Signs Oil and Energy Prices May Explode...

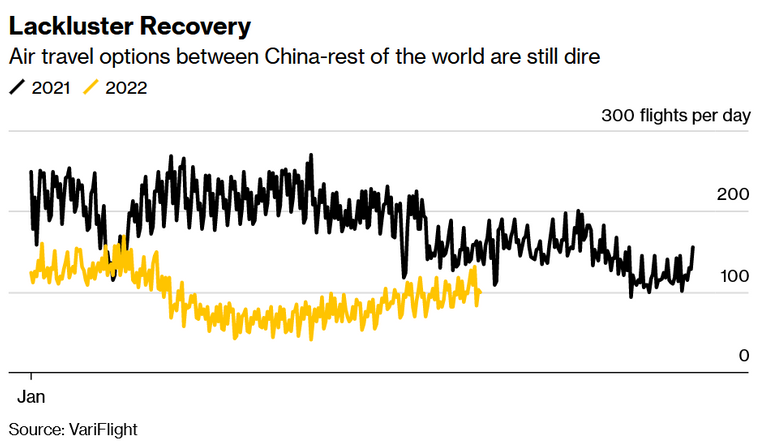

The front image is from a recent article by Bloomberg identifying China's low rate of air travel in and out of its country in the past two years. The chart lists less than 200 flights a day in current 2022 while even last year at 2021 it averaged around 200 a day. But that is all relative when we go further out toward the past.

(Courtesy of a Bloomberg Article)

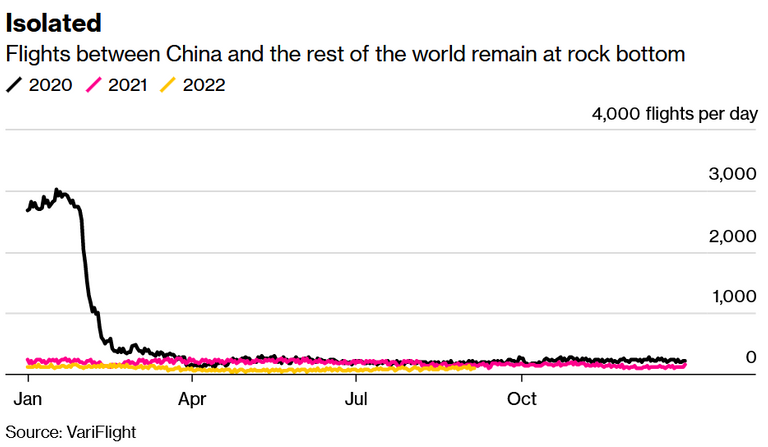

Since December 2019 where Covid became a concern China's international flights had been steadily on a decline and grinned nearly to a halt from peak of 3,000 flights to 100 flights a day. That is down 97% from two years ago.

China Jet Fuel Usage

(Courtesy of The Global Economy Dot Com)

Every year since 1990 China has increased its use in jet fuel and data collected up until 1990 had the country using on average 800,000 barrels of jet fuel a day! For comparison US as of 2021 on daily basis is consuming around 1.2 million barrels of jet fuel a day.

So what is the point I am making here? China alone has been restricting a lot of flights from occurring with the mandatory lock down in parts of its country. This has dramatically reduced China's consumption of oil in recent years. However this can not be permanent and when the country reopens we have to expect the demand for oil will soar on the premise of more flights going in and out of China.

