How to Best Pay Off Credit Card Debt Fast

Are you thinking of ways on how to best pay off your debt? In the past, people were stuck with huge debt worries. This is because they have charged up their debts without realizing it. Now that the problem has been solved, they can finally breathe a sigh of relief and start on anew.

How to best pay off credit card debt fast depends on how deep we are in debt. It also depends on our ability to make good decisions. Debt can drive us to make poor decisions that will hurt our future. Hence, before you pay off any debt, do the necessary homework first.

If you are working, try to allocate some money for your credit cards. Or perhaps you can ask one of your friends to loan you some money. If you are planning to buy something, try not to be impulsive when making the purchase. Instead, think about whether you really want the item or not. If you really want it, go for it.

Paying off credit card debt is also based on your budget. You must learn to be practical. Set a realistic budget for yourself. Remember, you can always borrow money from your friends and relatives but not in excess. In addition, try saving up for major purchases like your child's college education. Credit card debt can become a burden if you cannot pay for it in full.

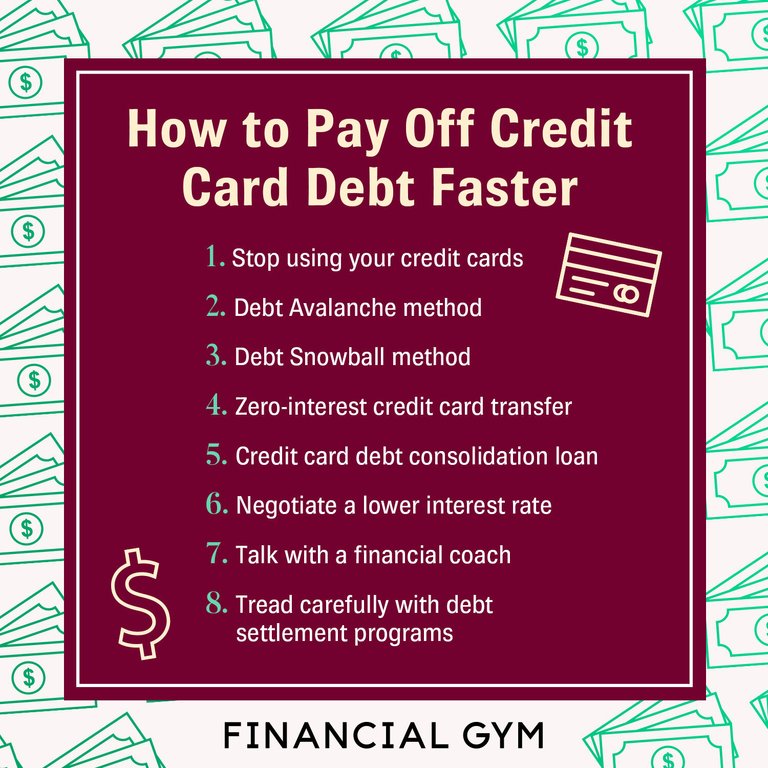

Once you know your financial situation, the next step is to figure out how much you can spare for repayment every month. If you are working, then work for it. Do not use your credit card to make purchases. If you really have the need for a purchase, then seek the help of credit card consolidation services. One of these services will give you a loan at a very low interest rate. Using your credit card is not advisable when you are working, especially if you do not earn enough.

Paying off credit card debt fast will not be possible without discipline. Many people will simply charge on their cards even when they run out of cash. This leads to a vicious cycle: charging more. When you stop charging, this stops. To get out of this vicious cycle, learn to only charge the minimum amount required for the payment every month.

The credit card debt will also involve understanding the impact of late payments. Many times, people become lax on their payments because they fear that other card users may steal their identity. In this case, you should inform your card issuer that you will be late on your payment. They will probably increase your rates or even cancel your account. However, if you inform them before they know it, you can possibly negotiate a settlement with them and your card company.

The first step is to determine what is the cause of the problem. For example, if you have a high interest rate, then you may need to find a lender who will offer you a better interest rate. This does not mean that you cannot obtain a lower rate on your own. It just means that you may want to look for alternatives. If you find that you have no alternative but to charge, then you should seek the help of professionals.

There are a number of financial advisors who are experienced in negotiating settlements with lenders and can help you get the best pay off deals. In addition to the interest rates, it is important to consider the penalties and fees that are tacked on to the balance. These can add up quickly. Therefore, it is important to take all these considerations into consideration. The time to start looking into these fees is after the grace period has expired.

After you have determined how long you will have to pay off credit card debt, you should look at the minimum monthly payments. Often, card holders will only make these payments once a month and then must begin paying extra interest on the balance. You may not have enough extra money each month to make the required minimum payments and you will find yourself facing a lot of extra debt.

Once you know exactly how much your minimum payment each month is, you should also budget for the interest and late charges that might incur on your outstanding balance. If you cannot afford to pay off credit card debt entirely within a year, you might need to obtain some sort of credit counseling service. While these services are not free, they are usually quite affordable. They will help you to better understand how the credit system works and will teach you how to avoid making the same mistakes again.

Posted Using LeoFinance Beta

INTERCOMMUNITY - HIVE - AFFILIATE team.

Thanks

Posted Using LeoFinance Beta

This is a good money management tips...