How Microstrategy Was Transformed Into The First Bitcoin Spot ETF - $2 Billion Hidden Value In The Balance Sheet

Microstrategy recently released the Q1 2023 report announcing a $460 million net profit, accredited vastly to tax returns.

The Q1 report suggests that the company maintains enough liquidity to cover immediate needs for the next 12 months, securing a financial position to meet short-term obligations.

What is also clear is how the company’s long-term prospect is connected with its massive investment into Bitcoin and remain attached to BTC’s extreme volatility.

The company’s digital assets comprise entirely of Bitcoin (140,000 BTC), which seems to be the sole objective for Microstrategy since 2020.

We examine parts of Microstrategy’s report and how a company transformed into a substitute of a spot-ETF, a proxy for the institutional adoption of Bitcoin ($BTC).

Moreover, the balance sheet of Microstrategy contains a hidden value from BTC’s valuation that currently stands at $2 billion, still a value priced in by the market.

Balance Sheet - 31st March, 2023

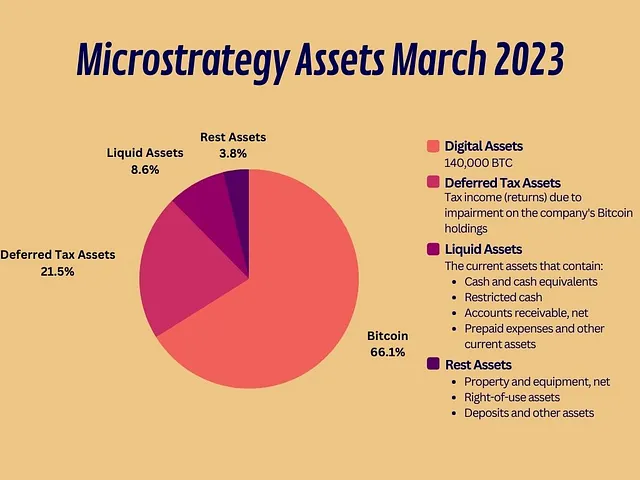

Made with Canva using the company's Q1–2023 Report

Assets:

Microstrategy’s assets as expressed in the most recent report:

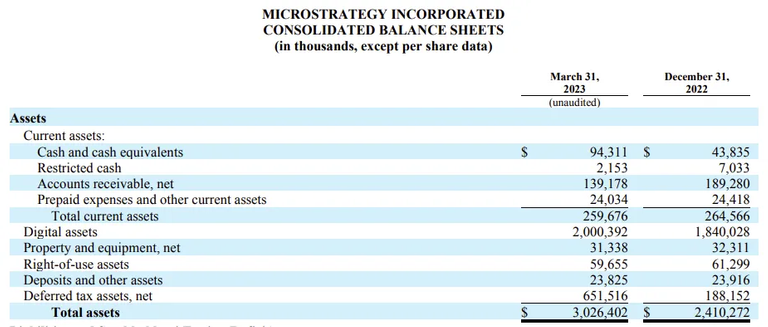

abstract from: First Quarter 2023 Financial Results (in thousands)

Microstrategy owns 140,000 BTC, representing 66% of the company’s total assets.

The stock price of $MSTR is pegged to Bitcoin ($BTC), as Microstrategy transformed into a proxy to a Bitcoin spot ETF.

Since 2021 Microstrategy bought 140,000 BTC, describing them on the company’s books as digital assets, following the latest accounting rules.

Excluding deferred tax assets, Bitcoin dominates Microstrategy books, reaching (close to) 90% of the total company assets.

Furthermore, 21,5% of the company’s assets are tax income (deferred tax assets: $651,516,000), also partially related to the company’s Bitcoin investment.

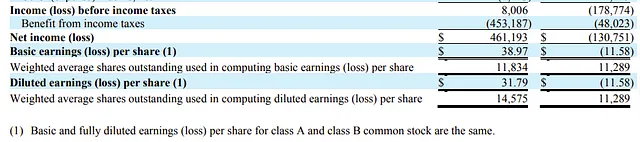

For the three months ended March 31, 2023, the Company recorded a benefit from income taxes of $453.2 million on a pretax income of $8.0 million, which resulted in an effective tax rate of (5,660.6)%.

For the three months ended March 31, 2022, the Company recorded a benefit from income taxes of $48.0 million on a pretax loss of $178.8 million, which resulted in an effective tax rate of 26.9%.

The change in the effective tax rate, as compared to the same period in the prior year, is primarily due to the release of valuation allowance on the Company’s deferred tax asset related to the impairment on its bitcoin holdings, attributable to the increase in market value of bitcoin as of March 31, 2023 compared to December 31, 2022.

