Rigel's Margin trading and its features.

Hi readers.

In this article, I am going to be introducing Rigel Protocol Margin trading and the unique features that make it stand out.

Margin trading is a method of trading assets using funds provided by a third party. Margin is the money borrowed from a lender to purchase an investment

and is the difference between the total value of an invest

ment and the loan

amount. Margin trading refers to the practice of using borrowed funds from

a lender to trade an asset, which forms the collateral for the loan from the

lender. In Crypto, most lenders are centralized exchanges.

When compared to regular trading accounts, margin accounts allow traders to access greater sums of capital, allowing them to leverage their positions. Essentially, margin trading amplifies trading results, so that traders can realize larger profits on successful trades.

How RigelProtocol Margin trading works

For the margin trading feature, it would require two sets of users:

● The Lending Pool Provider (The Rigel Lender)

● The Leverage Trader (The Rigel Trader)

The Lending pool provider will add funds to the margin lending pool. Funds will then be available to be leveraged by the leverage trader. The Leverage trader chooses a leverage size and sets collateral based on the level of risk he is willing to take.

The Leverage Trader can choose a buy or sell position. If the trade goes in the favor of the Leverage Trader, profits are assigned to the Trader wallet address. Otherwise, the losses or liquidated amounts are added up back to the lending pool to be distributed among the Lending Providers, RigelProtocol governance community, or RigelProtocol token native holders and the RigelProtocol treasury.

Features of RigelProtocol Margin Trading

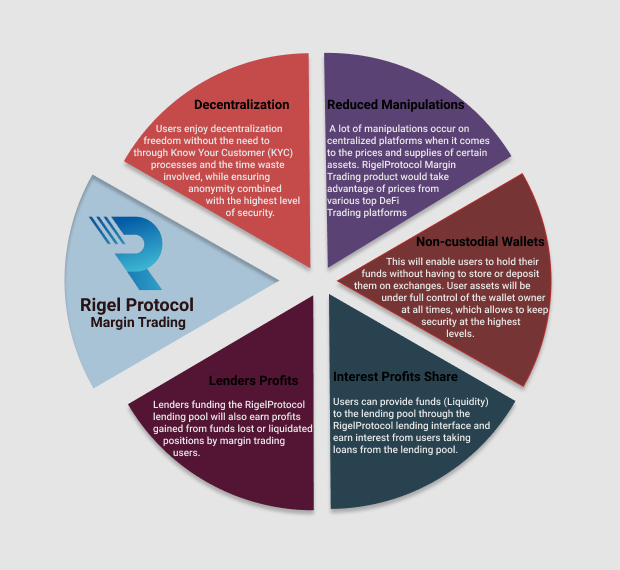

RigelProtocol margin trading is a decentralized finance design to help users tackle problems relating to leverage trading. The margin trading product will be more user-centric, enabling a new set of foundations for margin traders. The following are the features of RigelProtocol Margin Trading.

Decentralization: The RigelProtocol margin trading platform allows users to enjoy decentralization freedom without the need to through Know Your Customer (KYC) processes and the time waste involved, while ensuring anonymity combined with the highest level of security.

Reduced Manipulations: Many manipulations occur on centralized platforms when it comes to the prices and supplies of certain assets. RigelProtocol Margin Trading product would take advantage of prices from various top DeFi Trading platforms.

Non-custodial Wallets: This will enable users to hold their funds without having to store or deposit them on exchanges. User assets will be under full control of the wallet owner at all times, which allows keeping security at the highest levels.

Interest Profits Share: Users can provide funds (Liquidity) to the lending pool through the RigelProtocol lending interface and earn interest from users taking loans from the lending pool.

Lenders Profits: Lenders funding the RigelProtocol lending pool will also earn profits gained from funds lost or liquidated positions by margin trading users.

About Rigel Protocol

The Rigel Protocol is Decentralized protocol that aims to give to the community access to several instruments to expand the adoption of Blockchain technologies in daily life.

https://twitter.com/rigelprotocol

Whitepaper: https://www.rigelprotocol.com/whitepaper

Website: www.rigelprotocol.com

Telegram Update:https://t.me/rigelprotocolupdates

Medium: https://medium.com/rigelprotocol

Telegram Channel: https://t.me/rigelprotocol

E-mail: [email protected]

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism