LeoFinance - Terra Network's Anchor Protocol

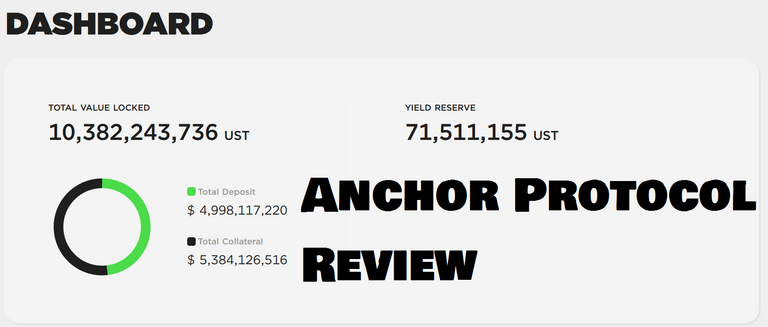

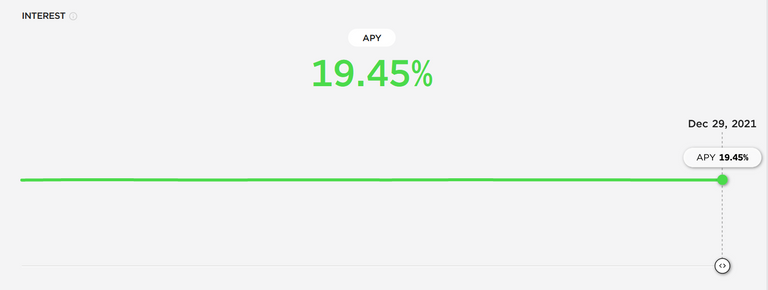

Investing in the Hive blockchain has its own limitations. One as such as investing in a stable coin that is pegged to the United States dollar. Over on the Terra blockchain there is a pegged token of the USD called UST. On that blockchain there is a protocol that is currently offering close to 20% interest just for staking UST. Here in this post we look over at this portocol, called Anchor.

https://app.anchorprotocol.com

Anchor Protocol

The protocol will allow users to earn close to 20% a year for simply depositing UST. For those unaware UST recently surpassed DAI in market cap. This is big news since DAI was the largest decentralized stable coin pegged to the dollar before UST surpassed it. With UST now in the lead it is proof that investing in UST is reasonably safe compare to all stable coins.

It is worth noting since its inception UST had a couple of periods dipped below its pegged but has recovered and mostly set around $1.

Bonding Luna and Borrowing UST

So one maybe wonder how Anchor can provide such high yield in earnings? The protocol allows users to lock in Luna as in bonding Luna which in turn makes it bLuna. In turn the bLuna is locked while Anchor can print out more UST to distribute. The bLuna will incur interest in UST to holders hence people who hold Luna who want to earn passive stable coins would bond their Luna on Anchor.

Furthermore the protocol allows users to borrow UST with the use of collateral. The collateral has to be either bETH or bLuna. It is bonded or aka locked for at minimum 3 weeks. With using bLuna as collateral Anchor will allow up to 60% of the the bLuna collateral to be used for borrowing. Example lock $1,000 in bLuna and user can borrow up to $600 in UST. The UST is liquidity that can be used to invest in either the same UST deposit interest on Anchor or any where else on the Terra Network protocols.

Conclusions

The Anchor protocol offers high interest rates for stable coins. So high, at 20% it is one of the highest in current markets. It has been at this rate for almost a year hence has proven itself as a good long term investment considering the change in speed of cryptocurrency.

On top of it Anchor allows users to borrow crypto with the use of Luna and that helps sustain the operations of Anchor. On top of borrowing on Anchor users who borrow get an earned interest from the borrowed UST. This makes the fee to borrow low and sometimes even positive! As of now the borrowing rate is -1.46%

On the flip side using the borrow UST to invest into the nearly 20% on Anchor will gain 19% in earnings.

If your interested in leveraging crypto to earn more the Anchor Protocol is one place to look for. In future posts we will look at other Terra blockchain protocols that can also use leverage to earn and in addition stack what is earned on Anchor to create multiple ways of earning on the same amount of assets.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

https://twitter.com/LeoAlpha2021/status/1476355286298292225

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Hive and Anchor can go hand in hand too.

If you have HIVE assets, you can easily move them to Cub Finance via LEO.

There, you can buy LUNA on BSC and use the Terra Bridge to move assets to the Terra blockchain.

Finally, you can then move into UST and stake that UST on Anchor.

Hive 🤝 Terra.

PS. I love your work, but you've gotta come back and post via leofiance.io to receive your full LEO rewards :)

Posted Using LeoFinance Beta

Thanks for the advice will try to out the conversion and will post through LeoFinance.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Earning 20% sounds really good and I wish this blog will grab attention of crypto investors. Indeed a very informative blog. I'm still learning about UST. Need time to think of investing in future.

Posted using LeoFinance Mobile

Thanks for showing us Anchor protocol.

Posted Using LeoFinance Beta

Very interesting. I wonder what the risks are

Posted Using LeoFinance Beta

20% is very good and attractive, nothing bad in having some UST there, that constantly do the work for us

Posted using LeoFinance Mobile

Thank you this article opened my eyes I thought all stable coins were pegged. I thought being pegged is what made them stable coins, but I must have misunderstood something.

You have it right. Pegged means it should be stable. What I am trying to get at in this post is that if you find pools to partake in where both assets pretty much are the same value such as bLuna and Luna you hold 50/50 in the pool to earn trading fees. That +20% APR is from the trading fees where other people are swapping for those tokens. This is all the more reason decentralized exchanges are a big hit. Normal retail investors like us can earn steady income for just providing liquidity. Skip the middle man like banks and centralized exchanges where they incur fees on trades.

Thank you so much for the extra break down as I obviously did not get it the first.

That is brilliant. 👍