New loan policy: volatility protection clause

Volatility protection clause

FOR A PAYMENT MADE ON A SCHEDULED DAY

The Bank may opt to value the payment currency value at an average price

over a 24 hour period.

FOR A PAYMENT MADE OUTSIDE OF A SCHEDULED DAY

The Bank may opt to value the payment currency at any price the currency

had during the last 3 days.

Prices are determined from a pre-agreed oracle.

https://www.coingecko.com shall be used if nothing else is specified.

Reasoning

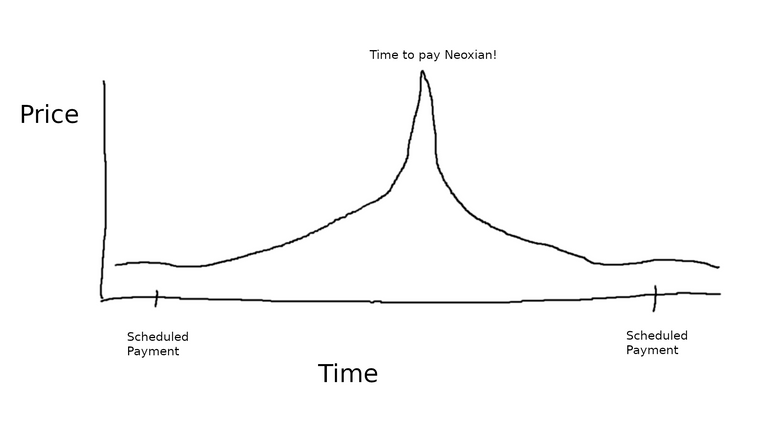

Here is a case where a picture is worth a thousand words. Just once glance at this image should tell you why I'm doing this.

I'm surprised I didn't make this policy earlier, clients have been doing this to me for years. If they paid on the scheduled day, and the payment coin spiked up, they just got lucky, it's mildly annoying, but it's not like it was planned by them.

It's much more annoying when a client is tripping over themselves to hurry up and pay you, even when payment isn't due yet, with a currency that just spiked up high, and they are in such a rush to pay you before it collapses back down. Basically this is a clever way to force me to buy your coin at the worst possible price for me and, yes I'm tired of it. So no more of that bullshit.

This policy shall be added to all my formal loan contracts and even the informal ones made on a chat. I'll try to make this policy clear.

Posted via neoxian.city | The City of Neoxian

I agree to this policy sir. I always pay earlier so you can opt for whatever price you think is good.

Posted via neoxian.city | The City of Neoxian

A early payment penalty fees is an another alternative but taking average of 3 days look great.

I'm always in a rush to pay so I don't end up expending the money that is not mine lol, but I completely understand this.

Didn’t know you doing it by $ amount. Back in the day it was crypto +% interest. Seems simplest. Example lend out 500 hive for a month and receive 550 hive at the end of the month. You won’t have to worry how much hive costs within that month. If hive price moon shoots and borrower pays early you still get the principal and 50 hive interest...

@tipu curate

Upvoted 👌 (Mana: 52/92) Liquid rewards.

!WINE

Congratulations, @theguruasia You Successfully Shared 0.100 WINE With @neoxian.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/5 Successful Calls.

Contact Us : WINE Token Discord Channel

WINE Current Market Price : 0.270

So they must be having liquid, why not sell instead and have that reserved in USD than pay you ?

this is a good policy @neoxian ,, hope it will be the best

This make much sense sire, it will make things balanced for you and your clients...

I agree. Good move.

I agree on your decision sir. This will balance things.

Posted via neoxian.city | The City of Neoxian

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism