Stablecoins and How They Work?

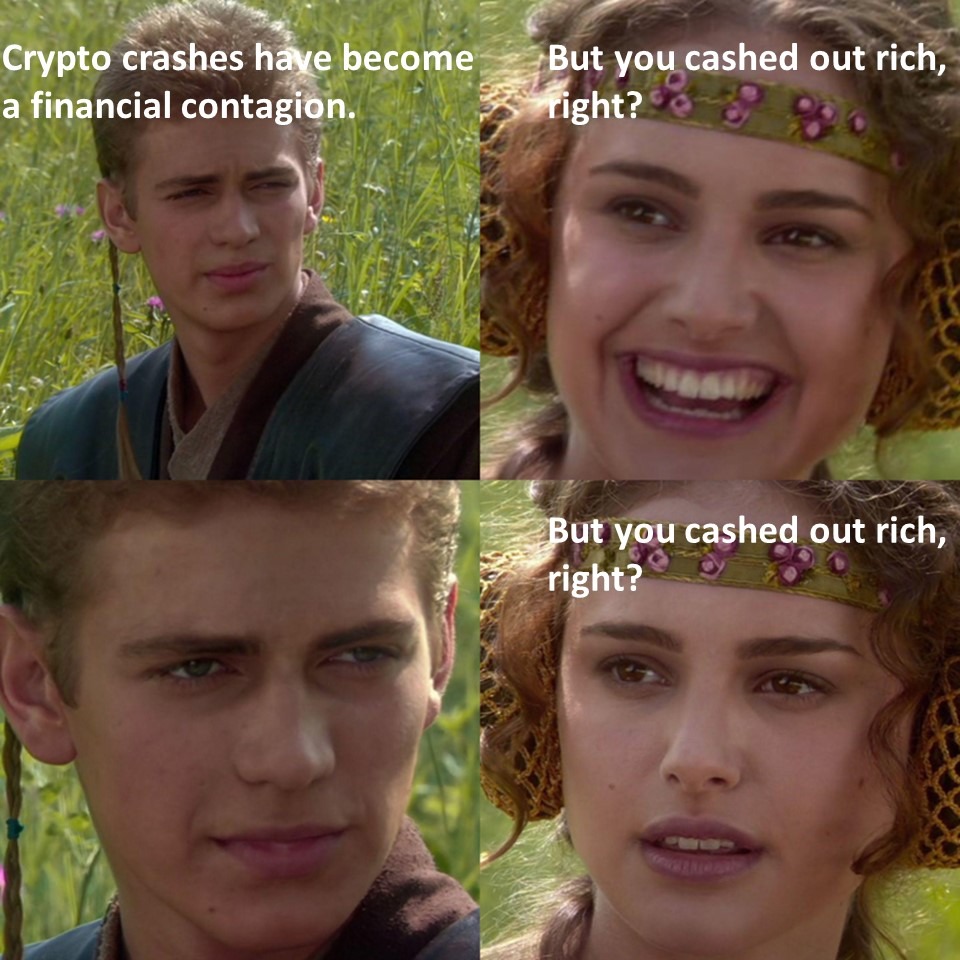

I have been catching up on the weekend news, and it's all been about the potential collapse of Silicon Valley Bank (SBV) and its ramifications on the global and crypto markets. When most people think about cryptocurrencies, they picture a highly volatile market with prices that can fluctuate dramatically. However, in recent years, the rise of stablecoins has offered investors a way to protect themselves against the intense price movements of Bitcoin and other tokens.

So, what exactly are stablecoins, and why are they becoming increasingly popular in the crypto world? In essence, stablecoins are cryptocurrencies whose value is pegged to an existing asset, most often the US dollar, but there are also stablecoins tied to the euro and gold.

Traders can buy stablecoins like Tether (USDT) or USD Coin (USDC) with real dollars and then use these tokens to trade bitcoins and other cryptocurrencies. Whenever someone wants to cash in, they can get the equivalent amount of dollars for however many stablecoins they wish to redeem.

Stablecoins solve a significant problem for the cryptocurrency market. Transferring from fiat currencies like dollars into cryptos is a hassle. It costs money, and it takes time. Stablecoins allow users to move fiat currency into an equivalent number of tokens quickly and cheaply. This makes a world of difference and helps ensure that the crypto market is efficient and functioning smoothly.

However, not all stablecoins are created equal. The recent collapse of one so-called stablecoin, terraUSD, has shaken investors' faith in the crypto market. TerraUSD, or UST, was marketed as a stablecoin but didn't hold up to its promise. Instead of fiat currency reserves, UST relied on a complex set of rules. If the price of UST sank below a dollar, an algorithm would kick in, creating new units of a sister coin called luna while taking an equivalent amount of UST out of circulation. The idea was that this would throttle the supply of the stablecoin and push its price back up to $1. However, this system failed in an extreme situation, causing the value of UST to drop significantly.

The collapse of UST has set off alarm bells for global regulators who worry that stablecoins could hold much broader risks to the financial system. Tether, the world's biggest stablecoin by market value, has long faced doubts over whether it holds enough assets to support its purported peg to the dollar. Tether processed over $10 billion in withdrawals in the past year as investors got cold feet about the token.

The source of Tether's reserves has been under scrutiny after a series of disclosures showed it wasn't always backed 1-to-1 by cash as initially claimed. Critics of Tether also worry that it has been used to manipulate crypto prices, a claim the company denies.

More recently, we saw USDC, another stablecoin, depegged from its $1 peg and reach lows of $0.88. It has started to rise, but we are unsure how it will react once the traditional banking market opens today and what the fallout is from the SBV collapse.

So, while stablecoins offer a compelling solution to a significant problem in the crypto market, investors must proceed cautiously. Not all stablecoins are created equal, and the collapse of one stablecoin can significantly impact the broader market.

In conclusion, stablecoins are cryptocurrencies whose value is pegged to an existing asset, most often the US dollar. They offer traders a way to protect themselves against the intense price movements of Bitcoin and other tokens. However, investors must be cautious as not all stablecoins are created equal, and the collapse of one stablecoin can significantly impact the broader market.

Thank you for reading, and I hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Steem || Read.Cash || Noise.App || Twitter || Torum

Posted Using LeoFinance Beta

https://twitter.com/1150276624119717889/status/1635225420718305283

The rewards earned on this comment will go directly to the people( @mercurial9 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.