is that ‘Shareholder Capitalism’ is a rigid model designed for just pleasing a small group of people. They proclaim the only feasible alternative is a ‘Stakeholder Capitalism’ model. This ignores the reality that the alternative they are misrepresenting belongs to a much broader group of capitalist models that also includes free market capitalism as well as various market structures that may occur naturally or are induced by intervention. See my post Market Structure #1 – Introduction for a brief description of several different types of market structures.

Value of Competition

Free market capitalism involves competition. Businesses compete with each other to attract customers. Workers compete with each other to get the most desirable jobs. Customers compete with each other to obtain the goods and services they desire. Suppliers compete with each other to supply businesses. Land owners compete with each other to attract customers to rent their plots. Landers compete with each other to attract borrowers. There is the potential for competition in almost every aspect of business. Competition enables the strongest to survive and thrive. There is potential for competition between businesses and all of its stakeholders. Figure 2 summarises interactions between business and their stakeholders.

Figure 2: Business stakeholders

Source: World Economic Forum

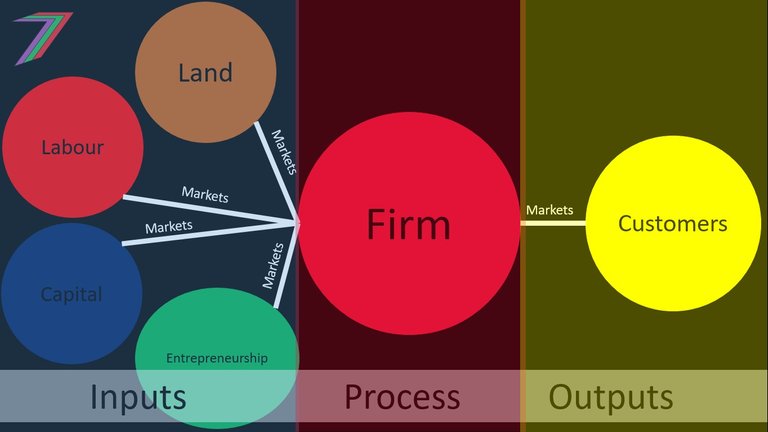

The above stakeholders can be categorised as factors of production or inputs into production, customers, and external parties. Factors of production or inputs into production include shareholders, lenders, suppliers, and employees. External parties are State and society and economy. The relationship between stakeholders can be rewritten as shown in Figure 3.

Figure 3: Relationship between a business and its stakeholders

There are market interactions between business and its direct stakeholders. Competition and level of competition determines these interactions.

External parties can also benefit from these interactions. Successful businesses are good for the economy. They lower prices, increase output, increase exports, encourage skilled migration. They are good for the State by increasing tax revenue by producing higher profits. They are good for society by increasing real wages, and increasing quality of goods and services.

Anti-competition

The metrics and pillars outlined by the World Economic Forum do not encourage genuine competition. They focus on ideals that they desire businesses to tackle directly. For this to be possible, businesses need to be in a position to control their relationships with their stakeholders (i.e. have some form of monopoly power). This would reduce most of the incentive for competition between stakeholders. Instead, if we assume the proposed ideals are accurate, they are being given what they would have competed for under a free market capitalist structure. Here, we create at least two critical points of failure. Firstly, efficiency is discouraged as there as there is no additional reward for achievement. Secondly, we are relying on a small group of people to determine the desires of many large stakeholder groups. No amount of feedback exercises could substitute free market responses.

An environment with minimal competition could be good for large businesses. They do not face pressure to adjust to often unpredictable markets. They do not have to worry about smaller more adaptable businesses taking significant portions of their market share. They have opportunities to be more socially responsible if they do need to devote as much energy to competing with more and new emerging businesses. However, lack of competition does not push large businesses to continuously improve operating efficiency or better meet their customer’s needs. With the additional strain of meeting the ESG objectives, large businesses could still become unprofitable. Therefore, ‘Stakeholder Capitalism’ needs to be incentivised to at least cover the additional costs of implementing them. For example, companies such as Tesla have greatly profited from regulatory credits (monetised incentive for producing low-emission cars). This earned them US$1.6 Billion in 2020 (CNN Buiness).

