What's the Best Financial Advice You've Ever Gotten?

So if you have experienced life as a poor person in a rich country, you have undoubtedly been inundated with "advice" from middle class or rich people who just can't seem to fathom that the problem is that you don't have enough money; surely, it's that you don't know how to budget and save money and must be a spendthrift ...because that's the only reason THEY would ever be struggling to pay bills.

Let me tell you, if you're genuinely poor, you are the MASTER of budgeting and saving money. When you are counting pennies just to buy groceries, you KNOW how to budget and coupon and cook with cheap ingredients. You know it better than anyone.

What you generally actually might need help with, is what to do if you ever get out of poverty and succeed in reaching at least a level of wealth where you can do things like buy a house, or start a retirement account, because nobody teaches you that in school and it's unlikely your parents did, either.

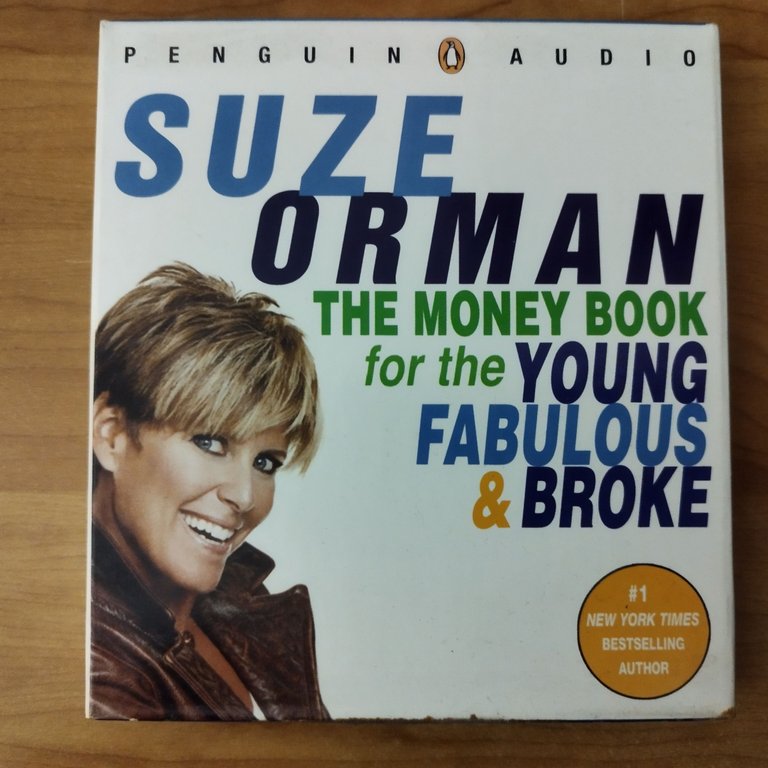

This is the book, y'all. Now, most Suze Orman books (I've read several) are more like, empowerment around money, and not actually practical how-to, but this one is the down-and-dirty, this-is-how-shit-works book. It's so good I own it both in print and in audio (CDs pictured, lol).

She teaches you how mortgages, escrow, downpayments and all of that around buying a house works. How a 401(k), regular IRA, and Roth IRA work and what the difference is between them. All the things that really should be a mandatory high school economics class, is in this book. I highly recommend it, because I really learned a lot from it.

Years ago I had a job where I actually started to save for a retirement account (and then I lost that job and lived off of that savings for a long time... ). When I was signing up, you had to sit down with a financial planner to pick what you wanted. I went in with my notebook of notes and was like, "Well Suze Orman says... " and the dude was like "OH you're a Suze person? You know what you want!" and just let me do it. I barely had any questions.

What's the best financial advice (either a book or a class or just something that someone imparted to you that really helped you) that you've ever gotten? Let me know in the comments!

I actually agree truly with that part you said.. when you are poor, that is when you think and have brain the most..

Posted Using LeoFinance Beta

Yep. Because you have no other choice.

Yeah we dont

One of the revelations was when I learned how compound interest works and how, essentially, that keeps poor people poor and rich people rich. The second most important thing was learning about negotiating, and the third about understanding and managing risk.

Like the US, in the UK we don't teach things like basic money management or how pensions and mortgages work. It's a big shock to just about every school leaver when they start their first job and discover that a third of what they thought they were going to get has disappeared in Income Tax and National Insurance Contributions. Not that those things are not important, just that no one ever tells young people that it is going to happen.

Money changed such a lot in the 1980s with new financial instruments and the liberalisation of financial regulations. Before then, it was very hard to get a mortgage (you needed to have been saving with a building society for at least two years before your parents ever met, never mind when you were conceived); after that, it was easier, but also came with greater risk.

Yeah, compound interest - I think that's in this book too. It's been a while since I've read (or listened) to it.

Egads I didn't know mortgages used to be like in the UK! It's good that it opened up, but yeah that risk factor - a lot of people were suckered into risky mortgages here before the 2008 crash, and boy was the aftermath awful.

Yeah, there was a big problem here with endowment mortgages - you just paid the interest on the loan and alongside that had an endowment insurance policy into which you paid premiums every month for the lifetime of the loan (usually twenty five years in the UK). The idea was that the money invested through the endowment would grow enough over the lifetime of the loan to pay back the capital and (it was sold as) provide you with a lump sum as well - like a savings insurance policy. That was great until interest rates fell, and then people found that there weren't enough funds in their endowment to cover their loan and I learned a new term "negative equity".

I never quite found out how people resolved that, but now, mortgage/insurance sellers have to demonstrate why that particular model is best for achieving what you want - your mortgage paid off at the end of the term. I got caught up with a mortgage seller who sold me one of these endowment policies although it didn't meet my needs and I didn't want it (long and murky story). Anyway, I found an independent financial adviser who helped me make a claim for being mis-sold the policy - I got all the money back. It was an unpleasant experience, those sellers can exert a lot of pressure. For example, he kept my salary slips - probably the thing that infuriated me and set me off on a quest to get my money back!

I'm glad you got resolution, that sounds shady!!

I think the biggest thing for me as Shanibeer has alluded to is the power of compounded interest and the importance of getting good savings habits as early as possible as the money you invest in your early years does the heavy lifting in your portfolio in the later years due to the compounding effect.!

Mr Money Moustache is my favourite guy and i loved some of his articles on his blog.

Compounding interest can make such a difference!!

I love this! I love it for you that you got out of poverty, and I love that you love Suze Orman! I kind of remember listening to her in the early '00s? Does she still do this work?

Love the cd cover. 😄

Well I am back in poverty now; I have some chronic illness issues and I can't work a regular job anymore.

This book is probably from around the early aughts, the last book I read of hers was probably around five years ago though she may have written another one since. She also had a tv show on MSNBC but I don't have any kind of cable or streaming app so I don't know if it's still on.

Oh, I pray for healing from heaven, and divine restoration of strength, and all that has been taken away

Thank you :)

This relates more with the breast financial advice I have gotten ago far, it says (It says instead of spending less, try to earn more). Everyone has to keep looking out for how high value of income would enter for him continuously.

A man who earns the same amount for 5 years every day/week or month would be poorer as years goes by because needs would always arise, and expenses will keep increasing, so to overcome these daily expenses, one has to beat it by far with the income he or she gets as time goes on, and this can best be achieved by minimizing time and maximizing value