Five Ways to Identify and Avoid Crypto Scams - Newbie's Guide

Last few days, I have talked a lot about crypto scams and rug pull. The reason behind my articles is to keep newbies safe from this wild west so that they don't face scams like me! Yeah, I lost a lot into crypto scams. About six months ago, I lost around 4000 Dollars from a pishing website. But thanks to almighty that I am trying to get my confidence back. It's my duty now to alert people about all types of scams.

Here I am mentioning some basic rules on how to avoid crypto scams. I believe these will help you stay safe from all types of scams currently happening in this space!

Don't Buy Dumb Shit!

The title says it all! Don't buy stupid coins if you want to stay secure! Now the question is - how will you know if any token is bad or good?

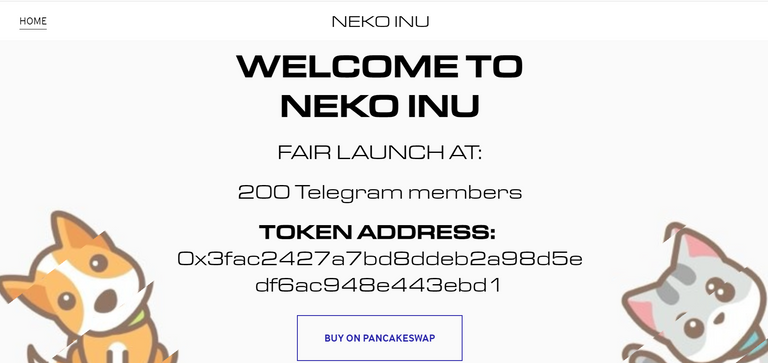

It's pretty easy if you look into the token's details! For example, the token's name itself can sound like scams like Neku Inu, ShibaCumFloki Inu, Godfather Doge, etc. Scammers are using shitname and trending names to scam ordinary investors. These tokens may pump well at launch. But in the long run, most of these tokens scam people. That's what I am saying from my experience.

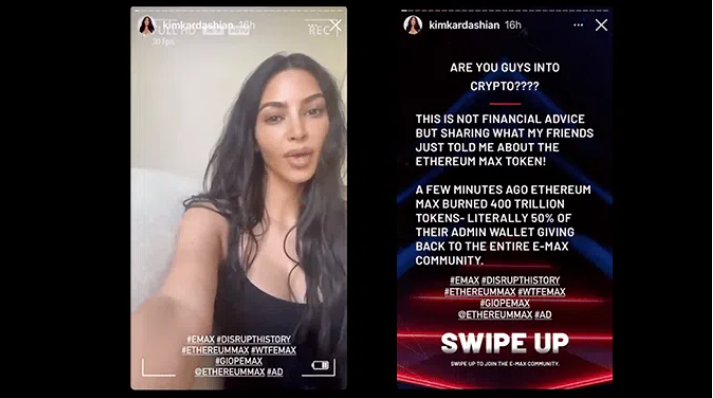

Also, the scammer can use influencers for advertising their scam tokens. For example, Ethereum Max paid Kim Kardashian to promote their token, and you can easily find that Kim doesn't have any idea about crypto. And guess what? Ethereum Max scammed the day after Kardashian posted!

Look at the Website

All crypto projects usually have websites. If it is a bad-looking website, it's most likely a scam! For example - have a look at the website of Neko Inu. Even you can create a better website in WordPress by learning in just three days! The website is super bad.

Now, look at their chart! They took out the liquidity from the pool and scammed traders! This is the reward you get for buying scammy-looking cryptocurrency.

Also Read - What is a Rug Pull? Easy Explanation for Newbies!

You can also check the website creation date and other details from Whois!

But, nowadays, scammers are getting smart! They code their site so well and make it looks worthy! So you have to be smart enough to check thoroughly and find the loophole! If the website is fine, you have to check other factors as well that I am writing below!

Check the Developers

Find out who the developers are! If the devs are well-known people, then the chances are meager that they will scam you. For example, we all know that Vitalik Buterin and his team created Ethereum. Solana was created by Anatoly Yakovenko.

On the other hand, if you look at Apes Token, then you will laugh hard because the devs are two monkeys (or Apes)! Ok, fun aside, the devs are human who wants to hide their identity. There're no social media links like LinkedIn profile links attached with them!

And we know when folk is willing to hide their identity! When they have something terrible in mind! Look at the Apestoken chart. I didn't investigate thoroughly, but it looks like the coin has almost died! And if they scam, you can never track them because it's blockchain!

I have tried to teach you by showing one example! I hope you got my point! Do not invest if the developers are not that popular and not doxxed!