According to the World Economic Forum: Measuring Stakeholder Capitalism, White Paper, Page 75, businesses that contribute to the ESG goals and pillars will receive financial assistance from Governments. This essentially makes the Government customers for the actions performed by businesses. Thus, moving away from multiple buyers to a single buyer representing multiple buyers. Therefore, it is not surprising that large businesses would support ‘Stakeholder Capitalism’. It offers them a low risk, stable and reliable flow of income. Small businesses will not be able to benefit in the same way as large businesses. The initial cost and wide range of activities required to receive financial assistance from Governments cannot be realistically met by businesses with small capital and limited scale of activities. Hence, the support from large businesses and no reported response from small businesses.

Application of Stakeholder Capitalism

As mentioned earlier in the post, ‘Stakeholder Capitalism’ is not a new idea. It dates back to the early 1930s. It was attempted by both public sector and private sector businesses. According to a Forbes article by Steve Denning, ‘Stakeholder Capitalism’ failed because businesses were unable to manage conflicting claims from their various stakeholders. They became disorganised and inefficient. These businesses became fondly know as garbage can organisations. Milton Friedman’s alternative model to ‘Stakeholder Capitalism’ expressed in his New York Times article ended the open pursuit of ‘Stakeholder Capitalism’. We could also argue that Friedman’s ideas around free market capitalism were also not fulfilled. Governments still intervened in markets and the operation of business. This intervention appears to be increasing rather than declining; thus, keeping elements of ‘Stakeholder Capitalism’ present in business operations.

FTX Example

An interesting modern day example of a business that proclaimed to follow a form of ‘Stakeholder Capitalism’ is the cryptocurrency exchange company ‘FTX’. Company founder and owner, Sam Bankman-Fried, preached many of the same goals as the World Economic Forum with his ‘Earn to Give’ concept. He claimed to be funding the following objectives:

- Reduce global warming

- Increase Covid-19 preparedness

- Fight tropical diseases

- Improve animal welfare

- Anywhere else the world needs help

See the following promotional video.

FTX was previously listed as a corporate partner to the World Economic Forum, the page has since been deleted but can be viewed as an archive.

Sam Bankman-Fried’s self-proclaimed altruism was used to attract investors and customers. The business was heavily promoted in sports such as basketball, motor racing, and American football. It was promoted at sporting events and venues, by sports teams and sports stars such as Tom Brady (NFL player) and Stephen Curry (Basketball player). The emphasis of their promotion was on altruist and charitable causes (FTX Partners).

Unfortunately for both customers and investors, FTX suddenly filed for bankruptcy. It appears that stakeholders’ assets have gone. Sam Bankman-Fried allegedly transferred US$10m Billion in customers’ assets to his trading firm Alameda Research. FTX has also, allegedly, been involved with laundering money between the US Democrat party and the Ukrainian Government. US tax payer money was sent to Ukraine to aid them in their war against Russia but some of this money (several billion) was invested in FTX. FTX donated more than US$40 million of this money to the Democrat party for their midterm elections. Private donations to Ukraine that were worth millions of dollars have also gone missing. Proclaimed philanthropy has turned into a multi-billion dollar scam (The Gateway Pundit).

The natural response from Governments to prevent scams such as FTX will be regulations. This will involve further regulations for any businesses that claim to engage in ‘Stakeholder Capitalism’ activities. Cryptocurrency exchanges will be targeted as FTX was a cryptocurrency exchange. Government are also likely to attempt to further regulate cryptocurrency in general. This would be used to blame cryptocurrency for the downfall of FTX even though their mismanagement of funds has nothing to do with cryptocurrency in general. Cryptocurrency is deemed by Government and Central Banks as a competitor to Central Bank Digital Currencies, which can be expected to be launched in many countries before the end of this decade.

