Debunking 5 biggest Myths on Cryptocurrencies - 2nd Part

3. Cryptocurrencies will take decades to be wide-spread

A few days ago, I was chatting about cryptocurrencies. The level of knowledge was very low, I would say “Entry Newbie Level” and I was told that cryptocurrencies are tools that are not ready yet, and it will take 40–50 years more for their mass adoption.

My answer was a “Maybe you mean 4–5 years”. She felt quite disoriented but yes, I think that cryptocurrencies will reach a mass adoption in a few years from now.

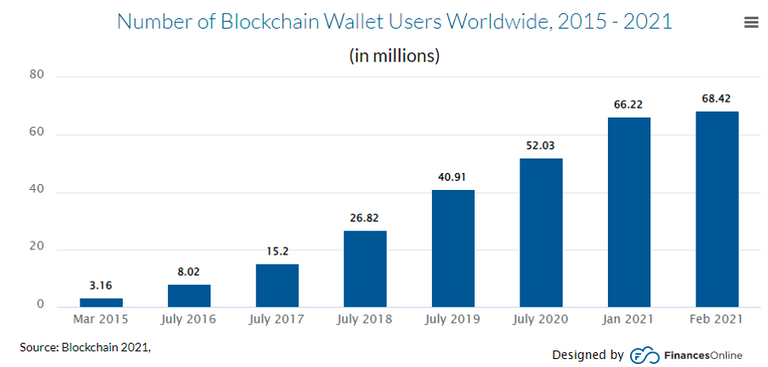

At the moment, we can merge two different statistics: the strong growth in the number of wallets and the estimated number of users worldwide.

This is the trend of the wallets amount

Source: https://financesonline.com/number-of-blockchain-wallet-users/

It’s one year old, but I liked it because it clearly represents the progressive growth of the number of wallets. There can be also different wallet for a single user. Maybe these numbers are not the “Holy Truth” but they can give a respectable order of magnitude.

Another stats I liked is an estimation that provides also some demographic insights on the usage of all cryptocurrencies in different countries. According to triple-a.io the number of cryptocurrency holders in late August 2022 are 320 millions, about 4.2% of the total population. We can see that the highest percentage of users on the total population is in Vietnam where more than 20% of the people have cryptocurrencies.

4. People lose money with cryptocurrencies

That is true, if they do not know what they are doing.

People can lose money with cryptocurrencies in two main ways: price fluctuation and Scams.

The chance to lose money for price decrease is very common, since every market has fluctuating prices meaning that in some moments, we will potentially have profits and losses in other moments.

“It’s the market baby”

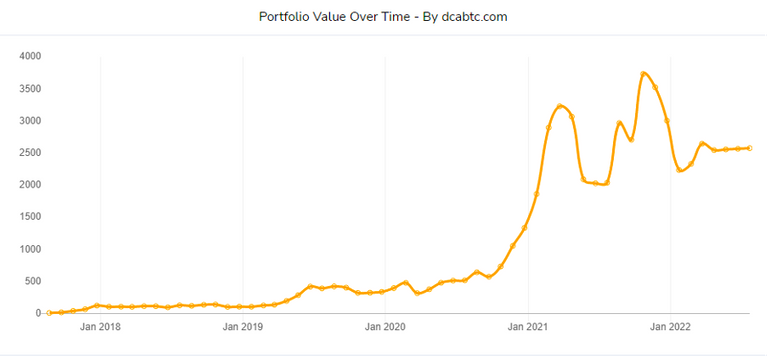

Anyway, here you have a very nice website I suggest you to give a deep read, that explains very well the potential of the Dollar Cost Averaging (DCA) with Bitcoin.

This is for example the result of a monthly purchase of Bitcoin of 10$ since the last 5 years.

Source: dcabtc.com

And you can play with the variables you can find on the left, seeing that on average, Bitcoin beats the market and the inflation on a multi-year perspective.

Losing money on Scams, instead, has a lot of meanings but I will focus my attention on the main two: the first one is putting money into projects that are worthless having their token going to zero (or rug-pulling). The second is connected to the use of non-safe platforms.

In the first case, a deep analysis of the project can definitely help to reduce risks connected to the project default. I will write more about how I usually fo my research on projects and every week we publish contents on most attention-worth tokens.

In the second case, it’s always good to rely on well know and well audited platforms. From exchanges, to wallet and payment providers I always suggest to follow the volumes, meaning that where the most part of the people are actually working, there it will be a good solution for many others to operate as well.

5. Bitcoin consumes and pollutes too much

On this topic, I already wrote a whole and deep article, that you can find at these links:

https://ecency.com/hive-150329/@mikezillo/crypto-consumption-il-consumo-delle

https://ecency.com/hive-150329/@mikezillo/crypto-consumption-il-consumo-delle-79fdbb41799c8

I am sharing here just a couple of numbers so to give you a snapshot of the scenario:

Bitcoin produces 95 Million of tonnes of CO2 per year

Intensive Breeding produces 7100 Million of tonnes of CO2 per year (source FAO.org)

According to the UNEP Food Waste Index Report 2021, 17% of food is wasted.

17% of 7100 Million of tonnes equals to 1207 Million of tonnes per year of CO2 created to produce from intensive breeding that is lately disposed.

Bitcoin produces 12 times less Carbon Dioxide than the simple CO2 produced for wasted food from intensive breeding. So has your perception on Bitcoin Environmental Impact changed?

I hope that this article could contribute to your knowledge and potentially to a lot of people still skeptical about this topic.

Feel free to quote, share and repost this article, to support our work and to help us debunking all the false myths on cryptocurrencies.