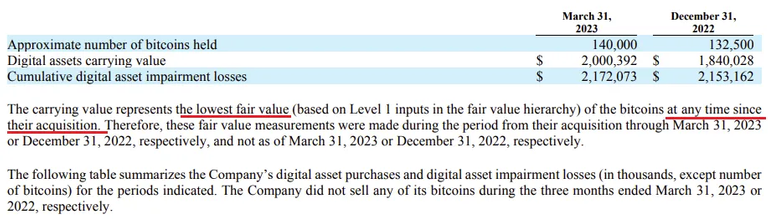

Considering that accounting rules demand the digital assets to be evaluated at the lower price reached after their purchase, the book price of these 140,000 BTC is the lowest (fair) market price since the acquisition.

First Quarter 2023 Financial Results (in thousands)

In the books, the digital assets of Microstrategy are worth only $2 Billion, while the current valuation is more than double (close to $4,1 Billion).

$MSTR trades according to the price volatility of BTC, though, and this $2 Billion gap is explained in the details of each accounting report.

The correlation is incredible, as $MSTR mirrors BTC perfectly since mid-2020.

Microstrategy recorded losses in the previous two years, but it should begin recording profits as the Q1 report shows:

Perhaps at some point, the company will have to sell small parts of the BTC it holds since it bought them with funding from the issuance of convertible notes, which has to repay in stock options or cash.

With the price pegged to BTC’s volatility, Microstrategy has become a spot ETF for Bitcoin ($BTC), a vehicle for institutional exposure.

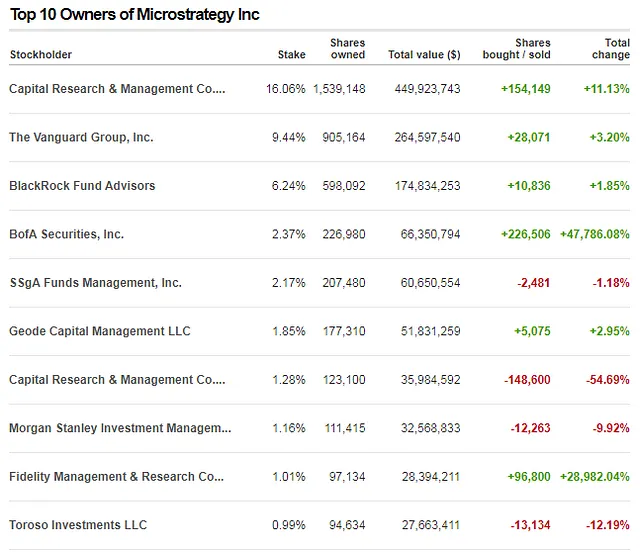

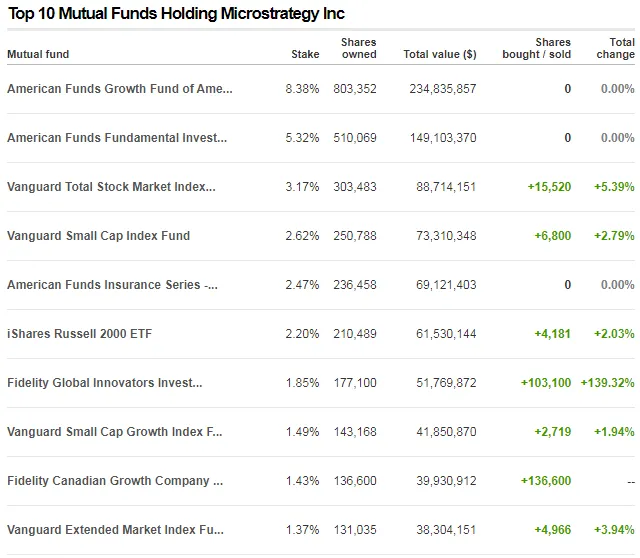

These institutions represent some of the top global banks and funds.

CNN Money

CNN Money

In Conclusion

With the fourth halving of Bitcoin (BTC) in 2024, a renewal of interest will emerge, driving the prices of cryptocurrencies higher.

Michael Saylor advocates for favorable Bitcoin regulations in the US.

Saylor and Bitcoin investors want Bitcoin in finance as a large-scale institutional asset class, although Bitcoin finds obstacles from the SEC, central banks, and governments.

Bitcoin diverted from its original purpose, as described by Satoshi in the whitepaper and the early discussions.

Instead of Peer-to-Peer electronic cash, we find today a regulated financial instrument of speculation and a cascade of ever-changing narratives, aggressive online marketing, and even political lobbying.

$MSTR is already a proxy Bitcoin spot ETF, with institutions, funds, and banks invested in it, but the company also carries all the risks involved Bitcoin’s price volatility.

Cover Picture on Pixabay: link

Images, and material in this article are used for research, and educational purposes and fall under the guidelines of fair use. No copyright infringement intended. If you are, or represent, the copyright owner of images used in this article, and have an issue with the use of said material, please notify me.

Originally published at Medium.com

Find me on:

Medium - Noise Cash - Read Cash - Hive - Vocal - Minds - Steemit - Publish0x - Twitter - Reddit

Like & Follow if you enjoyed this story!