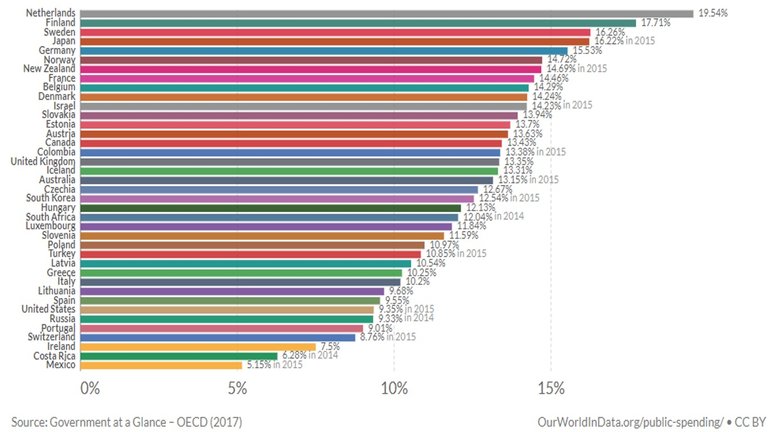

Direct Business with Governments

Governments often do direct business with the private sector. They spend a large portion of taxpayer’s money procuring goods and services from the private sector. Figure 4 shows Government expenditure on procurement as a percentage of GDP for many of the largest OECD countries for 2016.

Figure 4: Government expenditure on procurement as a percentage of GDP (mostly 2016)

Source: Our World in Data

Note: For information on Government Expenditure and size of Government see my post ‘The Masters of Production’.

Many large companies earn a large proportion of their revenue from direct business with Governments. The top ten contractors and the value of their obligations to the US Government in 2021 were as follows:

- Lockheed Martin Corp (Obligations: $41.9B)

- Boeing Co (Obligations: $23.8B)

- Raytheon Technologies Corp (Obligations: $21.6B)

- General Dynamics Corp (Obligations: $20.8B)

- Northrop Grumman Corp (Obligations: $15.0B)

- Pfizer Inc. (Obligations: $14.1B)

- McKesson Corp (Obligations: $12.5B)

- Leidos Holdings Inc. (Obligations: $9.9B)

- Huntington Ingalls Industries Inc. (Obligations: $7.4B)

- Moderna Inc. (Obligations: $7.3B)

Source: Bloomberg

When the Government does direct business with a company, they determine the output of that company and can determine how that output is produced. If the Government contributes a significant portion of that company’s revenue, the company are compelled to fulfil the Government’s demands. This also makes it easier for Governments to dictate that the companies they do business with follow a ‘Shareholder Capitalism’ model. This is also good for the companies that the Government do business with as they are ensured a revenue stream that will cover any additional costs required as part of their contract.

Public Private Partnerships

Another way Governments interact with private businesses is through Public Private Partnerships. According to Investopedia, Public Private Partnerships involve collaboration between a government agency and a private-sector company that can be used to finance, build, and operate projects, such as public transportation networks, parks, and convention centers.

Government offer contracts to private businesses to build and operate infrastructure projects that they would have previously built and operated themselves. The argument is that the private sector can build and operate them more efficiently than if done solely by Government agencies. Public Private Partnerships do not need to be limited to just infrastructure. For example, the development and production of the Covid-19 jabs by companies such as Pfizer. Pfizer made use of initial Government funded research to develop their mRNA jabs (Arnold Ventures).

The Government determines the outputs for these partnerships and the private sector delivers them based on the Governments requirements. Therefore, the Government can be considered the customer for these projects. Once the output is delivered, the private sector might be responsible for operating the project but they are normally regulated and subsidised if necessary. Since many of these projects are large, income from these projects become a substantial part of the contracted companies revenue. Therefore, the businesses need to follow the Governments requirements. This is often only possible for very large businesses. This means smaller businesses miss out on these opportunities and there is less competition for the largest businesses.

