The Reality of Money. BTC and Crypto Are The Creation of "Money Printing"

Many people tend to get very defensive and emotional when their favorite stock or crypto gets trashed by the market. The new generation of crypto maximalists is happy living in the crypto bubble and rarely look back to the traditional markets. The ideology for many in the crypto is fiat is going to zero, BTC will replace fiat, BTC is the future.

Maybe, maybe not.

It is not right now, fiat is not going away today and tomorrow, markets are connected.

Knowing that, play it to your advantage, respect the power of fiat money, and benefit from what's going around you and not against it.

Whether it is stock market or crypto market, what's driving the up and down? Capital flow.

In the last decade, the hot air (money) pumped the balloon ever higher. Going just beyond the decade, to the Halloween of the Greatest Horror 2008, Bitcoin was conceptualized and born soon after. With very accommodative (cheap) monetary policy, coupled with Quantitative Easing injecting liquidity by monetizing debt on to the Fed's balance sheet, and gave people the illusion that interest rate will never go up again, and created a generation of investors thinking market can only go up forever.

BTC and GME and AMC run up were the climax. Pandemic support money inevitably turned into ammunition for retail investors to accomplish the unthinkable - BTC alone probably wouldn't have done that.

BTC and crypto are born after the the Great Recession, the era of forever debt monetization and cheap debt

Basic economics conclusion is when you have infinite supply, the price is got to be zero or close to zero (hyperinflation in the sense of unlimited money supply). It's a logical conclusion.

But the examples often cited are of small and failing governments and economies. Nothing of the magnitude of the US and almost the entire world doing the same thing. Jury is still out, history is still in the making that much is for sure.

If the monetary system were to reorganize, the predominant system replacing the one we have today will not likely to be forever bartering physical gold and silver (though some may argue that we are going back to stone age then okay), tokenization and blockchain and digital are likely be the next evolution whether we like it or not. The new government issued currency will likely to be digital, if it is back by anything it may be through tokenization or "trust me" if they can get away with it.

At some point further down, it will probably decouple as history continues to repeat over and over, with different flavor of technology or method to fit for the time.

Unless something dramatic happens, BTC or decentralized crypto will not be the "legal" and "mainstream". Please share your ideas if you disagree :)

We have to understand it is all relative, when every country is doing the same thing, it is difficult to see the impact immediately

The world is changing for sure, BRICS have been pivoting, but it will take time. We may see a world in the not too long future from now where there is another competing reserve currency.

Will competition make world a better place? It may stimulate something. There is benefit for the masses as we move away from monopoly, the value distribution will shift as a result that much is likely.

Fiats appear to be created out of thin air, it's complicated. But fiats can disappear out of thin air too

Bad debts, write offs, bankruptcy, market devaluation. Individuals and entities taking the haircut.

Trillions of value evaporated this year.

What happened to the value when crypto market went from $3 trillion to barely over $800 billion today?

Wiped out. As if the $3 trillion was never real (hint: you can never cash out at full market cap, that representation is flawed to begin with)

Actually, some disappeared out of thin air, some got transferred into other assets.

Taking a page from MicroStrategy, let's not sell BTC and crash the market, instead let's take advantage of current market value, collateralize and buy more BTC because it's only going to go up, and rinse and repeat until market crash.

That is kind of the fiat game. Use the value to create more value thanks to the fractional reserve magical banking system. It amplifies both the up and the down.

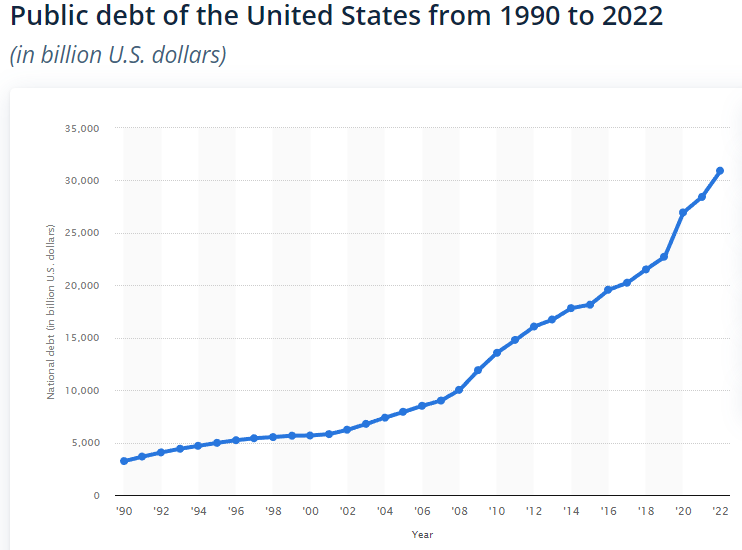

Let's go back to the US National Debt, $10 trillion in 2008 to $31 trillion today, after 14 years

If crypto could be worth $3 trillion, which encompasses high flying (now worth nothing) speculative shitcoins that you know just waiting for the bigger fool, then quickly evaporated $2 trillions in a year? $21 trillion of incremental debt (and the counter party still holds it, it hasn't disappeared just yet), at an average of $1.5 trillion per year, doesn't sound so bad does it?

BTC and crypto are the babies of this $10 trillion to $31 trillion "money printing" /s

Darth Vader to Luke: I am your father

Federal Reserve to Bitcoin: I am your father

Posted Using LeoFinance Beta

Yeah not easy to understand bitcoin last year bull market some people's can't cash his crypto coins and now he is almost down 99'/'. My investments also down 99./. Luna and ftx is the main reason of crypto crash. I am watching 2018 bear market and corona crash going down almost 80 percent and the bull market is back and crypto gain people's trust. Many coins gives 1 thousand percent profit to his users. Thanks for sharing your valuable opinion.

Some people think crypto is crazy all the time