Understanding Risk Management In Trading

Hello everyone, hope you all are doing good? This is the beginning of an exciting three part series, which promises to be informative and also educative, do well to follow all the parts, as you will definitely gain 1 or 2 useful information from the series. In today's article we would be looking at some trading terminologies.

I will be explaining different trading terminologies such as;

Buy Stop

Sell stop

Buy limit

Sell limit

Trailing stop loss

Margin call

Buy Stop: It is a type of order which is set by traders to automatically purchase an asset at a particular price above the current market price. Take for instance STEEM is currently at $0.6, and I as a trader want to sell STEEM when it reaches $0.8 for UDST, hence, I'm buying USDT, in order to make profit of $0.2 for each STEEM I have. Let's say I have 100 STEEM, that will be $20 profit.

I will place a Buy Stop Order on STEEM/USDT at $0.8. What that means is that, once STEEM gets to $0.8, 100 STEEM will be sold for 80 USDT, hence, I will be making a profit of $20. This order is usually for traders to Take Profit as they won't be around their system all day monitoring the market. Take a look at the image below for more understanding.

Sell Stop: It is a type of order which is set by traders to automatically sell an asset at a particular price below the current market price. Take for instance STEEM is currently at $0.6 and I'm scared that STEEM could fall to $0.4 and even further and I don't want to make any loss. I could place a Sell Stop at $0.5. When the market price reaches $0.5, STEEM will be automatically sold.

This order is usually used by traders to stop or reduce the amount of loss they could incur from a trade, as they won't be around their system all day monitoring the market. Take a look at the image below for more understanding.

Buy Limit: It is a type of order which is set by traders to automatically purchase an asset at a particular price below the current market price. Take for instance, STEEM is at $0.6, and that's too expensive for me to purchase, as I want to purchase STEEM at $0.4 and I believe that the price of STEEM will soon fall but I don't know when. I will place Buy Limit order at $0.4, so whenever the price reaches $0.4, my order will be automatically executed, with the aim of buying at lower price and hoping for the price rebound. Take a look at the image below for more understanding.

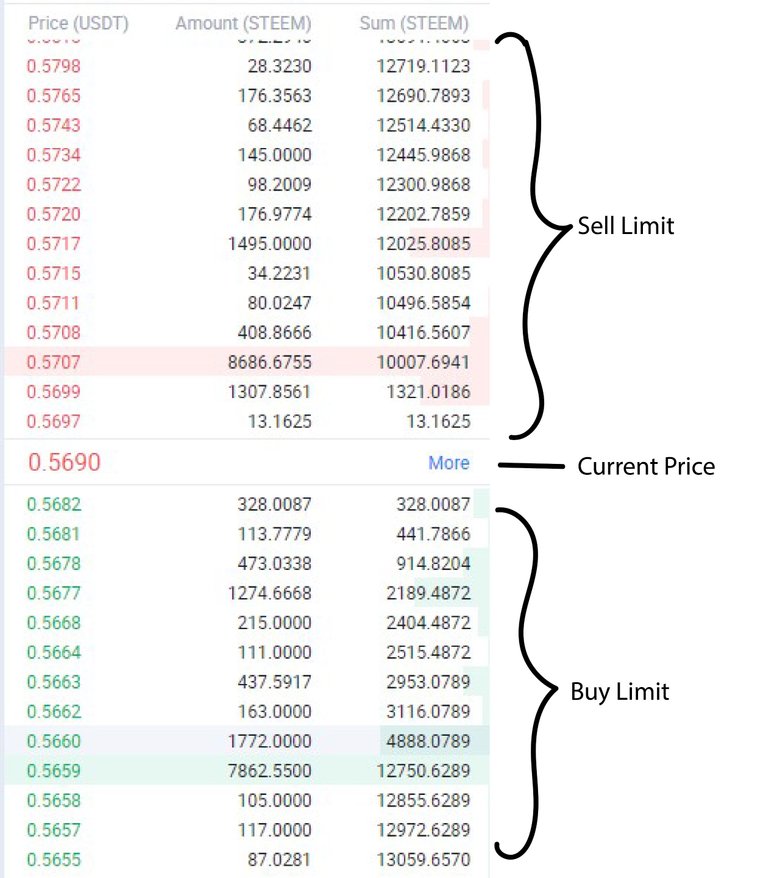

Sell Limit: It is a type of order which is set by traders to automatically sell an asset at a particular price above the current market price. Take for instance, STEEM is at $0.3 and I strongly believe that STEEM can make 2x, I will place my Sell Limit order at $0.6, with the aim of selling my assets as the price will soon fall. Look at the image below for more understanding

You can see both Buy and Sell Limit orders of other traders in the Order Book. Buy and Sell Limit orders are what causes price to go up and down. When traders set high Sell Limit Orders, price eventually goes up and vice versa. Look at the image below for more understanding.

Trailing Stop Loss: This is when traders monitor the price movement and adjust their stop loss in order to lock in profits already. For instance, you entered a trade at $0.3 and place a Stop loss at $0.25. The price of the asset increased to $0.35, you adjust your Stop loss to $0.3. The price of the asset appreciates again to $0.4, you adjust your Stop loss to $0.35. I hope you get the idea of the concept now.

Margin Call: Margin call occurs when an investor's risk level is getting too high and he/she gets notified or warned by his/her brokerage. After the notification, the investor will have two options, either to deposit more money into his/her margin account or end the trade. If the investor doesn't do either, the broker has all right to end the trade, in order to limit the loss that is been incurred.

I hope you all found the article interesting and exciting. Do well to share your thoughts about the article in the comment section below. Thanks.