The World Economic Forum strongly supports Public Private Partnerships. They see them as opportunities to achieve their objectives through both Government and the private sector (World Economic Forum). Public Private Partnerships are compatible with their ‘Stakeholder Capitalism’ model. Private businesses can pursue the ESG goals without fear of incurring losses as Governments will financially support them.

Global Public Private Partnership

The World Economic Forum are most outspoken about climate change and reaching their goal of net-zero carbon by 2050 (World Economic Forum). They have facilitated the creation of what they call a ‘First Movers Coalition’. This is a group of 65 businesses who are working together to develop low carbon technologies that are competitive with currently used more carbon intensive technologies (US Department of State). They have been tasked to complete this by 2030 (World Economic Forum). The ‘First Movers Coalition’ is considered a flagship Public Private Partnership. It is supported by several Governments from around the world. These include USA, Denmark, India, Italy, Japan, Norway, Singapore, Sweden and the United Kingdom (World Economic Fourm). It is likely much of the overall funding will come from these countries. We can expect them to incentivise the businesses to reach these goals by ensuring that they will profit directly or indirectly by doing so.

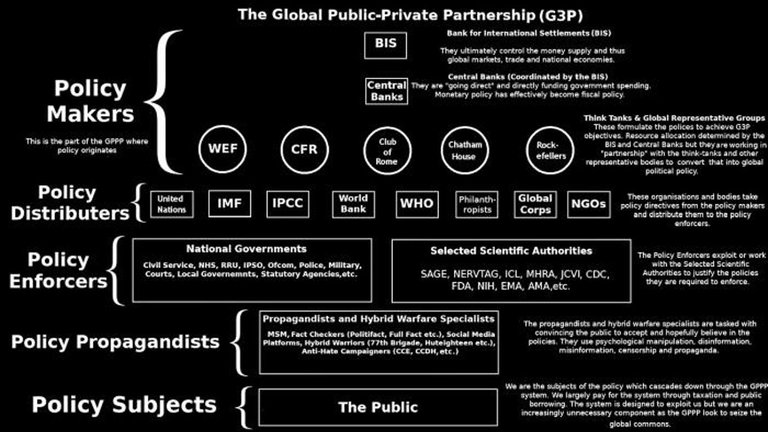

Global Public Private Partnerships could be another mechanism for global organisations and Central Banks (lead by Bank of International Settlements (BIS)) to control the policies of individual countries so that they align with their global agendas. The in-this-together websites published the following hierarchy of how global Public Private Partnerships may operate.

Figure 5: Global Public Private Partnership Hierarchy

The structure can be easily aligned with how Covid-19 policies were formed for most of the world. Information from the World Health Organisation (WHO) was passed down to national Governments. The national Governments made policies (e.g. lockdowns, mask wearing, social distancing, vaccine passports, etc.) that aligned almost directly to the advice provided by the WHO. The mainstream media promoted these policies and treated compliance as essential to the country. Both the mainstream media and Government promoted their policies using their own groups of experts. The costs of these policies were funded by borrowing from the Central Banks. The cost of implementing these policies created a massive increase in money supply and is one of the reasons for high inflation. The overall outcome of these policies has been a transfer of wealth from the working and middle class families to the richest in society (Forbes).

Paul Polman, former CEO of Unilever and current chairman of the International Chamber of Commerce (ICC), described Covid-19 as acid test for ‘Stakeholder Capitalism’. He called for more partnerships between the public and private sectors (Public Private Partnerships). He praised companies such as Microsoft, Google, and Uber for their support for sick employees. The ICC offers advice to over 45 million businesses on how to protect their workers, customers and local communities and contribute to the production and distribution of essential supplies (Business and Human Rights Resource Centre). This essentially paves the way for widespread adoption of the World Economic Forum’s ‘Stakeholder Capitalism’ model. Covid-19 has been used by the World Economic Forum as a trigger for the implementation of ‘Stakeholder Capitalism’.