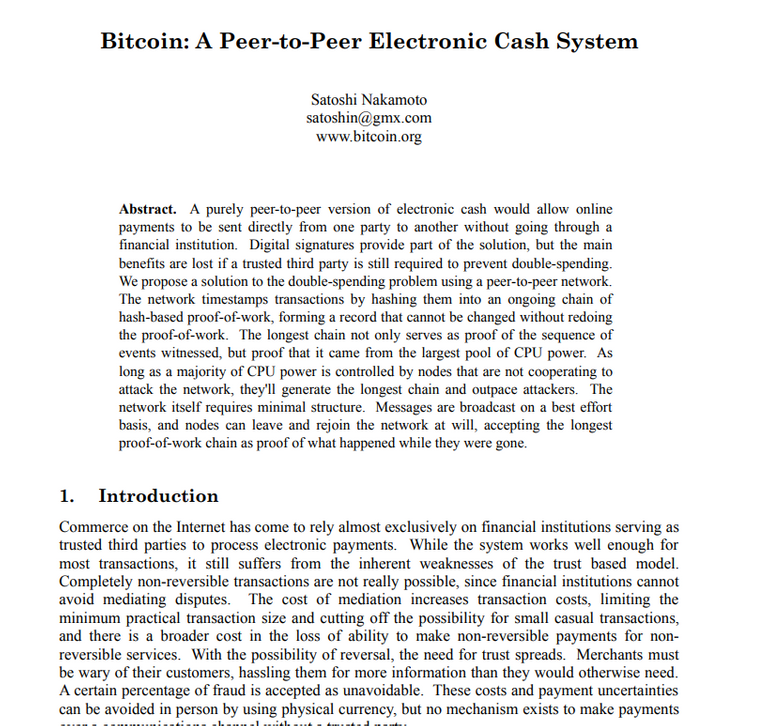

Whitepaper

The whitepaper is basically documentation on how crypto will work!

For example, this is Bitcoin's whitepaper! It tells you exactly how Bitcoin works, the proof of work system, incentive for the mining, and so on!

Or if you see Terra whitepaper, it tells you everything you need to know - what it is, how to run a node, how to contribute, etc. That's how a good whitepaper should look like.

Most of the scam coins don't even have whitepapers! But most of the shitcoins do have whitepapers as nowadays it doesn't cost more than 200-300 dollars to hire someone to write a whitepaper!

But you have to check the whitepaper thoroughly if you want to buy a token!

For example, if you look at Marvin Inu's whitepaper, you will find out that it talks about insurability, fast adoption, aiming for the stars, and all these craps. So they are saying you should buy their token because they are aiming for the stars! What a carp! Does it make any sense?

In the whole whitepaper, there is nothing about how crypto will work, details of the team, and its real utility! Totally nothing! This is how you can differentiate excellent and flawed whitepapers!

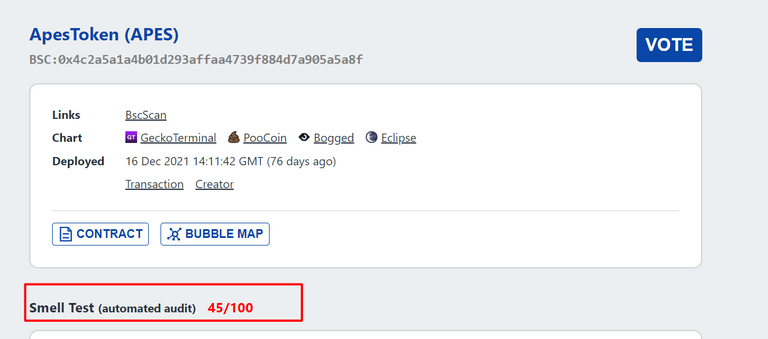

Token Sniffer

Thanks for reading all the previous factors and staying with me! Now, what if the token looks good, the website seems legit, the domain expiry date is extended, the whitepaper is super good, the team looks fantastic. Does that mean the token is legit? I am sorry but no, my friend. There's still a BUT!

If the scammers are rich enough, they can arrange and design everything in a perfect manner. For example - look at the Shelter Crypto! If you invest in it, you can be a part of improving the future of our world! And the website looks excellent too! The team seems doxxed with all the social media profiles attached!

This is when you will use the following tool - Token Sniffer!

Here they will show you something like a small test! It will indicate how smelly specific crypto is by analyzing all the data.

I checked the previous Apestoken contract in token sniffer and found out that the token got 45 out of 100, which is quite a high risk! If you look in the details, you'll find out some opposing sides like -

✘ Ownership renounced, or source does not contain an owner contract

✘ Owner/creator wallet contains less than 5% of circulating token supply (10.5%)

✘ All other holders possess less than 5% of the circulating token supply

Overall, the token sniffer will give you good insights into any token. But even it doesn't provide perfect results. So, you need to combine all the mentioned factors and only invest when you feel safe after exploring all data!

There's another good tool to check if the contract is a honeypot or not. It's called Honeypot IS. To learn more about honeypots, check my previous article.

There are some other factors that you can check before you can invest. For example, you can check the top holders of any token. You can check this in the BSCscan, ETHerscan, or following the token's chain. If the team wallets hold the majority of the tokens, they can easily dump on the traders and rug pull. So you have to be alert and check every possible scenario before putting your hard-earned money into any crypto project.

I hope these tips will help you to stay safe and sound. Let me know if you want me to write anything else regarding this topic!

Posted Using LeoFinance Beta

Absolutely, getting sorry for yourself is painful after using your hard earned money to buy what causes regret.

It's only right to watch carefully following the instructions outlined.

Thanks

Thanks. I am over it now and trying to help others. I wish I knew all of these before getting scammed. Lol. Life's lesson learned in a hard way!

https://twitter.com/Cryptogun/status/1499356892514033669

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.