Types of Investments

For many investors, the term investing means different things to different people. To some investors, investing is simply paying for a monthly income and not caring what it does or doesn't do for you in return. To others, investing is using your money to create wealth by building on equity so that you will profit more in the long run and not just pay interest.

Ultimately, investing refers to a systematic process that yields a predictable amount of income over time, month in and month out. How can this be possible? Simply put, investing is all about diversification. Diversification is the process of spreading your risk among different investments so that the possibility of loss is minimized while the possibility of gain is maximized. A well-diversified portfolio will allow for the optimal level of return, regardless of market conditions. So, how do you decide how much to invest?

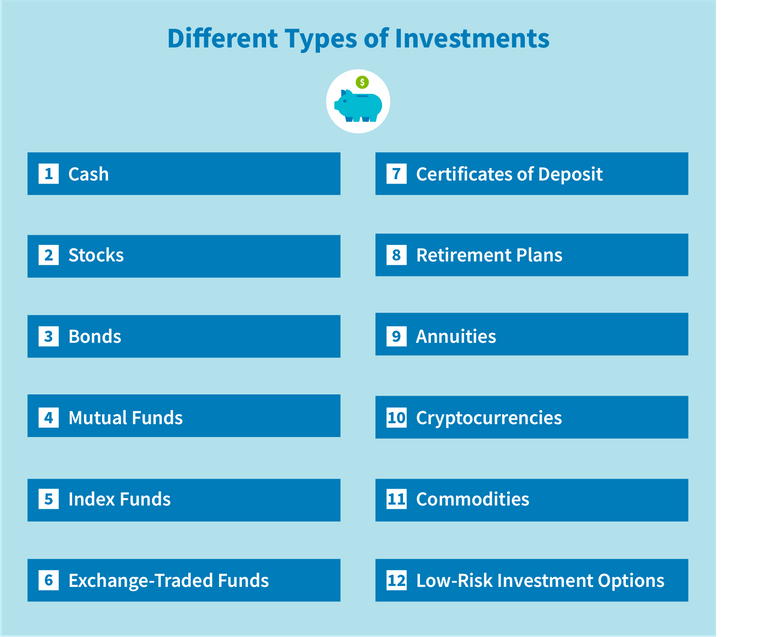

Diversification should be thought of as a combination of several different types of investing. For example, you can invest in stocks, bonds, mutual funds, or other common investing instruments. These are just a few of the different types of investments. As you increase your knowledge of investing and your portfolio, you will likely come across terms like distressed investing, penny stocks, growth-to-date investments, and other investing terms that may be unfamiliar to you. As you become more familiar with the investing terminology, you can learn to more accurately determine how your portfolio will do, both in terms of its performance and its return on investment.

One type of investing that is fairly low risk but offers excellent growth potential is short-term investing. Some examples of short-term investments include the safety of CDs, which are insured for only a certain amount of value, and certificates of deposits (CDs), which offer even lower returns. Long-term investments, such as bonds and money market accounts offer a wide range of possible returns, depending on market conditions and interest rates. In order to make these long-term investments grow at a relatively low rate, most investors will need to use some form of investment management, such as a self-directed IRA, or an annuity.

Capital gains are a major part of investing, because they represent the gain on the sale of an asset. Generally, the tax basis for capital gains is the increase in value over time, so that if you sell an asset and receive cash, this represents taxable income. On the other hand, dividends received are not taxable until the investor sells the security. Because most people have a hard time keeping track of their portfolio's returns, it is common for people to use a professional investment advisor to help them calculate their portfolio's annual returns. In some cases, an investor will invest using both strategies - selling while holding onto the stock - to maximize capital gains.

One of the most popular types of investing is the buy and hold strategy. This method of investing is not recommended for the start-up investor, because holding onto a stock for too long can hurt overall profits. It is best suited for those who are familiar with the market and its trends, and who are able to effectively predict where the market will go before it happens. These investors will usually opt for either a short-term investment option such as a CD or money market account, or a longer-term investment such as a certificate of deposit (CD) or a securities brokerage account.

A popular type of investing is bond investing. Bond investing is popular because it allows the investor to earn interest on the principal amount of his or her mortgage loan. However, one should remember that interest only returns on a mortgage are usually fixed, so it does not take into account the fluctuating rates of interest. In addition, many bond investments offer additional tax advantages, such as low capital gains and favorable tax brackets.

Other common types of investments include stocks and bonds, which are sold in numerous forms. Many people enjoy these investments, because they allow the investor to be exposed to the financial markets without having to hold physical certificates of deposit, like with bond investing. Other popular mutual funds include units, stock, and other indexed securities.

Posted Using LeoFinance Beta