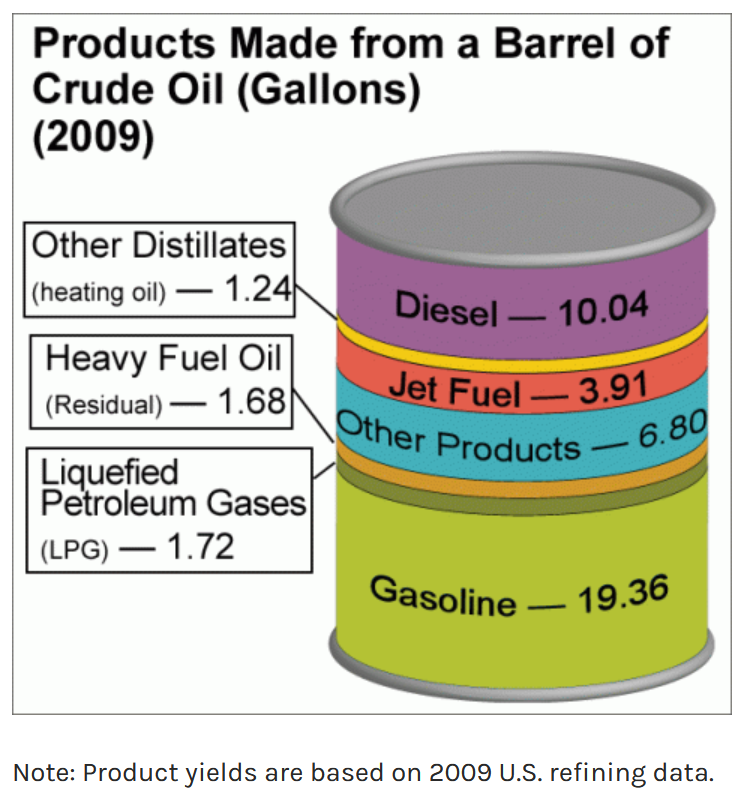

Barrel of Oil

(Courtesy of Energy.gov)

A barrel of crude oil consists of 40 gallons of fuel. If all the fuel are refined only a little under 4% of the original barrel are allocated for jet fuel. China's increase demand for jet fuel will require many more barrels of crude oil and refining.

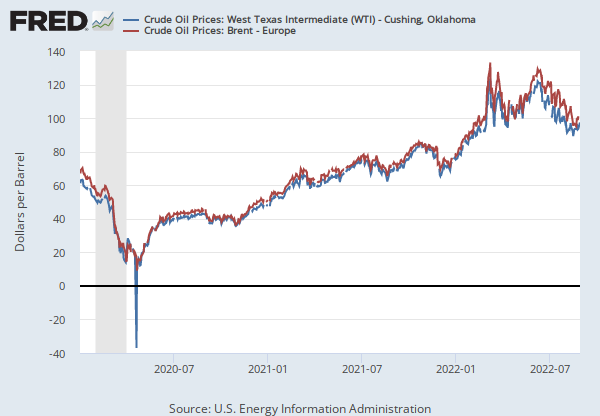

Price of Crude Barrel

A barrel of crude oil was negative priced in the 2020 Covid fear but as of today it is closer to $100 / barrel.

(Courtesy of St. Louis Fed)

Fuel costs are already a concern across the globe but having countries like China reduce demand has not help reduce fuel costs. Imagine how bad prices for gasoline will become if and when China begins to open up?

America's Crude Barrel Reserves

The US's Strategic Petroleum Reserve is where the government holds its country's oil that can be use under their discretion. President Biden had release millions of barrels on a daily basis since 2022 to help alleviate the price of fuel for consumers.

(Courtesy of Wikipedia)

What is staggering is the draw down in reserves have reach nearly a 40 year in reserves. Yet here we are with crude oil still nudging around $100 a barrel.

Conclusions

A report from Europe came out today estimating that remainder of 2022 - 2028 the expected use of higher grade gasoline will be on the rise.

USA is also projecting the use of crude demand will rise in 20223 and has stepped up production.

EIA projected that crude production will rise to 11.79 million barrels per day (bpd) in 2022 and 12.63 million bpd in 2023 from 11.25 million bpd in 2021.

(Courtesy of Reuters Article)

The facts are in plan sight that demand for energy and especially crude oil remains to increase on a daily basis for the foreseeable future. Whether the US or global economies will fall into a recession or economic slowdown it will only temper demand temporarily.

At present time there is so much action taken upon from many countries across the globe in lower usage and increasing supply of fuel and still see fuel prices soaring is definitely a concern. Looking ahead we may see higher prices for energy down the road.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

I can't see how it doesn't DXY continues to surge making it more expensive to get dollars and the panic to secure reserves is high, the US have drained strategic reserves too and winter is coming in the north, Opec also saying they slowing down pumping so plenty of forces pushing up energy prices

Sure seems like dark times are ahead. Meanwhile enjoy some !LOL !PIZZA

It's obvious that the demand isn't there because people have less discretionary income and the oil reserves are due in part due to the current administration and the environmentalists. I am not surprised they want to start lowering those to push the green energy agenda even though we have an energy shortage.

Posted Using LeoFinance Beta

I think the FED is trying to reduce discretionary income with rate hikes and QT. But government is spending like crazy to compensate. Just crazy. !LOL !WINE

Congratulations, @mawit07 You Successfully Shared 0.100 WINEX With @jfang003.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.162

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

PIZZA Holders sent $PIZZA tips in this post's comments:

@mawit07(1/5) tipped @chekohler (x1)

Join us in Discord!