Is Higher Interest Rate Really That Bad? From a Historical and Mathematical Perspectives.

Let's start this story with two charts...

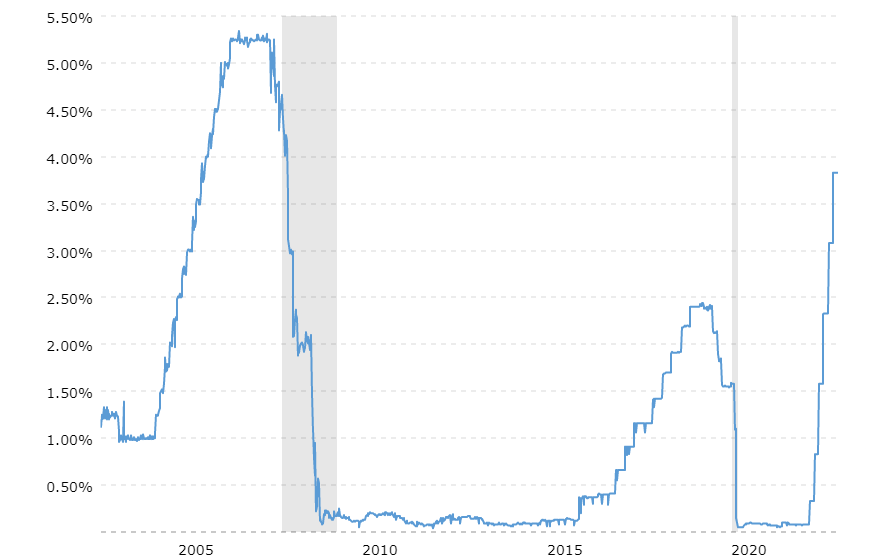

Federal Funds Rate from 2002 to 2022

- The above is the Federal Funds Rates for the last 20 years

- The grey shaded areas are the periods of recession

- We saw rates started to climb in 2004, and peaked in 2007

- Financial crisis happened in 2008 due sub-prime (greedy bankers and creative accounting), rates bottomed out in 2009, Fed was officially out of ammo with interest rate policies to stimulate the economy, then the Quantitative Easing started (helicopter Ben, does anyone miss him?)

Federal Funds Rate since 1954

.png)

- We are currently sitting at 3.83%, against 62 year average of 4.67%

Higher interest rates make borrowing more expensive (and saving more attractive)

Central Bankers use interest rates (monetary policy) as a tool to impact demand. When the inflation is expected to go above an upper limit, higher interest rate is desirable to reduce demand to prevent the economy from overheating (and retail FOMOing as cost of borrowing is almost free - maybe); when the economy is sluggish, they lower interest rates to encourage spending and less saving.

The impact typically takes some time to filter through the economy. People with fixed rate loans are not impacted right away. Assets price do not adjust overnight.

Powell et al dropped the ball, they signaled interest rates will stay low for a "long time" and caused further asset bubble (especially in housing), then out of the blue they had to cool off the "sudden rise in inflation" that's due to bad policies and supply chain disruptions, in my opinion

We can trace back to 2008 for the start of the asset bubble. Return to near zero interest rate further elevated asset prices

The last three years has been seen as the greatest wealth transfer in history, from the poor to the rich. Is this the final act?

As low interest rate stimulated demand, who benefit the most? People with assets, a lot of assets. Who are these people? The already rich.

All it does is causing people who NEEDED to borrow to buy a house, for example, paying a ridiculously elevated price BECAUSE OF the low rates, while transferring an unfair amount of FUTURE EARNINGS to the asset sellers TODAY. Thus creating debt slaves.

To visualize this and understand what's happening, let's use the simple financial math - perpetuity

"Fair Value" in its simplest form is the perpetuity formula (cashflow / interest rate)

Let's find out he fair value for an asset that gives you $10,000 worth of benefit every year at various interest rates (the house you live in, the dividend you receive, the interest payment you receive etc.):

- at 10% interest rate, it is $100,000 ($10,000 / 0.10)

- at 5% interest rate, it is $200,000 ($10,000 / 0.05)

- at 2% interest rate, it is $500,000 ($10,000 / 0.02)

- at 1% interest rate, it is $1,000,000 ($10,000 / 0.01)

(of course this is over simplification, in real world you wouldn't expect the cash flow nor the interest rate to stay constant in perpetuity)

As the interest rate gets smaller and smaller, the math eventually breaks apart and no longer applicable as a valuation tool.

As price of everything started to go up quickly, eventually retail investors FOMO

We see this over and over in every cycle near the top of a bull market.

When all the suckers are in, time to crush the party.

Stocks, houses, cryptos, you name it. Every cycle this is always the harvesting time for the big boys.

Best time to sell, is when everyone is bidding irrationally.

Now we have retail bag holders HODLing overpriced assets that they FOMO bought. This is going to be dead money for a long time or realized loss.

But here are the silver linings

From almost 0% and irrational FOMO price, to 1% or 2%, is the most painful, but it tapers as interest rates continue to climb. It takes a lot more rate increases to dampen asset prices as we continues to move up the interest rate curve. (The other end is hyperinflation and death spiral, let's not go there today)

You have to be willing to lose money to make money, but do it sensibly

No one can tell you for sure if this will become a repeat of 1970s and 1980s, I think the probability is low, however market humbles us.

Be Fearful When Others Are Greedy. Be Greedy When Others Are Fearful. - Warren Buffet

When Fear and Greed Are Roughly Equal, Stay The Course. - slhp

Posted Using LeoFinance Beta

Montly interest rate is very important for crypto and other online market industries. Yeah you are absolutely right its totally depends on you to spend your money on right way. I learn alot from my last year mistake i have my life savings in bull market and now my investments are almost zero.

I agree with your analysis because I have no knowledge of this field, so what you say I will learn, hopefully I will be able to understand more.