Cathie Wood And The Ark Of Innovation

ARK Invest is an investment management firm created by Cathie Wood, a visionary entrepreneur, not aligned with traditional investing strategies but following a revolutionary management strategy instead.

Leaders like Cathie Wood shape generations and challenge the status quo, by thinking outside of the box, with a disruptive approach and significant performance.

Like every successful entrepreneur or investor, Cathie Wood was praised for years for her intuition and investing abilities, but lately, it seems Ark Invest is a target of speculative funds sorting particular investments.

Ark Invest has specialized its investing strategy in predicting future trends and acquiring stocks in the fields that will radically advance the human race into the future and create better living conditions for billions.

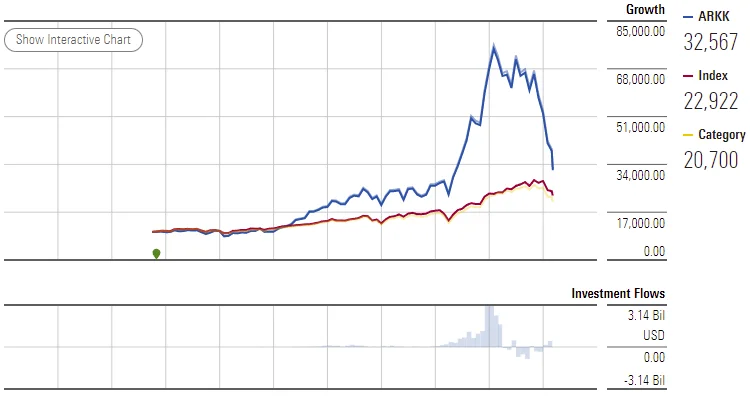

The outcome so far has been incredible, since by the end of 2021 Ark Invest was managing a portfolio worth 53.7 billion dollars, with a 2021 ROI of 86.59%, while also offering constant yearly returns of 48.36% on average for the past five years.

While the first two months of 2022 haven't been encouraging, as the fund lost its impressive profitability, investing in the potential of modern technological advancements is not as high-risk as it seems. The real question is which companies can succeed in a fiercely competitive environment.

Ark Invest Funding Innovation And Progress

The three previous industrial revolutions shaped the world economy and brought an exponential rise in productivity and innovation.

Research and Development is the cornerstone of successful corporations. Recent technological advancements brought vast opportunities for progress and increased the quality of our living conditions.

The top-performing investors are the visionaries.

The stock portfolio of Ark Invest includes companies at the edge of technological progress and research such as:

- Tesla (Electric Vehicles)

- Palantir Technologies (AI and Machine Learning Platforms) - Sold Position In Late February.

- Twilio (Cloud and communications Services)

- Shopify (E-commerce)

- Square (Jack Dorsey's Investing Platform)

- Zoom (Conference and Streaming Platform)

- Robinhood (Trading Platform)

- Roku (Streaming services)

- Coinbase (Cryptocurrency Exchange)

- Fate Therapeutics (Biotech)

Ark Finance invests in a wide variety of fields where innovation flourishes. From fintech to gene research, robotics, and space exploration, ARK ETFs constitute some of the most exciting opportunities.

ARK ETFs

The vision of the fund is progress, thus, all investments are towards visionaries in any field, those that support research and develop the technological wonders that billions will use by the end of the decade.

(source)

Main ARK ETFs:

- ARKK Ark Innovation ETF

- ARKW Ark Next Generation Internet ETF

- ARKF Ark Fintech Innovation ETF

- ARKQ Ark Autonomous Tech. & Robotics ETF

- ARKG Ark Genomic Revolution ETF

- ARKX Ark Space Exploration & Innovation ETF

Ark also presents a few more indexed ETFs in the fields of 3D Printing, Transparency, and Innovation.

At ark-funds all the ETFs are explained in detail.

The ARKK ETF includes companies offering technological and scientific research that could fundamentally alter and improve finance, industry, and living conditions:

- DNA Technologies and the “Genomic Revolution”

- Automation, Robotics, and Energy Storage

- Artificial Intelligence and the “Next Generation Internet”

- Fintech Innovation

(source)

The Ark Innovation fund currently holds shares of 36 companies which we can find updated daily on the cathiesark.com website. Recently Ark sold Palantir, as part of its risk management assessment.

Performance of ARKK ETF

The Ark Innovation ETF is the flagship of Ark ETFs.

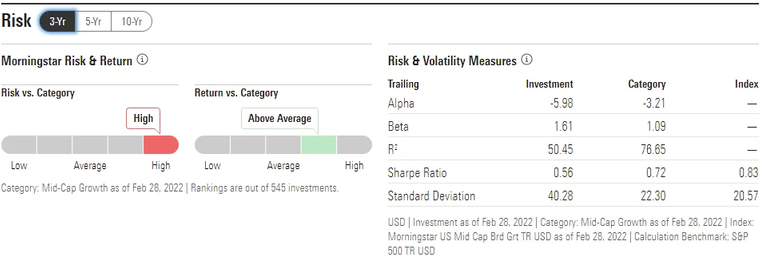

At this point, the fund is underperforming with a negative alpha (-5.98), and a beta indicating high volatility (1.61), on a 3-year analysis. (Investopedia)

(Source: Morningstar)

The ARK ETFs are in decline since Q4 2021 since the stock market corrected significantly, and today seems a bargain, having dropped significantly from last year's peak (-50%).

The vision behind these funds grows beyond the scope of short or middle-term speculation, but envision the not-so-distant future of economic and technological progress and invests in it.

The Ark ETFs offers its portfolio to hedge funds and profits by charging 0.75% fees for operational expenses.

In Conclusion

Investing habits change, and while Warren Buffet-type investing strategies still dominate the fund manager circles, a fresh approach by visionaries is changing the game.

Ark is investing in cutting-edge technologies, and established firms focused on research and innovation.

The ETFs by Ark Invest are growing hot again since they are offered at a bargain price today, after five years of rapid increase.

Cathie Wood is considered a star fund manager, yet she was recently called a "boom or bust investor" for not following traditional paths of risk assessment and deleveraging or focusing on sustainability indexes. The long-run performance of the Ark funds so far is admirable, though.

High-risk produces high rewards. A diversified portfolio in high-tech stocks traditionally delivers high yields. But is cutting-edge technology and research a high-risk investment? Investing in the future for visionaries is a no-brainer.

Innovative technology is the driving force of progress for all humanity.

Today we look at the stars and imagine the true potential of the human race.

Within these parameters, we invest in advanced and revolutionary concepts, not just for the expected returns, but for the additional value these fields bring to our societies.

Originally published at read.cash

- Cover Photo by geralt, on Pixabay

Writing on the following platforms:

Noise Cash - Read Cash - Hive - Medium - Vocal - Minds - Steemit - Den.Social - Publish0x

Follow me on social media:

Don't forget to Subscribe/follow if you enjoyed the content!