My Views

‘Stakeholder Capitalism’ is not a new idea. It has been attempted in the past with little success. ‘Shareholder Capitalism’ is a biased observation of current capitalism models that has been distorted by persistent Government intervention. Free market capitalism is rarely given a chance to operate as intended. It enables competition at all levels and enables the best suited to the current environment to thrive. It also offers a wide range of opportunities for all and provides most people with a chance to succeed in some areas. Seizing these opportunities sits with the individual but motivation from potential success will drive most to find it.

‘Stakeholder Capitalism’ sounds nice. Government and businesses work together for the benefit of all. It would be great to eliminate poverty and protect our environment. However, it will not happen unless there is motivation to do so. This motivation may come from Governments through incentives. They may directly request particular outputs and require them to be produced in a particular way to meet ESG requirements. The Government then becomes the main customer for businesses and not the people. Therefore, the Government needs to grow bigger and have access to more resources to pay these businesses to meet the requirements of ‘Stakeholder Capitalism’.

‘Stakeholder Capitalism’ relies on trust. Governments and global organisations need to:

- desire to pursue the best interests of the people

- know what is in the best interest of the people

- know the best ways of achieving what is in the best interest of the people

Failure in any of three areas will result in the failure of ‘Stakeholder Capitalism’ for the people. Even if Governments and global organisations are able to fulfil the above requisites, the people will experience a massive loss of freedom and opportunity. There will be less motivation to succeed and less opportunities for work. It is possible, under a best case scenario, that ‘Stakeholder Capitalism’ could fulfil the goals that it has been set to do but it will constrain the full potential of all societies.

The most likely scenario is that ‘Stakeholder Capitalism’ will be exploited by the few that control it. Power and wealth will continue to be transferred to the few and the majority of people will be forced to settle with the bare minimum to survive. A great example of this exploitation are the Covid-19 jabs. They have been proven to be ineffective at preventing the spread of Covid-19 and they have serious side-effects, which are causing serious widespread harm around the world. These jabs have proven to be very profitable for the pharmaceutical companies that developed them. They were paid well using taxpayer money. If the Covid-19 fiasco is a preview of the impact of ‘Shareholder Capitalism’, the world is far better off without it.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

Hive: Future of Social Media

Spectrumecons on the Hive blockchain

Well, I haven't particularly heard of stakeholder capitalism, but it's practical and one can notice it in most big businesses with a lot of shareholders responsible one way or another for the smooth functioning of the business.

I think your example of FTX is spot on. Firstly I feel the "earn to give" model is mostly a scam on the surface and the reason is because it's absurd for capitalists to make money and give it away to people who aren't going to be directly responsible for them getting back this Money. I think it's probably to sell a charitable cause on the surface to get social backing and legitimatcy.

It's sad that such a scam scheme will be blamed on crypto and regulations will begin to kick in even if the it had nothing to do with Crypto.

Since government aren't directly benefiting from crypto, it's easy to blame the technology, while allowing the man who masterminded the theft to walk free. Indeed, it's mainly a decision that's never beneficial to the majority..

@tipu curate

Upvoted 👌 (Mana: 35/45) Liquid rewards.

It is difficult to truly understand other people's motivations but their current and past actions offer a glimpse into their true intentions. Some people people act to accumulate wealth. Some people act because of other motivations but happen to have accumulated wealth along the way. Someone focused on accumulating wealth is not going to just stop doing so once they have accumulated a lot. This would be inconsistent with their observed behaviour. A person who became rich for a passion other than merely accumulating wealth are more likely to act more generously with their wealth.

In the case of FTX, Sam Bankman Fried was in it purely for the money. His actions always indicated that to be the case. Some of the people taken in by his claims such as sports stars like Tom Brady might have genuinely wanted to help society and the environment. These people have shown a passion for the sports they play and not necessarily the money they earn.

I will tell you being in cooperate world most of these ideas or values are fronts. I'm pretty jaded as I have not seen too many ELTs that actually care about all these pillars.They are in it for a few and most times it's to consolidate power or profits to a select few.

Congratulations @spectrumecons! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 79000 upvotes.

Your next payout target is 60000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: