Investing and living: the price of a “cheap” mentality

I recently read an article by Robert Kiyoasaki about “The price of being cheap”. It was an interesting article because it talked about how many self-help books will tell you the path to wealth is to change your thinking about saving and spending. Many books encourage you to be thrifty, but others encourage you to be Cheap; as in to buy the cheapest things, drive the cheapest car, buy the cheapest clothes and overall strive to buy only cheap things. This is the path laid out by some books as the way to become debt free.

While Mr K acknowledges the value of the philosophy to live below your means and save large portions of your earnings. However he drew a line at being cheap. He felt that being wealthy didn’t mean you had to be cheap. He felt that if you were always thinking like a cheap person you remain a cheap person even when your rich. He felt this cheap mentality deprived you of the enjoyment of your wealth and also deprived your loved ones of the fruits of your labor and investments. The joy of a prosperous and abundant life.

He gave an example of a person who lived a cheap, penny pinching life and died leaving his children an estate of eleven million dollars, which his children fought over like starving dogs. I think the father intended to live a prosperous life, but got stuck somewhere along the way and never shifted gears from save to enjoy.

I read the article and what came to mind was a scarcity mentality versus an abundance mentality. A scarcity mentality leads us to save money as if it’s scarce and irreplaceable commodity. I think some aspects of this scarcity mentality can help us invest instead of spend. But a scarcity mentality needs to be balanced with an abundance mentality which allows us to enjoy what we are earning and accumulating.

I think the point Mr K was emphasizing how undesirable dying a cheap rich person is and all the self deprivation which goes with it. But to me the operative word was balance. We balance our desire to save and invest money against our desire to enjoy our money and the freedom it can bring. Saving is not the goal, but wealth and more importantly the freedom it can bring us from the daily grind of trading “time” the currency of “life” for money.

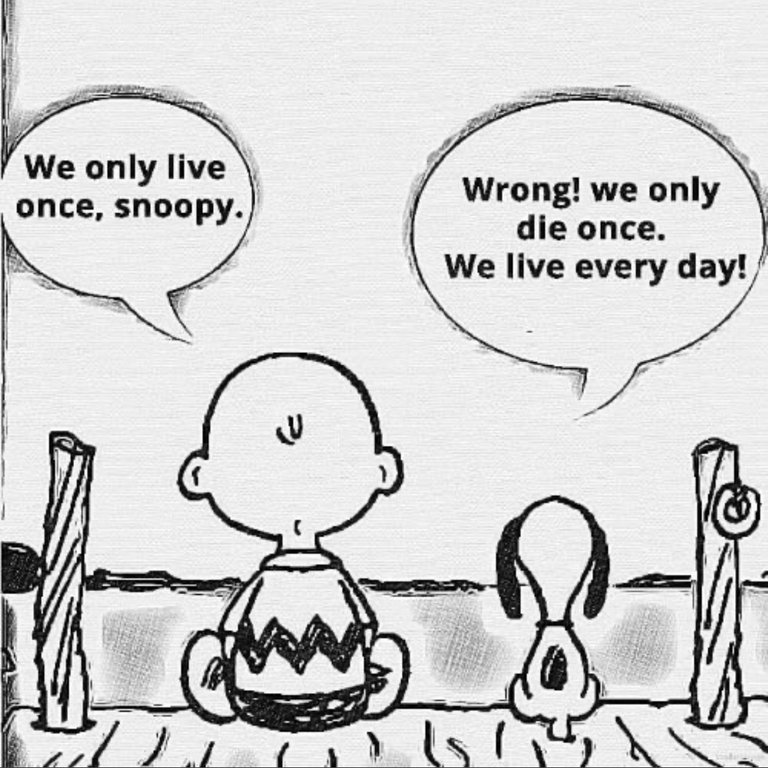

Money is not an irreplaceable commodity, but time is irreplaceable. Once spent it’s gone forever.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Cheap is a bad mentality. I think we don’t have to be cheap or thrifty, but wise. Invest in high quality items you really need that will last. Cheap stuff sometimes doesn’t last.

Posted using Partiko iOS

I agree high quality lasts a long time.

Posted using Partiko iOS

True

True

!giphy nice + essay

Posted using Partiko iOS

giphy is supported by witness untersatz!

!giphy good + read

Posted using Partiko iOS

giphy is supported by witness untersatz!

I think cheap or rich is a state of mind, but frequently associated with accumulated material things. To me it’s freedom.

Posted using Partiko iOS

I agree v

!popcorn

I like calling this bot 🤠

Posted using Partiko iOS

I like your mindset. The true currency is actually Time. The key to everything is balance. Thank you for sharing your perspective on this ❤️

Thanks.