BTC Fundamentals, Where Are We Compared To The Last Bear Market. TWO KEY METRICS To Look For.

Investors always look for clues to understand where we are in the cycle, to get an idea where we could be heading

Although history doesn't repeat itself, it often rhymes.

There are 8 billion people on Earth, crypto holders are still a tiny minority. We are still early in the game.

I am no Bitcoin maximalist, while understanding BTC is still synonymous to crypto, it would be foolish to not look at the state of BTC when assessing where the crypto market could be heading next.

As an investor in technology, there are many metrics to rely on

While it is difficult to impossible to follow all the nuisances happening in the crypto space, no one has enough time in a day to analyze all the developments that are happening at any given moment, there are two quick and important metrics I look for when assessing the health of the crypto space, using BTC as a proxy

Continued investment in the infrastructure, and trend in active users

For Bitcoin, infrastructure investment is its network hashrate

Capitals flow to where it generates great returns. For the infrastructure to continue to expand, it must generate enough return to justify the net new investments.

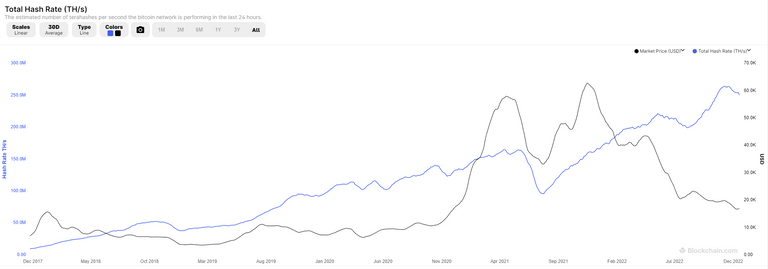

source: https://www.blockchain.com/explorer/charts/hash-rate

Despite all the price volatility, the network hashrate continues to increase.

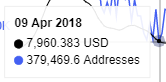

April 2018 - 27M, months after the previous ATH

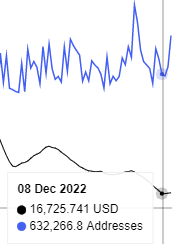

March 2022 - 198M, months after the most recent ATH

December 2022 - 250M, despite 80% price drop from ATH, network hashrate continues to grow

This is a very good sign. Capital continues to pour into the Bitcoin network. Miners continue to be optimistic, network security continues to improve at a very fast pace

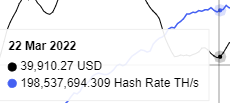

The next commonly used metric is Active Users

Although this is more difficult to measure as addresses are pseudo-anonymous, where we could be counting the same user multiple times.

There are also users who use centralized exchanges (CEX) exclusively and would not show up in this number. Directionally we can still get a good sense if the network is improving its reach.

Though we have to keep in mind crypto space is ever expanding with even more volume in DeFi, NFT, Web3 etc. BTC is not be all end all. Given its prominence as an important gateway drug for the uninitiated to this day, and the most prevalent on-ramp currency and trading pair to other altcoins, it continues to be the barometer to assess the health of the crypto space.

Comparing the two periods again after the ATHs, we saw an increase of about 67%

source: https://www.blockchain.com/explorer/charts/n-unique-addresses

April 2018, 379k addresses

December 2022, 632k addresses

Conclusion

Despite all the FUD, unprecedented macro-economic headwinds (for BTC and cryptos), and an impressive Christmas sale, crypto space continues to grow.

The path to a better tomorrow has never been a smooth path. Challenges along the way are expected.

Bear markets are when the wealth is made, but you have to be resilient and be proactive in managing your personal finances and risks.

No one can catch the absolute bottom, but if you are able continue to do dollar cost average in the bear market and hang on until the next bull market, we will likely be more than okay.

Just remember to book your profit at a price you are happy with, it may happen the next cycle, or the following cycles, or never if you are too greedy. Once the profit is booked, move on, and don't look back.

Make sure you write it down to keep yourself honest :)

This is not a finance advice, personal opinions only as always :)

LOL I wrote this in a different comment but didn't published it because didn't had the exact number. I was like, just focus on the fundamentals, the price is pretty subjective and correlated with peripheral data. At the core, at least BTC is enjoying some of the best numbers on the network.

This is a great reason to double down on the learning, the development and the building.

There are really a lot of things to do, things like decentralized trustless p2p markets, payment updates to the wearables and internet of things, and NFC reality (back in 2017 we didn't have that many NFC devices). Finally we need to solve subscriptions and other things that the e-commerce universe uses.

No one perfect know about the bottom of Bitcoin. I remember my last mistake. I am selling my all assects and 6 months later bull market is coming. My holding coins gives 100x but i was not lucky. This time i will never sale my single just waiting for bull market. I agree with you if you are gready to sale your everything and out to the market. Its canfarm one day bull market is coming so just never sale your assects in losst.